U.S. Cryptocurrency Market Investment Landscape for Affluent Clients

The U.S. cryptocurrency market is poised for strong growth, driven by institutional adoption, expanding payment use cases, regulatory clarity, and the rapid rise of DeFi.

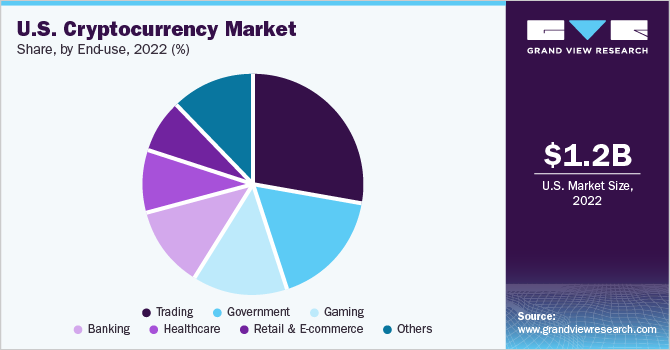

The U.S. cryptocurrency market size was valued at USD 1.19 billion in 2022 and is expected to reach USD 2.90 billion by 2030, growing at a CAGR of 12.0% from 2023 to 2030. The market has grown rapidly in recent years, supported by rising awareness of blockchain technology and the increasing adoption of cryptocurrencies by mainstream financial institutions. Leading banks and asset managers are investing in digital assets, providing custody services, and offering crypto-related investment products, which is strengthening the legitimacy of cryptocurrencies as an investment class.

The growing acceptance of digital assets as a payment method is another key driver. Major payment platforms such as PayPal now allow users to buy, sell, and hold cryptocurrencies, while some retailers have started accepting them for purchases. This has expanded the use cases and utility of cryptocurrencies, enhancing their consumer appeal.

Regulatory clarity has also shaped the U.S. cryptocurrency industry. Guidance from the Securities and Exchange Commission (SEC) has helped define the regulatory framework for crypto-related activities, improving compliance and boosting investor confidence.

In addition, the rise of Decentralized Finance (DeFi) has significantly contributed to market growth. DeFi enables peer-to-peer transactions and blockchain-based financial applications without intermediaries, posing disruption to traditional financial services. The U.S. is a leading hub for DeFi innovation, with many pioneering projects headquartered in the country.

Key Market Insights

- By component: The hardware segment accounted for the largest revenue share of more than 82.0% in 2022, supported by reduced power consumption of cryptocurrency miners and higher processing speeds.

- By hardware: The application-specific integrated circuit (ASIC) segment held the largest revenue share of over 43.0% in 2022. ASICs are specialized circuits designed for mining cryptocurrencies such as Bitcoin, Litecoin, and Ethereum.

- By software: The exchange software segment captured the largest revenue share of over 32.0% in 2022, fueled by the rising use of cryptocurrencies for payments and investments.

- By process: The mining segment dominated with a revenue share of more than 74.0% in 2022, owing to its critical role in transaction validation and blockchain maintenance.

- By type: Bitcoin led the market with a revenue share of more than 35.0% in 2022, retaining its status as the first and most widely adopted cryptocurrency.

Order a free sample PDF of the U.S. Cryptocurrency Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2022 Market Size: USD 1.19 Billion

- 2030 Projected Market Size: USD 2.90 Billion

- CAGR (2023–2030): 12.0%

Key Companies & Market Share Insights

The market features strong competition, with key players pursuing strategic initiatives such as partnerships, mergers, and acquisitions to strengthen their positions.

- October 2020: BitGo Inc. partnered with Chainlink to use its decentralized oracle network for Wrapped Bitcoin Collateralization (WBTC). Chainlink’s proof-of-reserve mechanism enhanced transparency and auditability of WBTC reserves.

- September 2022: Bit Digital, Inc. announced the launch of Ethereum staking operations in collaboration with Blockdaemon, expanding beyond Bitcoin mining into Ethereum transaction validation.

Key Players

- Advanced Micro Devices, Inc.

- Coinbase, Inc.

- Robinhood

- Kraken

- Intel Corporation

- Ripple

- Bit Digital, Inc.

- BitGo

- NVIDIA Corporation

- Anchorage Digital

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The U.S. cryptocurrency market is poised for strong growth, driven by institutional adoption, expanding payment use cases, regulatory clarity, and the rapid rise of DeFi. With innovation in both hardware and software segments, along with increasing participation from established financial players, the market is set to evolve into a more mature and mainstream financial ecosystem.