U.S. Gates Market 2030: Regional Insights from the South and West

The U.S. gates market was valued at USD 4.70 billion in 2024 and is expected to reach USD 6.15 billion by 2030.

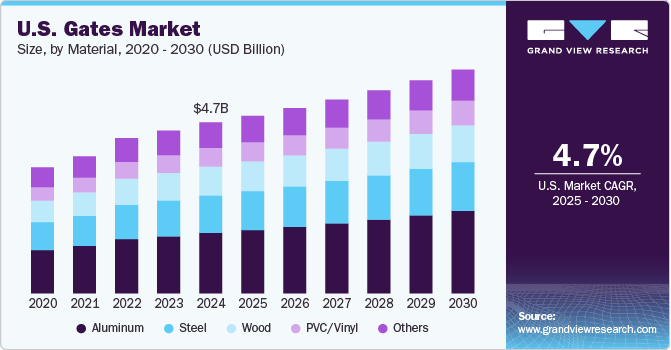

The U.S. gates market was valued at USD 4.70 billion in 2024 and is expected to reach USD 6.15 billion by 2030, registering at a CAGR of 4.7% between 2025 and 2030. A major factor contributing to this growth is the rising demand for residential gates, as homeowners increasingly prioritize security. Amid fluctuating crime rates and growing concerns over privacy, more Americans are turning to gate installations as a means to safeguard their properties and families. In addition to providing security, gates—especially those constructed from materials such as wood, aluminum, or custom-designed alternatives—also enhance a property's aesthetic appeal and overall value. This trend is becoming particularly prominent in new residential developments and renovation projects, especially in the rapidly expanding South and West regions of the country.

Another critical driver of market growth is the rapid expansion of commercial infrastructure across the U.S. With ongoing development in sectors like office buildings, retail centers, educational institutions, and healthcare facilities, there is a growing need for robust access control and perimeter security systems. In commercial settings, materials such as steel and PVC/vinyl are favored due to their durability, minimal maintenance requirements, and long-term cost benefits.

Additionally, increasingly stringent safety and building regulations across various states are prompting commercial entities to invest in higher-quality gates. This is particularly evident in metropolitan and industrial areas. For instance, the Consumer Product Safety Commission (CPSC) mandates compliance with 16 C.F.R. § 1239.2, which sets safety standards for expansion gates and enclosures, further fueling the demand for compliant gate systems.

Order a free sample PDF of the U.S. Gates Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Demand: The Southern U.S. accounted for the largest revenue share of 33.2% in 2024, driven by the region’s strong growth in real estate, agriculture, and manufacturing. The widespread use of gates in gated communities also supports this dominance, as they offer security and exclusivity.

- Material Segment: Aluminum gates led the market with a 35.4% revenue share in 2024. Their lightweight construction allows for easy installation, reduced labor costs, and high aesthetic versatility, making them a popular choice in both residential and commercial applications.

- End-Use Application: The residential segment was the largest in 2024, capturing 43.2% of the market. The focus on enhancing home security, privacy, and curb appeal has led homeowners to opt for both functional and decorative gates, thereby boosting segment growth.

Market Size & Forecast

- 2024 Market Size: USD 4.70 Billion

- 2030 Projected Market Size: USD 6.15 Billion

- CAGR (2025-2030): 4.7%

Key Companies & Market Share Insights

Prominent players shaping the U.S. gates industry include:

- Ameristar Perimeter: A leading manufacturer offering high-security steel and aluminum gates, as well as automated systems and crash-rated solutions for government, industrial, and commercial use.

- Greenfield Fence: Specializes in residential and commercial gates made from wood, vinyl, and aluminum. The company provides automated systems, weather-resistant materials, and full-service installation and maintenance.

Emerging participants include:

- Northeast Fence: Offers a variety of fencing materials and custom-built gates for residential, commercial, and municipal markets, including automation options.

- SEA USA Inc.: Focuses on gate automation and smart access control systems, including sliding and swing gate operators, remote controls, and integrated keypads for various applications.

Key Players

- Ameristar Perimeter

- Astro Fence

- Barfield Fence and Fabrication

- Seegars

- Greenfield Fence

- Northeast Fence

- Delta Fence & Construction

- Foster Fence

- Master Halco

- America’s Gate Company

- Gate Depot

- Amazing Gates

- City Gates USA

- TYMETAL

- SEA USA Inc.

- DBA “Mulholland Security Centers, LLC”

- Perimeter Security Group, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. gates market is poised for steady growth through 2030, underpinned by increasing residential and commercial demand for security and aesthetic enhancement. With an estimated CAGR of 4.7%, the industry benefits from expanding urban development, rising home security awareness, and tightening safety regulations. Regional growth in the Southern U.S., preferences for lightweight materials like aluminum, and a strong residential market presence are shaping the competitive landscape. As infrastructure development continues and technology integration advances, the demand for modern, durable, and compliant gate systems is expected to remain robust across the country.