U.S. Copper Wire Market 2030: Connectors of Tomorrow

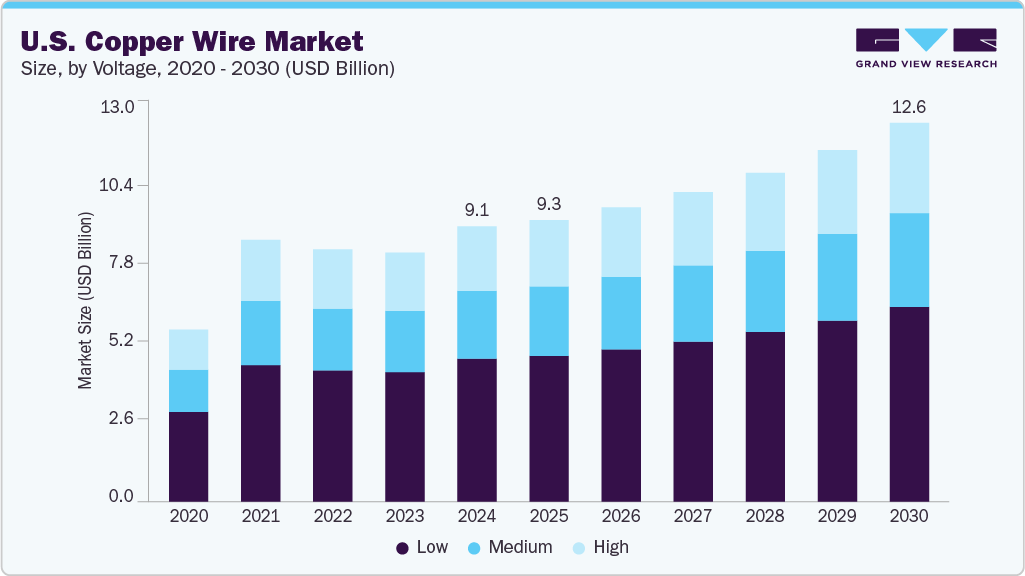

The U.S. copper wire market was valued at USD 9.14 billion in 2024 and is projected to reach USD 12.58 billion by 2030.

The U.S. copper wire market was valued at USD 9.14 billion in 2024 and is projected to reach USD 12.58 billion by 2030, registering a CAGR of 6.1% from 2025 to 2030. This market continues to expand steadily, owing to copper’s critical role across various applications including electrical infrastructure, automotive wiring, telecommunications, and energy systems.

Copper remains the preferred material in these domains due to its superior electrical conductivity, thermal resilience, and recyclability. The ongoing shift toward infrastructure modernization, increased construction activities, and the accelerating transition to renewable energy sources are key factors boosting demand for high-performance copper wire in residential, commercial, and industrial settings. Further, the rise in energy-efficient technologies and electrification of transportation and utility sectors strengthens the long-term outlook for copper wire in the U.S. market.

Sector-Specific Developments

Sector-Specific Developments

Renewable Energy - Copper is vital in renewable energy systems, particularly for its efficiency in transmitting electricity. For instance, in September 2024, Southwire partnered with Statewide Renewable to implement a solar energy system at its North Campus plant in Georgia. The installation is expected to generate approximately 5 megawatts of direct current electricity—supplying 15% to 20% of the facility’s energy needs, which is enough to power over 400 homes for a year. This project highlights the increasing demand for copper wiring in large-scale renewable installations, where material reliability and high conductivity are essential.

Automotive Sector - The automotive industry remains a strong growth area, particularly with the rise of electric vehicles (EVs). Copper wire is critical for high-voltage battery systems, regenerative braking, and vehicle diagnostics. In December 2024, General Motors announced a collaboration with ChargePoint under the GM Energy brand to install up to 500 ultra-fast DC charging ports across public locations and dealerships in the U.S. These charging stations will support both CCS and NACS standards, enhancing accessibility and promoting EV adoption—both of which increase the demand for robust copper wiring.

Order a free sample PDF of the U.S. Copper Wire Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Voltage: The low-voltage segment led the market in 2024, accounting for 51.9% of total revenue. Its dominance stems from wide usage in residential and commercial wiring, appliance connections, and LAN cabling. In March 2025, ABB announced a USD 120 million investment to expand its low-voltage production in Tennessee and Mississippi, aiming to boost capacity by over 50% to meet increasing demand from data centers, utilities, and construction projects.

- By Application: The building wire segment held the highest market share in 2024, driven by its central role in power distribution, lighting, and residential and commercial construction. In June 2023, Southwire Company announced a 30% expansion of its Florence, Alabama manufacturing site, adding 340,000 square feet to increase output of copper building wire—one of the most in-demand segments in the U.S. copper wire industry.

Market Size & Forecast

- 2024 Market Size: USD 9.14 Billion

- 2030 Projected Market Size: USD 12.58 Billion

- CAGR (2025-2030): 6.1%

Key Companies & Market Share Insights

The U.S. copper wire industry is highly competitive, featuring both large corporations and smaller regional players. Growth is being fueled by investments in electrical infrastructure, renewable energy expansion, and automation in manufacturing.

Mergers and acquisitions are increasingly common, with larger firms acquiring regional competitors to expand product portfolios and geographic presence, reshaping the competitive dynamics of the market.

Notable Companies:

- Encore Wire - Founded in 1989 and headquartered in McKinney, Texas, Encore Wire manufactures copper and aluminum wire for residential, commercial, and industrial applications. Operating a 460-acre campus with over 3.5 million square feet of space, the company is recognized for its innovations like Reel Payoff, Cyclone Barrel Pack, and PullPro, which enhance on-site installation efficiency.

- Aviva Metals - A leading U.S. manufacturer and distributor of brass, bronze, and specialty copper alloys. Operating a state-of-the-art foundry in Lorain, Ohio since 1998, Aviva Metals maintains an extensive inventory of over 10 million pounds across more than 100 copper alloy grades. It serves sectors including aerospace, marine, oil & gas, and electronics, with a global presence through its Toulon, France hub.

Key Players

- Aviva Metals

- Kris-Tech Wire

- Kalas. Manufacturing

- Encore Wire Corporation

- Technical Cable

- Southwire Company, LLC.

- Philatron.

- Rea.

- International Wire

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. copper wire market is set for steady growth through 2030, driven by key trends in electrification, infrastructure development, and the transition to clean energy. Copper's inherent properties—especially its conductivity, durability, and recyclability—keep it at the forefront of wiring applications across sectors.

Major developments in renewable energy installations, EV infrastructure, and low-voltage electrification projects are significantly boosting demand. While the market remains fragmented, ongoing investments, technological innovation, and strategic mergers are reshaping the competitive landscape.

With a projected market value of USD 12.58 billion by 2030, the U.S. copper wire industry is expected to remain a crucial pillar in the nation's evolving energy and electrical ecosystem.