U.S. Smart Home Market 2030: Transforming New Constructions

The U.S. smart home market was valued at USD 23.72 billion in 2024 and is projected to reach USD 84.20 billion by 2030.

U.S. Smart Home Market Overview

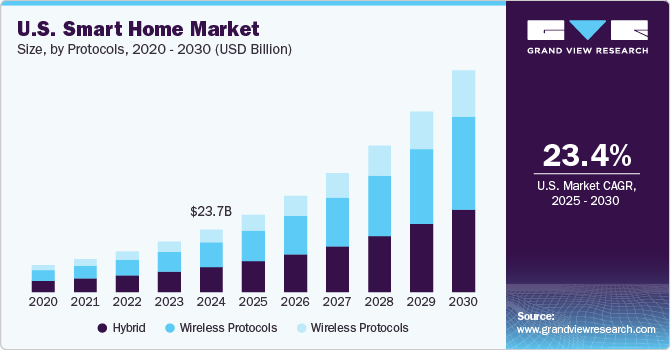

The U.S. smart home market was valued at USD 23.72 billion in 2024 and is projected to reach USD 84.20 billion by 2030, growing at a CAGR of 23.4% from 2025 to 2030. This robust expansion is primarily driven by increasing consumer focus on energy efficiency and sustainability. Smart thermostats, energy monitoring systems, and intelligent lighting solutions are gaining traction as homeowners seek to reduce utility bills and optimize energy usage.

Government-led initiatives, including tax incentives and state-level energy conservation programs, are further accelerating the adoption of smart technologies. Rising environmental awareness and ongoing energy price volatility are also encouraging households to invest in technologies that lower carbon emissions and manage energy consumption more effectively.

Integration of AI and Voice Assistants

The market is undergoing a transformative shift with the integration of AI-powered voice assistants such as Amazon Alexa, Google Assistant, and Apple Siri. These platforms offer seamless control over various smart devices, enhancing convenience and personalization. Advancements in natural language processing (NLP) and machine learning are continuously improving the responsiveness and intelligence of smart home systems. As demand for smarter, more intuitive systems grows, manufacturers are embedding AI capabilities across a wider range of devices—driving both innovation and market growth.

Rising Demand for Smart Security Solutions

Security remains a crucial growth driver within the smart home sector. The demand for smart cameras, video doorbells, and integrated alarm systems continues to rise as consumers seek real-time alerts, remote monitoring, and cloud storage features. Escalating crime rates in some urban areas and heightened awareness of personal safety are accelerating product adoption. In addition, insurance premium discounts for homes with certified smart security systems are further encouraging consumers to invest in these solutions—reinforcing the strategic importance of security in the evolving smart home landscape.

Order a free sample PDF of the U.S. Smart Home Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Product: The security & access control segment led the market with a share of over 28% in 2024, driven by growing consumer interest in smart locks, video doorbells, motion sensors, and alarm systems offering real-time monitoring and remote control.

- By Protocol: The hybrid protocols segment dominated the market in 2024, owing to its ability to combine wired and wireless technologies. Hybrid systems enhance reliability and reduce interference, often leveraging existing infrastructure like power lines to improve connectivity.

- By Application: The retrofit segment accounted for the largest market share in 2024. With rising concerns around sustainability and carbon emissions, homeowners are increasingly opting for retrofit smart devices such as smart thermostats, efficient lighting, and smart power outlets to manage energy usage in existing homes.

Market Size & Forecast

- 2024 Market Size: USD 23.72 Billion

- 2030 Projected Market Size: USD 84.20 Billion

- CAGR (2025-2030): 23.4%

Key Companies & Market Share Insights

Several major players are shaping the competitive landscape:

- Apple Inc. remains a dominant force in the U.S. smart home ecosystem via its HomeKit platform. With a focus on privacy, integration, and premium user experience, devices like HomePod and Apple TV act as central smart home hubs. Continued investment in AI and edge computing is expected to further enhance Apple’s position in the market.

- Google LLC has secured a strong foothold through its Nest ecosystem, offering AI-powered products such as smart thermostats, security cameras, and doorbells. Its use of machine learning and context-aware automation, along with seamless integration with Android and third-party devices, gives Google a significant advantage in delivering intelligent home experiences.

Emerging players include:

- Arlo Technologies is quickly gaining traction with its wireless security camera systems, known for high-quality video, intuitive interfaces, and AI-driven motion detection. Its focus on DIY-friendly solutions and cloud-based services has positioned it well in the growing remote surveillance market.

- Xiaomi is gradually expanding in the U.S. by offering affordable smart home products such as robot vacuums, smart bulbs, and security cameras. Its Mi Home ecosystem, combined with increasing compatibility with U.S. platforms and voice assistants, makes it a promising challenger, especially for budget-conscious consumers.

Key Players

- ADT Inc.

- Apple Inc.

- Arlo Technologies

- Ecobee

- Google LLC

- Honeywell International

- Lutron Electronics Co., Inc.

- Panasonic Corporation

- Samsung Electronics

- Schneider Electric

- Sony Corporation

- Vivint, Inc.

- Xiaomi.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. smart home market is entering a high-growth phase, driven by strong consumer demand for energy efficiency, AI integration, and home security solutions. With government support, rising environmental awareness, and continuous technological advancements, the sector is poised for continued innovation and expansion. As leading players enhance their offerings and new entrants bring competitive, affordable solutions, the smart home market is expected to become an integral part of the modern American household—reaching USD 84.20 billion by 2030.