Valve Positioners Market 2033: Understanding Regional Dynamics

The global valve positioners market was valued at USD 1.99 billion in 2024 and is anticipated to reach USD 3.01 billion by 2033.

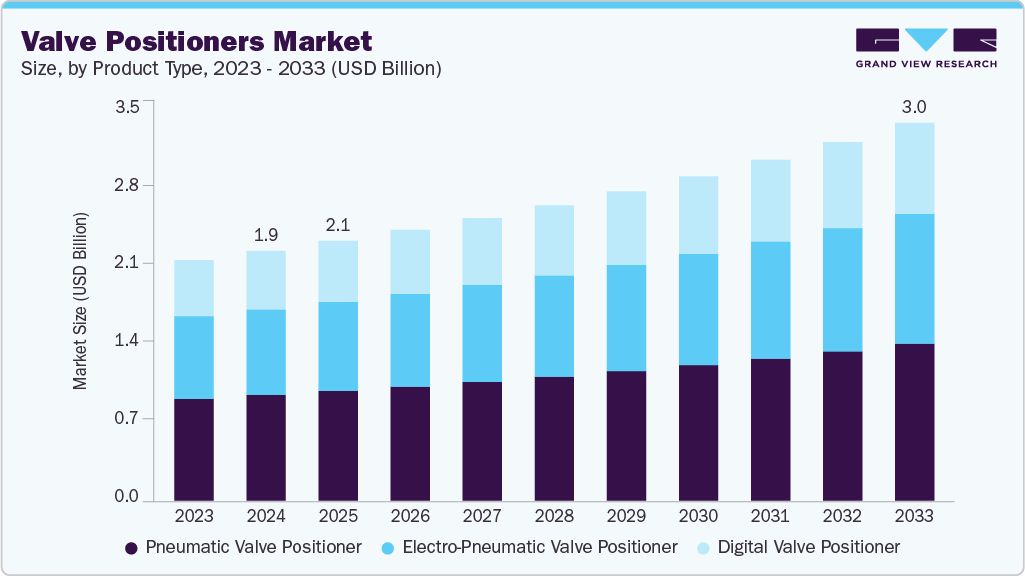

The global valve positioners market was valued at USD 1.99 billion in 2024 and is anticipated to reach USD 3.01 billion by 2033, expanding at a CAGR of 4.8% from 2025 to 2033. This growth is largely driven by the increasing adoption of industrial automation across key sectors such as oil and gas, chemicals, and pharmaceuticals. Automated systems require high precision in valve control to maintain operational efficiency, safety, and reliability. Advanced valve positioners—including digital and electro-pneumatic models—play a critical role in delivering this precision, thereby supporting market expansion.

The rising focus on process optimization within industries such as power generation, water treatment, and manufacturing is further reinforcing demand. Valve positioners help ensure accurate valve alignment, which enhances system efficiency and minimizes operational costs. This growing emphasis on performance improvement continues to drive adoption across various applications.

Technological advancements are also shaping market trends, particularly the development of digital communication protocols that support the rising usage of digital valve positioners. These devices offer enhanced control capabilities, improved diagnostics, and better integration with modern automation systems. Additionally, the increasing prioritization of energy efficiency in industrial operations is boosting product demand, as advanced positioners enable better valve control, reduce energy losses, and improve overall system performance.

However, the high upfront costs associated with advanced valve positioners—especially digital and electro-pneumatic variants—pose a challenge, particularly for small and medium-sized enterprises. The need for technical expertise for installation, calibration, and maintenance can also limit adoption for organizations lacking skilled personnel. Despite this, stringent safety standards across multiple industries continue to create a strong requirement for reliable and precise control systems, reinforcing the importance of valve positioners in mitigating safety risks.

Order a free sample PDF of the Valve Positioners Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: Asia Pacific held the largest share of the market in 2024, accounting for 36.19%, and is expected to grow at the fastest rate over the forecast period. Rapid industrialization and expanding infrastructure in emerging economies are supporting the increasing demand for advanced valve positioners.

- By Product Type: Pneumatic valve positioners dominated the market with a 42.3% revenue share in 2024 and are projected to record the highest growth rate. Their popularity stems from their proven reliability, straightforward design, and cost-effectiveness, especially in industries where pneumatic systems are widely used, such as oil and gas, chemicals, and power generation.

- By Application: The oil and gas sector led with a 32.8% revenue share in 2024 and is anticipated to grow significantly throughout the forecast period. Valve positioners are essential for maintaining safe and efficient operations throughout the upstream, midstream, and downstream stages of hydrocarbon processing.

Market Size & Forecast

- 2024 Market Size: USD 1.99 Billion

- 2033 Projected Market Size: USD 3.01 Billion

- CAGR (2025-2033): 4.8%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Leading players in the valve positioners market include Emerson Electric Co., ABB, and Schneider Electric, with additional emerging competitors such as Flowserve Corporation, Christian Bürkert GmbH & Co. KG, and ControlAir Crane Co.

- Emerson Electric Co., founded in 1890 and based in Missouri, provides engineering and automation solutions across industries including oil and gas, power generation, water and wastewater, and manufacturing. The company offers a broad range of automation products, including advanced valve positioners tailored for diverse industrial uses.

- Schneider Electric, established in 1836 and headquartered in France, specializes in digital energy management and automation solutions. Its extensive product portfolio supports industrial automation, energy management, and building systems, including solutions relevant to valve control and positioning.

- Flowserve Corporation, formed in 1997 and based in Texas, manufactures pumps, valves, seals, and related motion control equipment for industrial applications.

- ControlAir Crane Co., founded in 1980 and located in New Hampshire, is known for producing precision pneumatic and electro-pneumatic control devices used across various automation processes.

Key Players

- Emerson Electric Co.

- ABB

- Schneider Electric

- Azbil Corporation

- Baker Hughes Company

- Bray International

- Flowserve Corporation

- Christian Bürkert GmbH & Co. KG

- ControlAir Crane Co.

- Dwyer Instruments LTD.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The valve positioners market is set for steady growth as industries worldwide continue to prioritize automation, process optimization, and energy efficiency. With the market projected to rise from USD 1.99 billion in 2024 to USD 3.01 billion by 2033, advanced valve control solutions will remain essential for ensuring operational reliability and compliance with stringent safety standards. Asia Pacific’s strong industrial expansion, together with technological advancements—particularly in digital valve positioners—will drive future market momentum. Despite challenges related to cost and technical expertise, ongoing modernization efforts across key industrial sectors position valve positioners as a vital component of global automation infrastructure.