Utility Poles Market 2030: Adapting to Climate Change

The global utility poles market was valued at USD 57.66 billion in 2023 and is projected to reach USD 75.88 billion by 2030.

The global utility poles market was valued at USD 57.66 billion in 2023 and is projected to reach USD 75.88 billion by 2030, growing at a CAGR of 4.0% from 2024 to 2030. Market expansion is supported by rising electricity consumption, the growing need for efficient energy distribution, and continued development of power transmission and distribution networks. Additionally, widespread adoption of smartphones, increased internet penetration, and expanding use of data-heavy applications are boosting demand for robust communication networks, which in turn drives demand for utility poles.

The transition toward smart grid systems is further accelerating market growth, as these technologies provide real-time monitoring of energy usage, early fault detection, and improved maintenance management. These capabilities enhance the reliability and efficiency of power transmission and distribution, creating new growth opportunities for utility pole manufacturers.

Sustainability is becoming an essential focus across the industry as environmental concerns rise. Manufacturers are increasingly adopting eco-friendly materials and production processes to reduce environmental impact. Governments are also supporting these efforts by encouraging the use of sustainable materials and cleaner manufacturing methods. A notable advancement occurred in February 2024 when the American Composites Manufacturers Association (ACMA) finalized the Utility Pole Product Category Rule (PCR). This initiative introduces new standards for environmental transparency and performance evaluation in the utility pole industry, marking a key milestone for sustainable infrastructure.

Order a free sample PDF of the Utility Poles Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: The Asia Pacific region led the market with a 44.54% revenue share in 2023, and is anticipated to grow at a CAGR of 4.9% from 2024 to 2030. Rapid urbanization, industrial growth, and expanding utility infrastructure are major factors driving regional demand, alongside rising electricity and telecommunication needs.

- By Product: The transmission and distribution pole segment dominated with a 63.6% revenue share in 2023. This is largely due to global initiatives to modernize outdated grid infrastructure, replace aging poles, and expand electrical networks to meet rising energy demands in developing regions.

- By Application: The lighting segment is expected to experience the fastest growth from 2024 to 2030. Increasing urban development and smart city initiatives are promoting the integration of advanced lighting solutions into utility poles. IoT-enabled capabilities, such as adaptive lighting, remote monitoring, and data collection, are expanding the role of utility poles beyond traditional illumination.

- By Size: Utility poles within the 6m to 15m range held the largest share in 2023. Growing reliance on renewable energy sources like solar and wind requires enhanced transmission and distribution infrastructure, boosting demand for poles in this size category. Advancements in durable and lightweight materials also support the segment’s growth.

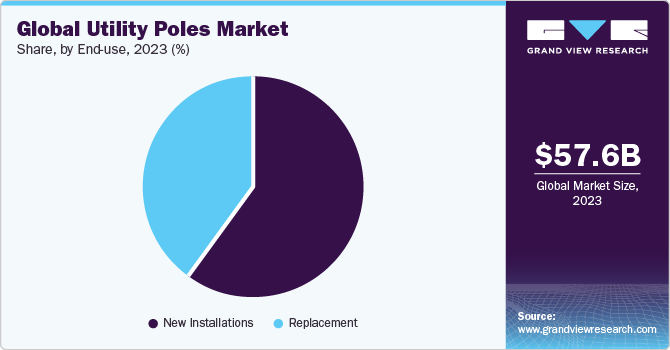

- By End-Use: New installations accounted for the largest market share in 2023 and are expected to remain dominant through 2030. Increasing modernization of electrical grids, replacement of aging infrastructure, and expanding urban and industrial construction activities are key factors reinforcing demand.

Market Size & Forecast

- 2023 Market Size: USD 57.66 Billion

- 2030 Projected Market Size: USD 75.88 Billion

- CAGR (2024-2030): 4.0%

- Asia Pacific: Largest market in 2023

Key Companies & Market Share Insights

Leading companies in the utility poles market include Tata Power, Nov Inc, SAE Towers, Nippon Steel Corporation, and KEC International Ltd.

- Tata Steel provides a wide range of steel products such as hot and cold rolled coils, galvanized sheets, tubes, wires, and construction rebars. These offerings support diverse industries, including automotive, construction, consumer goods, and engineering, highlighting its capacity to meet global steel demands.

- NOV Inc., formerly National Oilwell Varco, supplies equipment and components for oil and gas drilling and production. The company is heavily invested in R&D to improve product performance, durability, and sustainability, emphasizing technological innovation across its portfolio.

Emerging participants include New Forests Company, Lishu Steel Co. Ltd, and Omega Company.

- New Forests Company manufactures and supplies transmission poles across East and Southern Africa, serving national utilities, government agencies, and turnkey operators.

- Lishu Steel Co. Ltd offers a wide variety of steel, concrete, and composite utility poles designed for diverse environmental conditions, structural loads, and aesthetic preferences, catering to a global client base.

Key Players

- Al-Babtain Power & Telecom

- American Timber and Steel

- Bell Lumber & Pole

- Energya Steel-KSA

- Europoles Middle East LLC

- Foresite Group LLC

- Frank R. Close & Son, Inc.

- George Scott (Geo Stott)

- HAS Engineering LLC

- Hidada

- Jiangsu Guohua Tube Tower Manufacturer Co. Ltd.

- Jyoti Structures Limited

- Kalpataru Projects International Ltd.

- KEC International Inc.

- Lishu Steel Co., Ltd

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The utility poles market is poised for continued growth as global electricity demand rises, communication networks expand, and smart grid technologies become more widespread. With the market expected to increase from USD 57.66 billion in 2023 to USD 75.88 billion by 2030, ongoing infrastructure modernization, renewable energy expansion, and sustainability initiatives will be central drivers. Asia Pacific’s rapid development, coupled with technological advancements and regulatory support for eco-friendly materials, positions the market for stable, long-term expansion. Overall, utility poles will remain a critical component of modern energy and communication systems as cities and industries evolve.