U.S. Kayaks And Canoes Sports Equipment Market 2030: Key Players to Watch

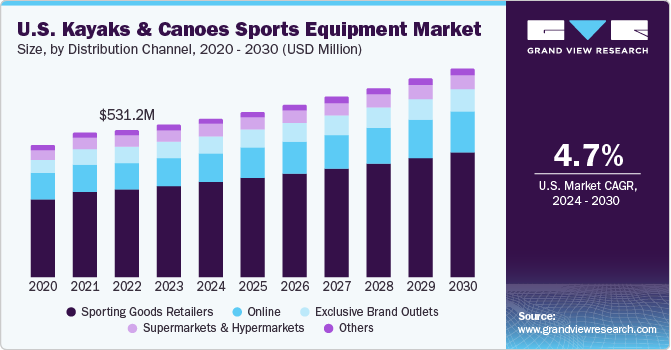

The U.S. market for kayaks and canoes sports equipment was valued at USD 551.7 million in 2023 and is projected to grow to USD 754.2 million by 2030, reflecting a compound annual growth rate (CAGR) of 4.7% between 2024 and 2030.

The U.S. market for kayaks and canoes sports equipment was valued at USD 551.7 million in 2023 and is projected to grow to USD 754.2 million by 2030, reflecting a compound annual growth rate (CAGR) of 4.7% between 2024 and 2030. This growth is being driven by the rising popularity of water-based recreational activities, increased awareness of the health benefits of kayaking and canoeing, technological innovations in product design and materials, expanded product variety, and strategic marketing efforts by outdoor sports retailers.

Interest in paddle sports, particularly kayaking and canoeing, continues to rise among Americans. This growing demand is fueled by a combination of outdoor lifestyle trends, health and fitness awareness, and recreational interests. The 2022 Outdoor Participation Trends Report recognized kayaking as the leading water sport in the U.S., while the 2021 Outdoor Participation Report by the Outdoor Foundation reported a 32% increase in kayaking participation over five years, making it the fastest-growing water sport.

As more Americans acknowledge the physical and mental wellness benefits of these activities, participation rates continue to climb, directly influencing equipment demand. According to the 2022 Outdoor Participation Trends Report by the Outdoor Foundation, 54% of Americans aged six and older engaged in at least one outdoor activity in 2021. That year, the number of outdoor recreation participants reached 164.2 million, representing a 2.2% increase over the previous year and continuing the upward trajectory observed since the onset of the COVID-19 pandemic in early 2020, which saw an overall 6.9% rise in outdoor participation. The report also emphasizes the role of outdoor activities in promoting health, supporting the economy, and fostering environmental stewardship.

Order a free sample PDF of the U.S. Kayaks And Canoes Sports Equipment Market Intelligence Study, published by Grand View Research.

Technological improvements in kayak and canoe production, particularly in materials and construction processes, have enhanced the quality and affordability of equipment. In 2022, notable shifts occurred in the paddle sports industry, with new leadership and acquisitions of well-established brands. For example, Pelican International Inc. acquired Confluence Outdoor, becoming the largest player in the paddle sports sector. Additionally, ownership changes in brands like Jackson Kayaks and Hobie Cat Co. reflect industry confidence and a push to attract a broader customer base while upholding quality standards.

Key Market Trends & Insights

- Kayaks held 85.6% of the total market revenue in 2023. The increasing popularity of soft adventure sports, such as kayaking, has led to heightened demand for advanced and safe equipment.

- The equipment segment represented 88.5% of the total market revenue in 2023 and is forecasted to grow at a CAGR of 4.7%. Innovations in design and lightweight, durable materials are key contributors to this growth.

- Mass-priced equipment accounted for 80.3% of the market in 2023, driven by the increasing number of beginners and casual participants entering the sport.

- Sporting goods retailers generated 61.1% of the market’s revenue in 2023, largely due to their broad product range, including accessories like paddles, life vests, and waterproof gear.

Market Size & Forecast

- 2023 Market Size: USD 551.7 Million

- 2030 Projected Market Size: USD 754.2 Million

- CAGR (2024–2030): 4.7%

Leading Companies in the U.S. Kayaks & Canoes Sports Equipment Market

Prominent players in the market include:

- Johnson Outdoors Inc.

- Lifetime Products

- Sawyer Station

- The Coleman Company

- NRS

- Hobie Cat Company II LLC

- Pelican International

- Sanborn Canoe Co.

- Mustang Survival Corp.

- Werner Paddles

These companies continue to lead through innovation, quality products, and robust marketing strategies aimed at a growing and diverse customer base.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. kayaks and canoes sports equipment market is poised for steady growth through 2030, driven by the increasing popularity of paddle sports, heightened awareness of their health benefits, and advancements in product design. With kayaking now recognized as the fastest-growing and most popular water sport in the U.S., the market is benefiting from a broadening participant base and supportive industry dynamics. Strategic investments, acquisitions, and continued innovation by key players signal strong confidence in the market's future, making it a dynamic and promising segment within the outdoor recreation industry.