U.S. Medical Spa Management Software Market 2030: How Technology Meets the Demand for Self-Care

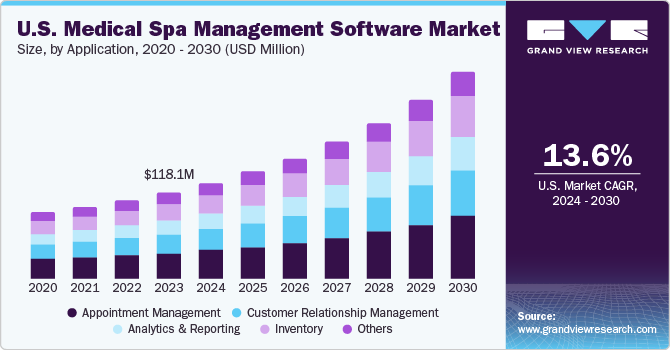

The U.S. medical spa management software market, valued at an estimated USD 118.1 million in 2023, is poised for significant growth, projected to expand at a compound annual growth rate (CAGR) of 13.6% from 2024 to 2030.

The U.S. medical spa management software market, valued at an estimated USD 118.1 million in 2023, is poised for significant growth, projected to expand at a compound annual growth rate (CAGR) of 13.6% from 2024 to 2030. Medical spas have surged in popularity, offering a compelling blend of cosmetic treatments and procedures within a relaxing, spa-like atmosphere. These establishments provide a diverse array of services, including popular options like Botox injections, laser hair removal, chemical peels, and various other non-invasive cosmetic procedures.

A key factor driving the adoption of medical spa software solutions across the U.S. is the increasing consumer preference for convenient online booking and highly personalized services. Data from the American Medspa 2022 report highlights the industry's remarkable growth, even during the COVID-19 pandemic, with 7,340 med spas operating in the U.S. in 2021. Notably, 17% of these were newly established facilities, indicating a substantial influx of new businesses into the sector.

Get a preview of the latest developments in the U.S. Medical Spa Management Software Market; Download your FREE sample PDF copy today and explore key data and trends

The pandemic also triggered a shift in consumer behavior, fostering a greater emphasis on self-care and wellness. Many individuals are now prioritizing their health and well-being, leading them to explore options for enhancing their physical appearance and boosting self-confidence. Medical spas offer a holistic approach to beauty and wellness, catering to those seeking tailored, personalized treatments. The increasing demand for non-invasive cosmetic procedures, driven by advancements in technology and techniques, has further fueled the expansion of the medical aesthetic industry, as more individuals opt for enhancements without undergoing surgery.

To comply with U.S. regulatory standards, medical spas are mandated to integrate specialized software solutions. This ensures that patient data is accurately recorded and securely protected, further propelling the demand for medical spa management software. Technological advancements, such as cloud-based platforms and integrated analytics, provide avenues for optimizing operations and enriching client interactions. Improvements in efficiency, heightened productivity, and significant financial savings all motivate medical spas to embrace comprehensive management software.

The burgeoning popularity of medical spa treatments is also being propelled by rising disposable incomes, empowering consumers to invest more in appearance-related treatments and self-care experiences. Additionally, with a growing geriatric population, there's a heightened interest in services aimed at preserving appearance and enhancing well-being, which is driving the need for sophisticated medical spa management software.

Detailed Segmentation

Type Insights

Web and cloud-based patient monitoring systems dominated the market with a market share of 68.7% in 2023 and are expected to grow at the fastest CAGR in the forecast period. Web and cloud-based software provides cost-effective, scalable, secure, and user-friendly solutions, making it the preferred choice for most U.S. medical spas. Web-based software eliminates the need for expensive upfront investments in hardware and software licenses. This makes it accessible to a broader range of medical spas, especially smaller businesses with limited budgets. Cloud-based solutions can easily adapt to changing business needs.

Application Insights

Appointment management applications accounted for the largest revenue share in 2023. This is attributable to its pivotal role in optimizing operational efficiency and enhancing customer satisfaction. With the increasing demand for personalized treatments and experiences, medical spas rely heavily on appointment management software to streamline the booking process, minimize scheduling conflicts, and send timely reminders to clients, thereby reducing no-show rates and maximizing revenue potential.

Key U.S. Medical Spa Management Software Company Insights

Some of the key companies operating in the U.S market include, Mindbody, Zenoti Software Solutions Inc, Booksy (Versum), SpaSoft Inc, and PatientNow/EnvisionNow.

- Zenoti Software Solutions is a major player in the market. The company offers comprehensive solutions tailored to the specific needs of medical spas. Their platform enables medical spa owners and practitioners to efficiently manage appointments, streamline operations, process payments, and engage with clients effectively.

- Mindbody is one of the key players in the market with a specific focus on the wellness industry including medical spas.The user-friendly interface and robust features of its solutions help medical spas enhance efficiency, improve client experiences, and drive business growth.

Key U.S. Medical Spa Management Software Companies:

- Agilysys NV LLC

- Birch Medical & Wellness

- Booksy (Versum)

- PatientNow/EnvisionNow

- Mindbody

- Nextech Systems, LLC

- Rosy Salon Software

- SpaSoft Inc. (Gary Jonas Computing Ltd.)

- Square (Block, Inc.)

- Silverbyte LTD

- Vagaro Inc

- Zenoti Software Solutions Inc.

U.S. Medical Spa Management Software Market Segmentation

Grand View Research has segmented the U.S. medical spa management software market based on type, application, and region.

U.S. Medical Spa Management Software Type Outlook (Revenue, USD Million, 2018 - 2030)

- Web and cloud-based

- On-premises

U.S. Medical Spa Management Software Application Outlook (Revenue, USD Million, 2018 - 2030)

- Appointment management

- Customer relationship management

- Analytics & reporting

- Inventory

- Others

U.S. Medical Spa Management Software Regional Outlook (Revenue, USD Million, 2018 - 2030)

- West

- Midwest

- Northeast

- Southwest

- Southeast

Curious about the U.S. Medical Spa Management Software Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends

Recent Developments

- In October 2023, Treatwell, announced its collaboration with mParticle, a platform for managing customer data. The objective of this partnership is to provide spa clients with a more personalized and data-driven experience to enhance customer engagement and improve targeted marketing efforts

- In June 2022, Booksy, a U.S.-based cloud-based platform for booking appointments, launched a new feature called "Add-ons." This feature enables spa professionals to offer extra services and products to their clients directly through the Booksy platform.

- In 2022, Glamplus secured USD 700,000 in funding to support its B2B marketplace expansion and further develop software features tailored for medical spas. This funding demonstrates the continued investment and growth potential within the medical spa software market.