U.S. Clear Aligners Market 2030: Teledentistry Shapes the Future

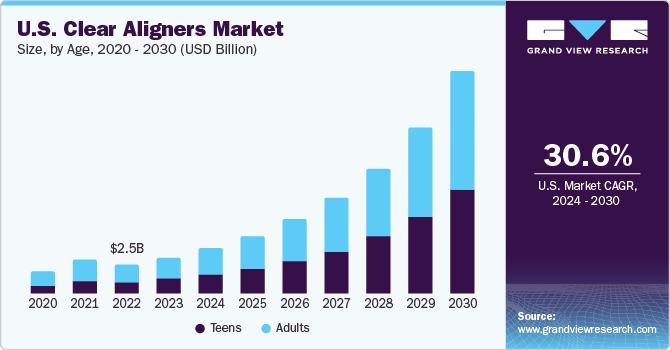

The U.S. clear aligners market was valued at USD 2.49 billion in 2023 and is expected to grow significantly, reaching USD 15.59 billion by 2030. This represents a robust compound annual growth rate (CAGR) of 30.6% from 2024 to 2030.

U.S. Clear Aligners Market Overview

The U.S. clear aligners market was valued at USD 2.49 billion in 2023 and is expected to grow significantly, reaching USD 15.59 billion by 2030. This represents a robust compound annual growth rate (CAGR) of 30.6% from 2024 to 2030. The growth is driven by the rising prevalence of malocclusions and the strong presence of advanced infrastructure and technologies such as CAD/CAM software and digital radiography systems. The growing customization of dental procedures, combined with the integration of modern technologies like digital impression systems, is making it possible to effectively treat mild to moderate misalignment cases using clear aligners.

An increasing number of dental issues, particularly malocclusions, and the proven effectiveness of clear aligners in treating such conditions are key growth drivers. According to the World Health Organization (WHO), malocclusion ranks as the third most prevalent dental condition globally, following dental caries and periodontal disease. It often results in teeth misalignment, which may lead to severe oral health complications over time. Being largely genetic, this condition frequently causes tooth crowding and irregular bite patterns.

The American Association of Orthodontics reports that over 4 million people in the U.S. wear dental braces, with more than 25% of them being adults over 18. Clear aligners have gained popularity as an aesthetically pleasing and comfortable alternative to traditional braces. Initially used only for minor dental corrections, advancements in technology have enabled their application in treating more complex conditions, including Class I and Class II malocclusions. This has led to broader acceptance of clear aligners among U.S. patients.

Order a free sample PDF of the U.S. Clear Aligners Market Intelligence Study, published by Grand View Research.

Key Market Trends and Insights

- Adult Segment Leadership: Adults accounted for 60.2% of market revenue in 2023. The demand rose notably during the COVID-19 pandemic due to increased online interactions, which emphasized dental aesthetics.

- Standalone Practices Dominance: These accounted for 52.9% of the market in 2023. Many orthodontists recommend clear aligners as they promote healthier gum tissue and carry less risk of enamel decalcification compared to metal braces.

- Orthodontists as Leading Providers: Representing 67.6% of the market share in 2023, orthodontists play a key role, as they are specialists referred to for clear aligner treatments and other corrective procedures.

- Medium Treatment Segment: This category, referring to treatment durations of over 6 to 12 months with 20-40 aligner sets, captured the largest market share at 49.4% in 2023. Most orthodontic cases fall within this treatment window.

- Polyurethane Material Usage: The polyurethane segment held 77.2% of the market share in 2023. Its popularity stems from its adaptability for both flexible and rigid aligner components, particularly in Invisalign products.

- Offline Distribution Dominance: Offline sales channels captured 74.8% of the market share in 2023. Clear aligner products are marketed to general dentists, orthodontists, DSOs, dental labs, and third-party distributors predominantly via offline routes.

Market Size & Forecast

- 2023 Market Size: USD 2.49 Billion

- 2030 Projected Market Size: USD 15.59 Billion

- CAGR (2024–2030): 30.6%

Key Companies and Market Share Insights

The market features a competitive landscape with key players such as Align Technology and Dentsply Sirona, alongside emerging names like 3M, Ormco Corporation (Envista Corp), and TP Orthodontics, Inc. A key driver of competition is the adoption of advanced digital technologies, including 3D printing, intraoral scanning, digital tooth modeling, and CAD/CAM appliances.

To strengthen their market positions, companies are increasingly focusing on strategic partnerships, product innovation, and geographic expansion. For instance, in April 2023, Henry Schein Inc. partnered with Biotech Dental Group to enhance its digital workflow, offer clear aligner solutions, and improve clinical outcomes for dental practitioners.

Leading U.S. Clear Aligner Companies Include:

- Align Technology, Inc.

- Dentsply Sirona

- SmileDirectClub

- Ormco Corporation (Envista)

- Henry Schein, Inc.

- TP Orthodontics, Inc.

- Argen Corporation

- 3M

Browse Horizon Databook on – U.S. Clear Aligners Market Size & Outlook

Conclusion

The U.S. clear aligners market is undergoing rapid transformation, fueled by rising cases of dental misalignment, technological innovations, and growing consumer demand for discreet orthodontic solutions. With a projected CAGR of 30.6% from 2024 to 2030, the market is set for exponential growth. Widespread adoption among adults, increasing application scope beyond minor corrections, and the shift toward digital and customized dental treatments are central to this trajectory. Companies that invest in innovation, strategic partnerships, and expanded access through offline and clinical channels are expected to gain a strong foothold in this highly dynamic market.