U.S. Chemical Distribution Market 2030: Industrial Chemicals Lead Growth

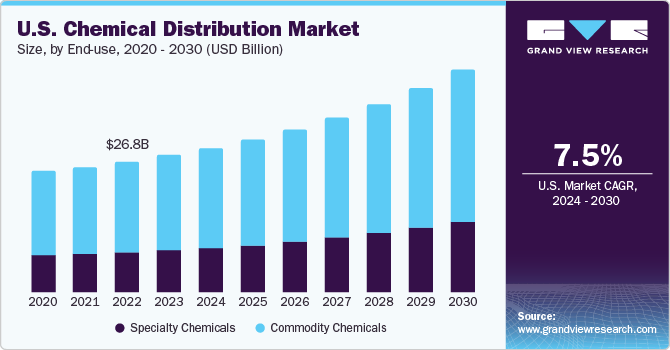

The U.S. chemical distribution market was valued at USD 28.03 billion in 2023 and is projected to reach USD 45.62 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.5% from 2024 to 2030.

U.S. Chemical Distribution Market Overview

The U.S. chemical distribution market was valued at USD 28.03 billion in 2023 and is projected to reach USD 45.62 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.5% from 2024 to 2030. The industry in the United States is relatively fragmented, with a wide range of distributors operating across the country. Leading market players often benefit from broader geographic presence, diverse product lines, and strong supplier relationships, giving them a competitive edge. Nevertheless, smaller companies remain active contributors, shaping a moderately fragmented competitive landscape.

The robust growth in this market is fueled by increasing demand across several end-use industries. Infrastructure development projects—such as the construction of hotels and hospitals in New York, Missouri, and Los Angeles—are anticipated to support the expansion of the construction sector, consequently driving chemical demand and benefiting chemical distribution companies.

Additionally, there is rising demand for downstream chemical products like diesel fuel, heating oil, and lubricants in industries including construction, automotive, and pharmaceuticals. According to the U.S. Energy Information Administration, the average daily diesel fuel consumption in the U.S. stood at around 159 million gallons in 2020. Ongoing expansion in chemical production facilities and the growth of the construction and pharmaceutical sectors are expected to further support the distribution market.

Chemical distributors are increasingly positioned to serve as intermediaries between chemical manufacturers and end-users. These distributors can take advantage of industry insights related to planned applications and the development of eco-friendly products. By offering advisory services on sustainable and compliant solutions along with their trading functions, distributors can enhance their value proposition in the market.

Chemical distribution involves both bulk and packaged transport and storage of chemical products, using containers such as barrels, sacks, and pipelines. These chemicals serve as raw materials in a wide array of industries, including oil and petroleum, food and beverages, cosmetics, textiles, paints, agriculture, and construction. Globally, distributors supply a mix of specialty and commodity chemicals.

Order a free sample PDF of the U.S. Chemical Distribution Market Intelligence Study, published by Grand View Research.

Key Market Trends and Insights

- Commodity Chemicals Dominance: The commodity chemicals segment accounted for the highest market share at 69.80% in 2023. This is largely attributed to increasing usage in plastics, polymers, and petrochemical industries.

- Downstream Segment Growth: Within the commodity chemicals category, the downstream segment held the largest share at 37.48% in 2023. These chemicals—used in producing petrol, diesel, kerosene, lubricants, jet fuel, waxes, and asphalt—are critical for industries such as automotive, aviation, steel, and shipping.

Market Size & Forecast

- Market Size (2023): USD 28.03 Billion

- Projected Market Size (2030): USD 45.62 Billion

- CAGR (2024–2030): 7.5%

Key Players and Market Share Insights

The U.S. market features a high number of regional and local distributors, leading to moderate fragmentation. Many firms are pursuing mergers, acquisitions, partnerships, and investments to grow their market presence. Additionally, companies are focusing on enhancing product quality and maintaining competitive pricing.

Major Market Participants Include:

- Univar Solutions Inc

- Brenntag AG

- ICC Industries, Inc.

- Helm AG

- Barentz

- Azelis

- Safic-Alcan

- Ashland

- Biesterfeld AG

Browse Horizon Databook on – U.S. Chemical Distribution Market Size & Outlook

Conclusion

The U.S. chemical distribution market is poised for significant growth, driven by rising demand across various industrial sectors and ongoing infrastructure development. While the industry remains moderately fragmented, both major and smaller distributors are finding opportunities to grow. The market’s expansion is underpinned by increasing demand for downstream chemicals, broader production capabilities, and the push toward sustainable and specialized chemical solutions. As the market grows at a projected CAGR of 7.5% through 2030, players who adapt to evolving industry needs and invest in strategic partnerships are likely to gain a competitive edge.****