U.S. Plastics Market 2030: How Regulations Shape Industry Dynamics?

The U.S. plastics market was valued at USD 90.14 billion in 2023 and is projected to reach USD 114.65 billion by 2030.

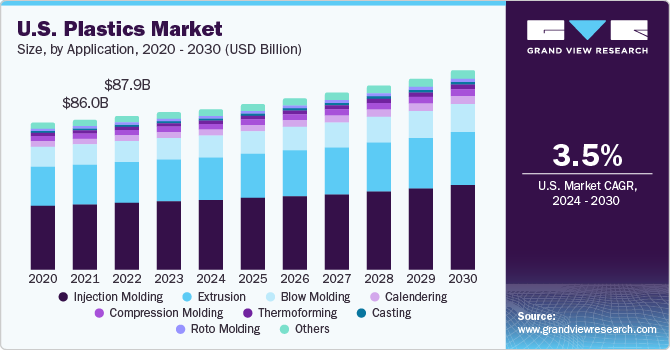

The U.S. plastics market was valued at USD 90.14 billion in 2023 and is projected to reach USD 114.65 billion by 2030, growing at a CAGR of 3.5% from 2024 to 2030. This growth is primarily driven by the increasing use of plastics across diverse end-use sectors such as automotive, packaging, and manufacturing.

In the automotive sector, the demand for lightweight vehicles—which offer improved fuel efficiency—is encouraging the use of plastic materials like polypropylene (PP). This material is preferred for components such as bumpers, door trims, and instrument panels due to its durability and resistance to chemicals. With continued R&D, the automotive industry has successfully incorporated PP into vehicle designs without compromising safety, further driving plastic usage in the sector.

Beyond automotive, plastics continue to play a crucial role in the production of recreational toys, containers, and consumer goods, contributing significantly to overall market growth.

E-Commerce & Packaging: Key Demand Drivers

The surge in e-commerce is another major contributor to the U.S. plastics market. As consumers increasingly favor online retail over traditional brick-and-mortar stores, the demand for durable, cost-effective packaging materials has soared. Plastics, with their versatility and performance, are integral to meeting the logistics and packaging needs of the growing online retail sector.

Robust Manufacturing Sector

The U.S. manufacturing industry also underpins the growth of the plastics market. Materials like polystyrene are widely used in the production of everyday items such as toys, electronic components, and disposable utensils. The steady demand for these products supports the consistent consumption of various types of plastics across the country.

Order a free sample PDF of the U.S. Plastics Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Product: The polyethylene (PE) segment led the market in 2023, accounting for a 23% revenue share. PE’s affordability and availability continue to make it a top choice across industries. Innovations in additives and performance enhancements are expected to broaden its application, particularly in CNC machines and 3D printing.

- High-density PE (HDPE) offers strong moisture resistance and cost-effectiveness.

- Low-density PE (LDPE) is preferred for its flexibility, heat-sealing ability, and softness, making it suitable for packaging applications.

- By End Use: The packaging segment dominated in 2023, capturing the largest market share. Rising demand from the food & beverage, personal care, pharmaceutical, and e-retail sectors continues to drive the need for durable and cost-efficient plastic packaging. The ability of plastics to withstand extreme environmental conditions further reinforces their widespread use in the packaging industry.

- By Application:

The injection molding segment held the highest share, accounting for 43% of market revenue in 2023. This technique is extensively used to produce items such as automotive components, medical devices, and containers.

Injection molding benefits from advancements in heat- and pressure-resistant materials, particularly amid ongoing infrastructure development projects. As a result, manufacturers of building products are increasingly utilizing plastic injection molding technologies.

Market Size & Forecast

- 2023 Market Size: USD 90.14 Billion

- 2030 Projected Market Size: USD 114.65 Billion

- CAGR (2024-2030): 3.5%

Key Companies & Market Share Insights

The U.S. plastics market is moderately concentrated and highly competitive, with leading players accounting for a substantial share of revenue and influencing broader market trends. These companies continue to focus on innovation, sustainability, and strategic expansion to maintain their market positions.

Key Players

- ExxonMobil Chemical

- Dow, Inc.

- Chevron Phillips Chemical Co., LLC

- Westlake Chemical

- DuPont

- Celanese Corporation

- Eastman Chemical Company

- Huntsman International LLC

- RTP Company

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. plastics market is on a steady growth path, driven by increasing demand across automotive, e-commerce, manufacturing, and packaging sectors. The transition toward lightweight and fuel-efficient vehicles, the explosive growth of online retail, and the resilience of consumer manufacturing are all reinforcing the need for innovative and efficient plastic solutions.

Key trends such as the dominance of polyethylene, the growing use of injection molding, and the rise of performance-enhancing additives highlight how the industry continues to evolve. As the U.S. economy leans further into digital commerce and infrastructure modernization, the plastics market is poised to remain a critical enabler of industrial and consumer innovation through 2030.