U.S. Pet Grooming Products Market 2030: Addressing Pet Allergies with New Formulations

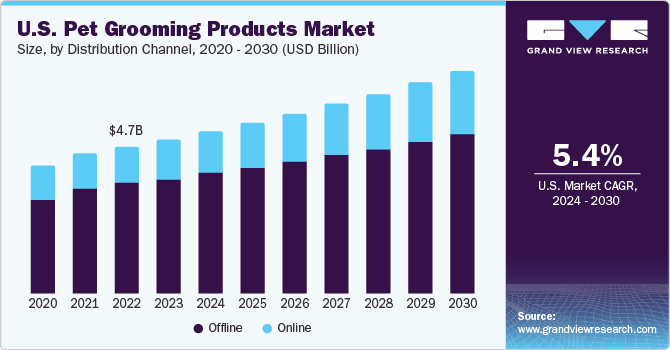

The U.S. pet grooming products market was valued at USD 4.94 billion in 2023 and is projected to reach USD 7.10 billion by 2030, growing at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2030.

U.S. Pet Grooming Products Market Overview

The U.S. pet grooming products market was valued at USD 4.94 billion in 2023 and is projected to reach USD 7.10 billion by 2030, growing at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2030. This growth is primarily driven by increasing pet adoptions, rising pet humanization trends, and heightened awareness regarding pet health and hygiene. As more consumers treat pets as family members, spending on grooming, accessories, and pet care essentials continues to surge.

In 2023, the U.S. accounted for 35.6% of the global pet grooming products market revenue, highlighting its significant role in the global landscape. The growing number of pet-owning households in the country has led to rising demand for grooming products. According to the National Pet Owners Survey conducted by the American Pet Products Association (APPA), over 70% of U.S. households-equating to 90.5 million families-owned a pet in 2021 and 2022. This increase in pet ownership directly supports sustained demand for pet grooming items designed to ensure pets' cleanliness, health, and overall well-being.

Additionally, major retail companies are strategically expanding into the pet care segment. Many are incorporating grooming services and veterinary clinics into their existing grocery store formats to meet evolving consumer preferences for convenient, all-in-one pet care solutions. For instance, in September 2023, Walmart announced the launch of a dedicated pet services center adjacent to its main store. Operated by PetIQ, the center offers veterinary services and grooming appointments, reinforcing Walmart’s intention to become a one-stop destination for both routine shopping and pet care needs.

Order a free sample PDF of the U.S. Pet Grooming Products Market Intelligence Study, published by Grand View Research.

Key Market Trends and Insights

- Offline sales channels dominated the U.S. market in 2023, accounting for 74.4% of the revenue share. Brick-and-mortar outlets-including supermarkets, hypermarkets, and specialty pet stores-continue to thrive due to the physical product visibility and the ability for customers to assess product quality before purchase.

- The pet shampoo and conditioner segment led the market in 2023 with a 54.4% revenue share. This dominance is attributed to the essential nature of hygiene maintenance for companion animals. These products are specifically formulated to clean, condition, and refresh pets' skin and coats, catering to both practical needs and consumer preferences for specialized care solutions.

Market Size Summary

- 2023 Market Value: USD 4.94 Billion

- 2030 Projected Value: USD 7.10 Billion

- CAGR (2024–2030): 5.4%

Key U.S. Pet Grooming Products Companies

Market players continue to pursue strategic expansion through mergers and acquisitions. A notable example includes BioAdaptives, Inc., a U.S.-based natural health products company, which acquired Philco Animal Health Inc., a Canadian veterinary products provider, in March 2018 to broaden its reach in the pet health sector.

Prominent companies in the U.S. pet grooming products market include:

- Groomer's Choice

- Himalaya Herbal Healthcare

- Spectrum Brands

- Earthbath

- Resco

- SynergyLabs

- Petco Animal Supplies, Inc.

- Coastal Pet Products

- Vet's Best

- 4-Legger

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. pet grooming products market is witnessing steady growth fueled by increasing pet ownership, rising consumer spending on pet care, and expanding retail innovations. Offline retail remains a dominant distribution channel, while product demand is particularly strong for essential hygiene items like shampoos and conditioners. As retailers like Walmart continue to invest in integrated pet services and as companies explore strategic acquisitions, the market is well-positioned for continued expansion through 2030. The combination of consumer demand for convenience, product quality, and specialized pet care will drive the market forward in the coming years.