U.S. Embedded Finance Market 2030: The Evolution of Payment Solutions

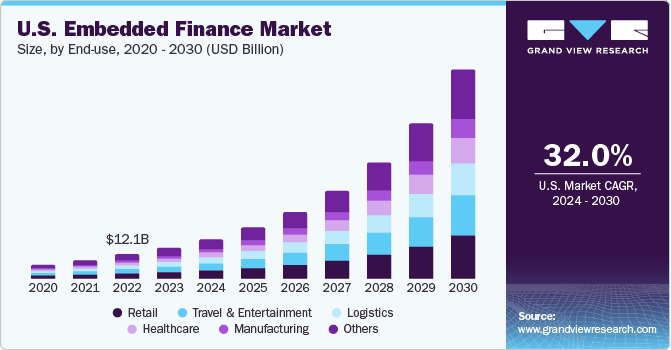

The U.S. embedded finance market was valued at USD 15.36 billion in 2023 and is projected to grow significantly, reaching USD 103.86 billion by 2030, at a compound annual growth rate (CAGR) of 32.0% between 2024 and 2030.

The U.S. embedded finance market was valued at USD 15.36 billion in 2023 and is projected to grow significantly, reaching USD 103.86 billion by 2030, at a compound annual growth rate (CAGR) of 32.0% between 2024 and 2030. This growth is primarily driven by increasing smartphone penetration and the rapid expansion of internet services across industries such as retail, logistics, and media & entertainment.

Major companies like Uber, Amazon, Tesla, and Apple have already integrated financial services into their mobile applications to enhance user experience. This trend has influenced other businesses to follow suit. Additionally, the rise of e-commerce platforms offering banking services through third-party banking-as-a-service (BaaS) providers is further fueling market expansion by streamlining the customer experience and eliminating the need for redirection to traditional bank websites.

Market Dynamics

In 2023, the U.S. contributed 18.43% to the global embedded finance market revenue. With widespread smartphone usage and high engagement on social media, the country remains a stronghold for e-commerce. According to the U.S. Department of Commerce, e-commerce made up 22.0% of total retail sales in 2023, highlighting the scale at which digital retail is operating.

To capitalize on this, e-commerce companies are integrating embedded finance solutions such as lending, insurance, and payment services. For example, Amazon.com and PayPal offer “Buy Now, Pay Later” options, while Home Depot and Shopify provide working capital and virtual cards to online merchants, enabling smoother operations and enhancing service levels at no added cost to users.

Order a free sample PDF of the U.S. Embedded Finance Market Intelligence Study, published by Grand View Research.

Digital Wallets & Financial Integration

As banks and tech firms continue to grow in the U.S., embedded finance is becoming increasingly essential for businesses seeking to diversify revenue streams and deliver frictionless customer experiences. A key growth area is the adoption of digital wallets.

According to a Capital One Shopping report, 53% of U.S. consumers used digital wallets more frequently than traditional payment methods in 2023, and 64% used them as often as conventional options. Digital wallets now often include integrated financial tools like loans, investments, and insurance—enabling full-spectrum financial service delivery while helping banks extend their reach and generate additional revenue.

Key Market Trends & Insights

- B2B Segment: Accounted for the largest revenue share of 31.12% in 2023, driven by an increasing number of embedded finance platforms targeting business clients.

- Large Enterprises: Held the highest revenue share by enterprise size in 2023. The U.S. is home to major technology players like Uber and Amazon, intensifying the push for advanced financial service integration.

- Retail Sector: Maintained a significant share in terms of end-use in 2023. Retailers are increasingly turning to embedded finance to offer customers more streamlined and complete service experiences.

- Embedded Payments: Dominated the market in 2023 due to the explosive growth of e-commerce, especially during and after the COVID-19 pandemic, as companies prioritized frictionless payment systems to retain customers.

Market Size & Forecast

- 2023 Market Size: USD 15.36 Billion

- 2030 Projected Market Size: USD 103.86 Billion

- CAGR (2024–2030): 32.0%

Key Companies & Market Developments

The U.S. embedded finance landscape is competitive and evolving rapidly, with both established firms and new entrants actively innovating. Companies are forming strategic partnerships, engaging in mergers and acquisitions, and complying with multi-state regulations to broaden their geographical and operational footprint.

Notably, in June 2023, Stripe partnered with Google Workspace, enabling customers to pay directly for appointments scheduled via Google Calendar. Stripe also introduced a charge card program under its Stripe Issuing product line, allowing platforms and fintechs to offer expense cards with flexible credit, thus opening new revenue channels. Similar initiatives across the sector are contributing to the growth of embedded finance in the U.S.

Key Players

- Stripe, Inc.

- PAYRIX

- Cybrid Technology Inc.

- ChargeAfter

- Lendflow

- Finastra

- FundThrough

- Fortis Payment Systems, LLC

- Transcard Payments

- Balance

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. embedded finance market is undergoing rapid transformation, fueled by high digital adoption, expanding e-commerce, and increasing consumer demand for seamless financial services. With a projected CAGR of 32.0% through 2030, the market is poised for exponential growth. As businesses continue to integrate financial tools into their ecosystems, embedded finance will play a vital role in shaping the future of digital commerce, offering both enhanced customer experiences and new revenue opportunities for providers.