U.S. Gas Turbine Market Dynamics: Fueling the Power & Utility Sector

The U.S. gas turbine market was valued at USD 2.27 billion in 2023 and is projected to reach USD 3.26 billion by 2030.

U.S. Gas Turbine Market Overview

The U.S. gas turbine market was valued at USD 2.27 billion in 2023 and is projected to reach USD 3.26 billion by 2030, growing at a CAGR of 4.7% from 2024 to 2030. This growth is primarily driven by the country's robust end-use industries, which continue to fuel demand for gas turbines. Additionally, the presence of a well-established natural gas infrastructure supports this market expansion. Increasing adoption of distributed power generation technologies and rapid technological advancements in the energy sector are further propelling market growth.

A gas turbine operates by using high temperatures to heat a mix of fuel and ambient air, which in turn causes turbine blades to spin, generating mechanical energy. This mechanical energy is then converted into electrical energy by a generator. Gas turbines are primarily used for power generation. Operating a basic cycle turbine power plant for electricity generation is typically costlier than importing electricity; hence, combined cycle power plants—known for their efficiency—are more commonly used. Among these, combined heat and power (CHP) plants are notable for their dual ability to generate mechanical drive and electricity.

Despite a diversified national energy mix, natural gas remains the predominant source of primary energy output. Ongoing efforts by the government to expand sustainable energy sources are expected to lead to an increase in gas turbine installations. The U.S. gas turbine market is poised for substantial growth, particularly due to federal support for low-carbon energy generation technologies.

Favorable economic conditions and policy frameworks promoting gas-based power generation are key drivers behind the transition from coal to gas power plants. The assurance of a steady fuel supply further strengthens the market's outlook. Gas turbines offer high efficiency and lower carbon emissions compared to other combustion-based power generation methods.

Order a free sample PDF of the U.S. Gas Turbine Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Capacity: The >200 MW segment held the highest market share in 2023, accounting for 78.47% of total revenue. This is largely due to the expansion of global power generation and a growing preference among major economies for gas-fired plants over coal-fired alternatives.

- By End-Use: The Power & Utility segment led the market with an 82.73% share in 2023, driven by increasing global electricity demand. While some major players are cautious about rising demand, the power and utility sector is expected to experience strong growth during the forecast period.

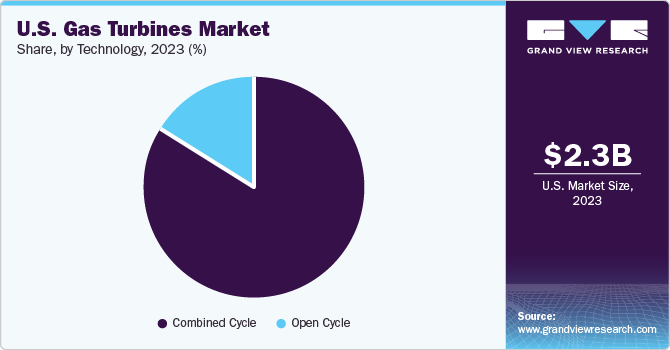

- By Technology: Combined cycle technology dominated the market in 2023 with an 84.29% share. This is attributed to its high efficiency, enabling greater power output from the same quantity of natural gas. Combined cycle gas turbine (CCGT) plants typically achieve energy conversion rates of 50% to 60%.

- By Application: Power generation was the leading application segment, comprising 42.70% of revenue in 2023. The increasing demand for electricity, driven by industrialization and urbanization—especially in developing economies—is fueling growth in this segment.

Market Size & Forecast

- 2023 Market Size: USD 2.27 Billion

- 2030 Projected Market Size: USD 3.26 Billion

- CAGR (2024-2030): 4.7%

Key Companies & Market Share Insights

The U.S. gas turbine market is relatively concentrated. Although numerous manufacturers operate across different segments, a few major companies dominate a significant share. High entry barriers, substantial capital investment, and economies of scale required for cost-efficiency and technological leadership contribute to this concentration.

Major players include:

- General Electric (GE): Offers a wide array of products and services in power generation and transmission. GE supports applications from nuclear and distributed energy to gasification and process technology for both on-grid and off-grid needs.

- Solar Turbines Incorporated: Specializes in gas turbine engines, generator sets, compressor packages, and related products. These are used across sectors including natural gas transmission, chemical processing, and pharmaceuticals.

- Capstone Turbine Corporation: Known for microturbine systems that provide clean and efficient energy solutions for commercial and industrial applications.

Other notable participants include:

- TurbineAero: A leading provider of MRO (Maintenance, Repair, and Overhaul), leasing, and brokerage services for aircraft components, with a focus on auxiliary power units (APUs).

- Columbia Manufacturing, Inc.: A contributing player in manufacturing components related to turbine systems.

Key Players

- General Electric

- Solar Turbines Incorporated

- Capstone Turbine Corporation

- Williams International

- TurbineAero

- Columbia Manufacturing, Inc.

- Sylvania

- Vericor Power

- Chromalloy Gas Turbine LLC

- Central Metal Fabricators, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. gas turbine market is on a steady growth trajectory, fueled by increasing demand for efficient and low-emission power generation solutions. The transition from coal to natural gas, government policies promoting cleaner energy, and ongoing innovations by major industry players are key factors supporting this momentum. As electricity demand continues to rise globally—especially in emerging markets—the role of gas turbines, particularly in combined cycle applications, is expected to become increasingly vital. With a projected market size of USD 3.26 billion by 2030, the U.S. gas turbine industry is set to remain a critical component of the country's evolving energy landscape.