U.S. Bedroom Furniture Market: The Influence of Urban Living

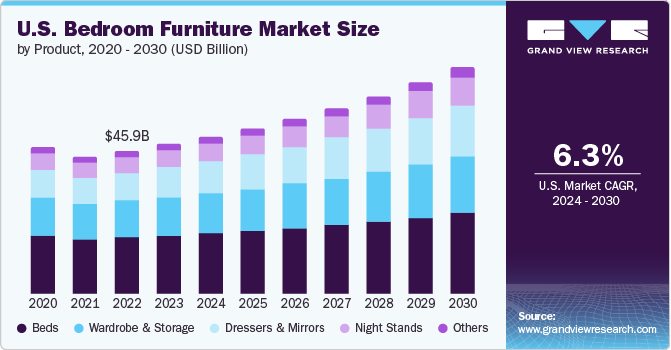

The U.S. bedroom furniture market was valued at USD 47.98 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2030.

U.S. Bedroom Furniture Market Overview

The U.S. bedroom furniture market was valued at USD 47.98 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2030. This growth is being driven by the increasing popularity of home improvement and renovation projects, prompting homeowners to upgrade their bedroom spaces. Consumers are replacing outdated beds, dressers, and nightstands with more stylish and functional options that better reflect modern aesthetics and offer enhanced comfort.

A growing focus on sustainability is also shaping the market. Many furniture manufacturers are adopting eco-friendly practices by sourcing materials responsibly or incorporating recycled components to meet rising environmental standards. In May 2023, Williams-Sonoma Inc. introduced GreenRow, a new sustainability-focused brand offering vintage-inspired, heirloom-quality products. Its portfolio spans multiple categories, including bedroom, living, and dining furniture, as well as bedding, lighting, bath accessories, décor, and tableware.

Retailers are increasingly leveraging digital advertising platforms to connect with key consumer demographics. For example, in November 2023, Raymour and Flanigan, the largest furniture and mattress retailer in the Northeast U.S., used Roku’s ad platform to target younger consumers, particularly Millennials and Gen Z. Their targeted streaming campaign reached approximately 4.5 million people, leading to 337,000 store visits, with 146,000 directly attributed to Roku media exposure.

Order a free sample PDF of the U.S. Bedroom Furniture Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By product, the beds segment dominated the U.S. bedroom furniture market in 2023, holding a 38% market share. This segment includes a variety of styles such as full, queen, king-size, guest beds, bunk beds, and storage beds. Demand is being driven by population growth, urbanization, and rising disposable income.

- By distribution channel, offline retail accounted for 56% of the market share in 2023. Consumers value the tactile experience of physically testing furniture, especially beds and mattresses, before making a purchase. Offline channels also offer added services like delivery, assembly, and removal of old furniture, enhancing the overall buying experience.

- By price range, furniture priced between USD 500 and USD 999 held the largest share, accounting for 42% of the market in 2023. This price bracket strikes a balance between affordability and quality, making it attractive to a broad spectrum of consumers seeking durable and stylish options at a reasonable cost.

Market Size & Forecast

- 2023 Market Size: USD 47.98 Billion

- 2030 Projected Market Size: USD 72.48 Billion

- CAGR (2024-2030): 6.3%

Key Companies & Market Share Insights

The U.S. bedroom furniture market is highly competitive, with a mix of established retailers and growing online platforms. Leading companies are actively investing in innovation, sustainability, and omnichannel strategies to strengthen their positions in the market.

Key Players

- Williams Sonoma, Inc.

- Inter IKEA Systems B.V.

- Amazon

- Target Brands, Inc.

- Wayfair LLC

- Ashley Furniture Industries, LLC

- Crate and Barrel

- Rooms to Go

- Living Spaces

- Restoration Hardware, Inc (RH)

- Raymour & Flanigan

- Herman Miller Inc.

- Article

- THUMA Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. bedroom furniture market is poised for steady growth through 2030, supported by rising consumer interest in home upgrades, sustainability, and personalized living spaces. The trend toward tactile in-store experiences, combined with the rise of targeted digital advertising, reflects evolving consumer behaviors and preferences. As major brands innovate and adopt environmentally responsible practices, the industry is set to meet both aesthetic and ecological demands. With strong demand across middle-price ranges and increasing focus on comfort and design, the market will continue to evolve in response to lifestyle shifts and environmental priorities.