U.S. Small Molecule Innovator API CDMO Market 2030: Pharma Outsourcing Rises

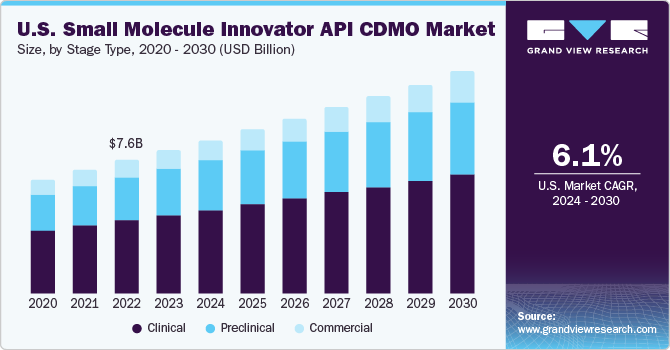

In 2024, the U.S. market for small molecule innovator API CDMOs was valued at USD 8.80 billion, with projections indicating it will expand at a compound annual growth rate (CAGR) of 6.0% from 2025 to 2030.

In 2024, the U.S. market for small molecule innovator API CDMOs was valued at USD 8.80 billion, with projections indicating it will expand at a compound annual growth rate (CAGR) of 6.0% from 2025 to 2030. Key drivers fueling this growth include increasing outsourcing by pharmaceutical firms, sustained demand for small-molecule drugs, and the growing number of clinical trials conducted within the U.S.

The market is further propelled by rising investments in pharmaceutical R&D, which aim to support the development of innovative small-molecule APIs. Additional contributing factors include heightened demand for new therapies, increasing incidence of cancer, and the growing prevalence of age-related diseases.

The expansion of R&D and manufacturing operations within the U.S., coupled with a significant presence of leading pharmaceutical companies, also supports the market's upward trajectory. The emphasis on drug discovery and the increasing number of early-stage R&D initiatives are expected to enhance growth prospects in the near future. As an example, in March 2023, Catalent, Inc. entered into a partnership with Grunenthal to develop an oral dosage small molecule, a move that enhanced Catalent’s capabilities in the U.S. market.

Small-molecule drugs continue to dominate the pharmaceutical development pipeline and FDA approvals, prompting many firms to focus on advancing new small-molecule therapies. Consequently, the need for API CDMOs capable of delivering efficient and cost-effective manufacturing solutions remains strong. According to the U.S. FDA, 50 novel drugs received approval in 2024, slightly down from 55 in 2023, yet still the second-highest annual figure in the last 30 years. Of these, 31 were small molecules, accounting for 62% of total approvals, underscoring the significant role of small molecules in current drug development trends.

Order a free sample PDF of the U.S. Small Molecule Innovator API CDMO Market Intelligence Study, published by Grand View Research.

Market Trends and Insights

- The clinical segment, broken down into Phase I, Phase II, and Phase III, led the market with a 54.68% revenue share in 2024.

- The contract manufacturing segment emerged as the leading segment, driven by growing demand for scalable and cost-effective production models.

- The pharmaceutical segment held the dominant position in 2024, supported by rising demand for novel therapies and increasing R&D and manufacturing outsourcing.

- The oncology segment accounted for the largest share of market revenue in 2024 and is projected to grow at the fastest rate through 2030, owing to increasing cancer prevalence, higher R&D investment, and a rising need for innovative oncology drugs.

Market Size and Forecast

- 2024 Market Size: USD 8.80 Billion

- 2030 Forecasted Market Size: USD 12.60 Billion

- CAGR (2025–2030): 6.0%

Key Industry Developments

Market leaders are adopting a range of inorganic growth strategies—such as mergers, acquisitions, partnerships, and service expansions—to strengthen their market position. For example, in June 2024, Formosa Laboratories acquired Synchem Inc., a U.S.-based contract research organization. This move expanded Formosa's footprint in the U.S. and enhanced its service capabilities.

Leading Companies in the U.S. Small Molecule Innovator API CDMO Market

- Lonza

- Novo Holdings (Catalent, Inc.)

- Thermo Fisher Scientific, Inc.

- Siegfried Holding AG

- Recipharm AB

- CordenPharma International

- Samsung Biologics

- Labcorp

- Ajinomoto Bio-Pharma Services

- Piramal Pharma Solutions

- Jubilant Life Sciences (Jubilant Biosys Limited)

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. small molecule innovator API CDMO market is poised for sustained growth, supported by increasing pharmaceutical outsourcing, expanding clinical pipelines, and strong demand for cost-effective and scalable manufacturing solutions. The dominance of small molecules in drug approvals and the robust pace of R&D investment underscore the market’s long-term viability. As strategic collaborations and acquisitions continue to reshape the competitive landscape, the market is expected to reach USD 12.60 billion by 2030, reflecting a healthy 6.0% CAGR over the forecast period.