U.S. Protein Ingredients Market Benefits from Lifestyle Diseases

The U.S. protein ingredients market is experiencing robust growth, fueled by increasing health awareness and a shift toward functional and plant-based nutrition.

The U.S. protein ingredients market, valued at $19,963.7 million in 2022, is projected to reach $33.34 billion by 2030, with a Compound Annual Growth Rate (CAGR) of 6.6% from 2023 to 2030. The market's growth is primarily driven by rising health consciousness among the U.S. population, which has increased the demand for protein-enriched functional foods and sports nutrition products. Additionally, growing environmental concerns are accelerating the shift towards plant-based and other alternative protein sources.

As the health and wellness trend continues, food and beverage manufacturers are increasingly incorporating protein ingredients into dietary supplements and functional foods. The rising demand for protein formulations from the athletic population is also a key growth driver.

However, the market faces challenges, such as the characteristic "off-flavors" associated with certain new protein sources. For instance, pea proteins can have a beany flavor, while soy protein isolates may have an "off-flavor." This has spurred significant research aimed at reducing these undesirable flavors in plant-based proteins.

Key Market Insights:

- By Product Type: The animal/dairy protein segment dominated the market in 2022, accounting for a revenue share of 105.76%. This segment is driven by the demand for high-quality protein from various industries, including food and beverage, animal feed, and personal care.

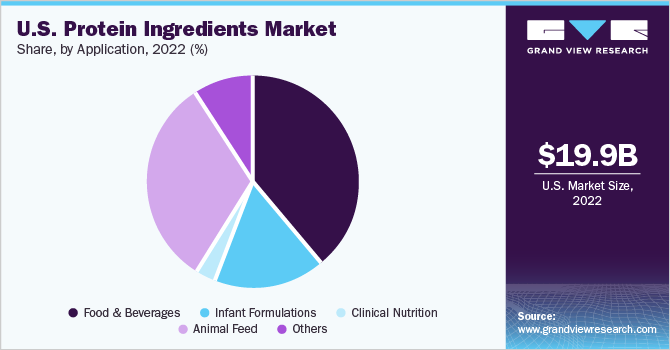

- By Application: The food & beverage segment was the market leader in 2022, with a revenue share of 39.21%, and is expected to maintain its dominant position throughout the forecast period.

Order a free sample PDF of the U.S. Protein Ingredients Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2022 Market Size: USD 19,963.7 Million

- 2030 Projected Market Size: USD 33.34 Billion

- CAGR (2023-2030): 6.6%

Key Companies & Market Share Insights

The U.S. protein ingredients market is a fragmented and competitive landscape with numerous players. Consumer demand for functional foods and sports nutrition products is driving manufacturers to utilize protein ingredients from diverse sources, including dairy, soy, pea, eggs, and insects.

Market leaders like Cargill, Incorporated, ADM, Roquette Frères, and Darling Ingredients maintain their strong position through a broad and varied product portfolio, extensive distribution networks, strong brand recognition, and financial stability.

To grow and adapt, key market players are adopting strategies such as new product launches, expansions, and strategic investments. A notable example is a collaboration announced in December 2022, where Ynsect, a leading insect protein company, revealed plans to build a large-scale farm in the U.S. in partnership with Ardent Mills. This facility was slated to begin operations in late 2023, reflecting the growing demand for alternative proteins in the U.S. market.

Key Players

- Cargill, Incorporated

- ADM

- Darling Ingredients

- Roquette Frères

- Ingredion

- Myco Technology, Inc.

- Axiom Foods, Inc.

- Farbest Brands

- Hilmar Ingredients

- International Flavors & Fragrances Inc.

- Diversified Ingredients

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. protein ingredients market is experiencing robust growth, fueled by increasing health awareness and a shift toward functional and plant-based nutrition. Demand from sectors like food, beverage, and sports nutrition continues to drive innovation in protein formulations. However, flavor challenges in plant proteins remain a concern, prompting ongoing R&D efforts. Market leaders are leveraging diverse strategies to stay competitive, including partnerships and product innovation. The growing interest in alternative proteins, such as insect-based options, reflects the market’s evolving landscape. Overall, the industry is set to expand significantly in the coming years.