U.S. Retail Clinics Market 2030: Navigating the Shift to Value-Based Care

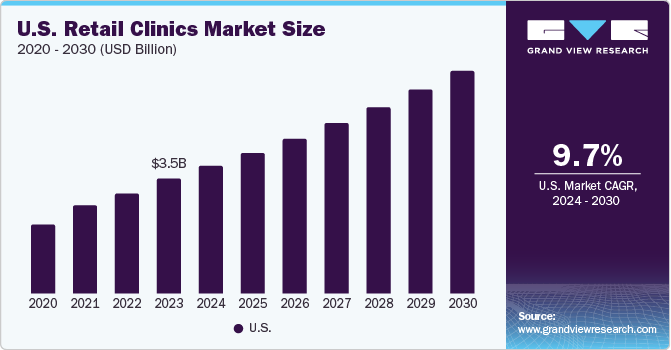

In 2023, this evolving tapestry already included a $3.55 billion thread representing the U.S. retail clinic market. Now, picture this thread steadily thickening, projected to expand at a vibrant annual pace of 9.7% from 2024 to 2030.

Imagine the American healthcare landscape, not as a collection of distant institutions, but as a network woven into the fabric of everyday life. In 2023, this evolving tapestry already included a $3.55 billion thread representing the U.S. retail clinic market. Now, picture this thread steadily thickening, projected to expand at a vibrant annual pace of 9.7% from 2024 to 2030.

The engine driving this growth? A fundamental shift towards healthcare that's not just needed, but reachable. Think of it as a strategic remapping, ensuring these vital healthcare touchpoints are sprinkled thoughtfully across the nation. These aren't your grandfather's doctor's offices; they're "walk-in wellness hubs," strategically nestled within the familiar environments of supermarkets and department stores, offering a nimble alternative to traditional primary care.

Their magic lies in their accessibility, both geographically and economically. By setting up shop where people already go and keeping costs down, they extend a hand to those for whom the emergency room is often the only perceived option.

Get a preview of the latest developments in the U.S. Retail Clinics Market; Download your FREE sample PDF copy today and explore key data and trends

Furthermore, these aren't lone entities. They often bear the insignia of respected healthcare systems, assuring patients that experienced professionals are at the helm, delivering care within well-organized clinical nooks. And in the quiet hum of the digital age, patient stories are captured and managed electronically, ready to inform future care.

Ultimately, the narrative of this market's ascent is one of breaking down barriers – making healthcare lighter on the wallet, simpler to access, and seamlessly integrated into the rhythm of daily life. Like adaptable building blocks, these retail clinics possess the inherent ability to scale and multiply, promising a future where healthcare is not a privilege, but a readily available resource.

Detailed Segmentation

Ownership Insights

Retail owned segment dominated the market with a share of 81.8% in 2023. Companies such as CVS Health, own, operate, or provide management for its MinuteClinic clinics. CVS has clinical affiliations with leading health systems such as Baptist Health System in Alabama. These health systems provide clinical support, chronic disease monitoring, wellness programs, and medication counseling to the customers of CVS.

Diagnosis Insights

Immunization segment held largest revenue share of 25.3% of market in 2023. During and after the COVID-19 pandemic, the retails clinics market observed increasing popularity among people for vaccinations as these clinics provided the testing facilities as well. Governments are promoting these facilities to accommodate the growing vaccination needs. Moreover, as large retail chains are mainly operating these clinics, better administration, data recording, medications are offered to patients.

Regional Insights

The Southeast region witnessed the largest revenue share of 34.2% in 2023 owing to the increasing utilization of accessible & non-emergency healthcare services in the region. As most of the retail clinics are in the metropolitan area, the market share is significant in Southeast region. These walk-in medical facilities are witnessing huge popularity in urban areas. They can helpprovide treatment options for some acute conditions and provide additional medication if needed. Availability without prior appointments, holidays and beyond working hours are crucial advantages of these facilities. Since the inception of the first retail clinic in the year 2000, the number has reached more than 1,700 in the U.S., in 2024 as they help curb issues of the increasing shortage of primary care providers, rising demand for value-based healthcare, and the emphasis to contain rising healthcare costs in the U.S.

Key U.S. Retail Clinics Company Insights

Some of the major companies operating in the U.S. retail clinics market include CVS Health, Kroger Health, Walgreens, Advocate Health Care, Kaiser Foundation Health Plan, Inc. and others. Major focus of companies dominating the market is on developing advanced service centers for patients through collaborations. Additionally, large players in the market are aiming to provide convenient healthcare facilities in remote areas as well by investing in rural areas.

- CVS Health is a health solutions company operating through local and national channels to deliver affordable and high quality health care facilities.

Key U.S. Retail Clinics Companies:

- CVS Health

- Kroger Health

- Walgreens

- Advocate Health Care

- Kaiser Foundation Health Plan, Inc.

- Walmart

- Bellin Health Systems

- Geisinger Health

- Target

U.S. Retail Clinics Market Segmentation

Grand View Research has segmented the U.S. retail clinics market on the basis of ownership, diagnosis and region:

U.S. Retail Clinics Ownership Outlook (Revenue, USD Billion, 2020 - 2030)

- Retail Owned

- Hospital Owned

U.S. Retail Clinics Diagnosis Outlook (Revenue, USD Billion, 2020 - 2030)

- Immunization

- General Symptoms

- Injuries

- General Screening & Examination

- Acute Respiratory Disease & Infection

- Urinary Tract Infections

- Ear Infections

- Sprains, Strains, and Fractures

- Others

U.S. Retail Clinics Regional Outlook (Revenue, USD Billion, 2020 - 2030)

- U.S.

- Southeast

- Midwest

- Southwest

- Northeast

- West

Curious about the U.S. Retail Clinics Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In June 2024, CVS Health announced the opening of a Community Resource Center and 2 new Workforce Innovation Talent Centers in Oklahoma City. The objective is to improve access to training and community services.

- In December 2023, Better Health Group and The Kroger grocery store chain collaborated to offer a value-based primary care to geriatric population enrolled in Medicare.