Virtual Cards Market 2030: Bridging Gaps in Financial Inclusion

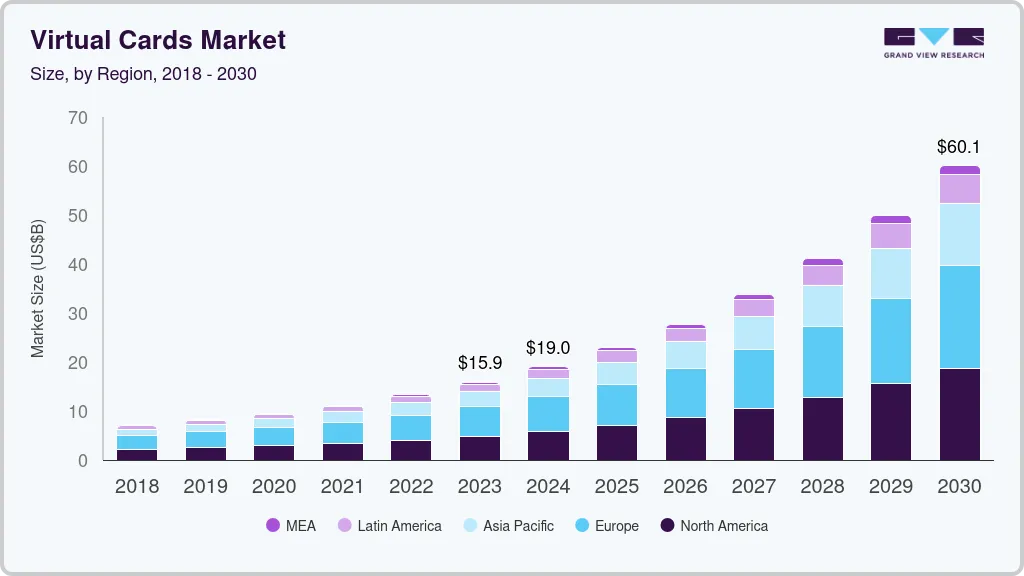

The global virtual cards market was valued at USD 19,016.7 million in 2024 and is expected to reach USD 60,064.6 million by 2030.

The global virtual cards market was valued at USD 19,016.7 million in 2024 and is expected to reach USD 60,064.6 million by 2030, expanding at a CAGR of 21.2% from 2025 to 2030. Market growth is largely driven by the rapid increase in digital transactions worldwide, which continues to fuel demand for multiple types of virtual card solutions.

The shift toward emerging payment technologies is reinforcing this trend. For example, in May 2021, a report published by the MasterCard Payment Index revealed that 93% of surveyed consumers favored modern payment methods such as biometrics, digital currencies, QR codes, and contactless payments. In response, payment service providers are actively introducing diverse payment and shopping solutions to meet evolving consumer preferences.

Demand for virtual cards is further supported by the rising need for enhanced security measures within digital payment gateways. Tokenization, which replaces sensitive card information with unique digital tokens, adds an additional layer of protection and is increasingly integrated into virtual card solutions. This technology improves user experience, lowers security-related costs, and enables secure data transfer between networks while safeguarding customer information. These advantages are expected to create favorable growth opportunities for the virtual cards market throughout the forecast period.

The widespread adoption of smartphones is another major factor accelerating virtual card usage. Continuous technological advancements, including the rollout of 5G networks, are enhancing mobile user experiences and increasing consumer satisfaction. Additionally, growing global internet penetration is driving the adoption of digital payments, thereby increasing demand for virtual cards. According to a World Bank report published in June 2022, approximately 60% of the global population were internet users, further strengthening the foundation for digital payment growth.

Order a free sample PDF of the Virtual Cards Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Europe dominated the virtual cards market in 2024, accounting for the largest revenue share of 37.28%. This leadership is driven by the strong preference for cashless transactions across countries such as the UK and Germany. Furthermore, leading market participants are launching innovative products to encourage virtual card adoption. For instance, in April 2021, Stripe introduced Stripe Issuing in several European countries, enabling businesses to create, manage, and distribute both virtual and physical cards while maintaining greater control over spending.

- By card type, the credit card segment held the largest market share of 60.6% in 2024. Growth in this segment is attributed to increasing concerns related to corporate fraud prevention. Businesses are shifting toward centralized and controlled payment methods such as Virtual Credit Cards (VCCs) to reduce fraud risks. Additionally, collaborations between banks and fintech firms are supporting segment expansion. For example, in November 2021, the Bank of Baroda partnered with fintech startup OneCard to launch a virtual credit card delivered within three minutes through BOB Financial Services Limited and operated on VISA’s Signature platform.

- By product, the B2B virtual cards segment led the market in 2024 with a revenue share of 70.3%. Rising global trade activities have increased the volume of B2B transactions, driving demand for secure and efficient payment solutions. Businesses are integrating virtual cards into their accounts payable processes to enhance cash flow management, improve security, and automate payments, replacing traditional methods such as paper checks. Virtual card acceptance through accounts receivable automation further improves efficiency and supports business growth.

- By application, the business use segment accounted for the largest revenue share of 68.6% in 2024. Organizations widely use virtual cards for online payments to vendors and suppliers, as well as for employee expenses and corporate travel bookings. These cards offer superior security since they cannot be physically lost or stolen and are often limited to single or restricted transactions, significantly reducing fraud risk. In case of suspicious activity, virtual cards can be instantly blocked by the issuing authority.

Market Size & Forecast

- 2024 Market Size: USD 19,016.7 Million

- 2030 Projected Market Size: USD 60,064.6 Million

- CAGR (2025-2030): 21.2%

- Europe: Largest market in 2024

Key Companies & Market Share Insights

Key participants in the global virtual cards market include American Express Company, BTRS Holdings, Inc., JPMorgan Chase & Co., Mastercard, and others. Market players are actively expanding their customer base through strategic initiatives such as partnerships, mergers, and acquisitions to strengthen their competitive positioning.

- Mastercard is a leading financial services organization offering comprehensive payment processing solutions, including virtual card capabilities. Its virtual card solutions are integrated across consumer digital wallets, mobile banking applications, and corporate payment platforms. Through programs such as Mastercard InControl and Commercial Card solutions, businesses can improve expense management, enhance online procurement security, and streamline accounts payable reconciliation.

- American Express Company (Amex) provides a wide range of financial services, including credit cards and payment solutions. Amex virtual cards are designed to enable secure and flexible business payments without physical cards. These solutions allow organizations to generate single-use or limited-use virtual card numbers for specific transactions or vendors, substantially reducing the risk of fraud and unauthorized spending.

Key Players

- American Express Company

- BTRS Holdings, Inc.

- Wise Payments Limited

- JPMorgan Chase & Co.

- Marqeta, Inc.

- MasterCard

- Skrill USA, Inc.

- Stripe, Inc.

- WEX, Inc.

- Adyen

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global virtual cards market is witnessing rapid expansion, driven by the accelerating shift toward digital payments, growing security concerns, and increasing adoption of mobile and internet technologies. The integration of tokenization, mobile connectivity, and advanced payment infrastructures has positioned virtual cards as a secure and efficient alternative to traditional payment methods. With strong adoption across B2B and business-use segments and continued innovation by leading financial institutions and fintech players, the market is expected to maintain robust growth through 2030, playing a pivotal role in the evolution of the global digital payments ecosystem.