U.S. Residential Washing Machine Market 2030: Adapting to Consumer Lifestyles

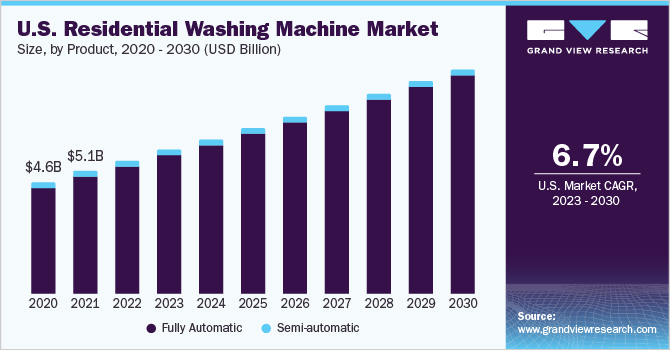

According to a recent report by Grand View Research, Inc., the U.S. residential washing machine market is projected to reach a valuation of USD 9,246.5 million by 2030, growing at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030.

According to a recent report by Grand View Research, Inc., the U.S. residential washing machine market**** is projected to reach a valuation of USD 9,246.5 million by 2030, growing at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. Data released by the U.S. Census Bureau and the Department of Housing and Urban Development indicated that sales of new single-family homes rose by 28.2% in August 2022 compared to July 2022. This notable increase in household formation is expected to be a major factor contributing to the market's expansion. In addition, rising urbanization and the ongoing introduction of smart and advanced home appliances are likely to further fuel product demand.

Growing consumer focus on conserving natural resources like water and electricity is encouraging manufacturers to produce more energy-efficient fully automatic washing machines. ENERGY STAR-certified washers, for example, use approximately 25% less energy and 33% less water than standard models. Leading companies are also increasing their investment in research and development to gain a competitive edge in the U.S. market for fully automatic machines, resulting in innovative technologies that simplify and enhance the laundry process.

Washing machines with a capacity of 6 to 8 Kg are expected to witness substantial growth during the forecast period. These larger machines often come equipped with smart features, including artificial intelligence (AI) and Internet of Things (IoT) integration. For example, in January 2022, LG introduced the FX washer and dryer, featuring a dual heat pump system. This laundry solution can assess load size, fabric type, and dirt levels, automatically dispensing the right amount of detergent and adjusting wash cycles accordingly for optimal results.

Get a preview of the latest developments in the U.S. Residential Washing Machine Market; Download your FREE sample PDF copy today and explore key data and trends

In terms of technology, the U.S. residential washing machine market is segmented into top-load and front-load machines. Among these, the front-load category continues to dominate, favored for its cost-effectiveness and user convenience. On the other hand, top-load machines offer benefits like vertical gaskets and integrated dryers that help prevent mold and mildew. They are also easier to use for seniors or individuals with mobility issues, as clothes can be loaded and removed without bending.

The offline sales channel held the largest share of the market in 2022. Major brands like General Electric and Whirlpool Corporation have expanded their brick-and-mortar presence globally to enhance distribution networks and boost brand visibility. Many manufacturers are opening exclusive brand outlets to provide authentic products and seamless customer service.

To further enhance the in-store shopping experience, leading brands are rolling out innovative marketing strategies. For instance, in May 2022, Whirlpool Corporation unveiled the World of Whirlpool (WoW) in Chicago. This marketing hub supports Whirlpool’s North American brands, such as Maytag, KitchenAid, and Amana, with creative customer engagement initiatives.

Key players shaping the U.S. residential washing machine market include Whirlpool Corporation, LG Electronics Inc., GE Appliances, and Samsung Electronics Co. Ltd. These companies are employing a range of strategic initiatives—such as market expansion, partnerships, mergers and acquisitions, and the development of new products—to increase their market share.

U.S. Residential Washing Machine Market Report Highlights

- Fully automatic segment is estimated to grow at the highest CAGR over the forecast period. Factors such as lifestyle changes, hectic routines, and urbanization coupled with technological advancements have increased the need to save time while washing clothes, an attribute provided by fully automatic machines

- The large size family structures in U.S. households require a higher loading capacity for washing clothes, which makes the front load a suitable option as it can hold more clothes load. This factor is likely to fuel product demand in the forthcoming years

- Online segment is forecast to grow at a rapid CAGR over the forecast period. The high convenience provided by the online channels is anticipated to contribute to the growth of the segment

U.S. Residential Washing Machine Market Segmentation

Grand View Research has segmented the U.S. residential washing machine market based on product, capacity, technology, and distribution channel:

U.S. Residential Washing Machine Product Outlook (Revenue, USD Million, 2017 - 2030)

- Fully Automatic

- Semi-automatic

U.S. Residential Washing Machine Capacity Outlook (Revenue, USD Million, 2017 - 2030)

- Below 6 Kg

- 6 to 8 Kg

- Above 8Kg

U.S. Residential Washing Machine Technology Outlook (Revenue, USD Million, 2017 - 2030)

- Top Load

- Front Load

U.S. Residential Washing Machine Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

- Online

- Offline

Curious about the U.S. Residential Washing Machine Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.