Unmanned Ground Vehicles Market 2030: Robotics for Hazardous Missions

The global unmanned ground vehicles (UGVs) market was valued at USD 2.92 billion in 2022 and is projected to reach USD 5.62 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.8% from 2023 to 2030.

The global unmanned ground vehicles (UGVs) market was valued at USD 2.92 billion in 2022 and is projected to reach USD 5.62 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.8% from 2023 to 2030. This growth is driven by increasing demand for UGV systems across both commercial and military sectors, as well as advancements in UGV technology. These innovations have reduced ownership costs and improved accessibility, particularly for civilian applications.

UGVs are robotic platforms capable of operating across land, air, and water, and can perform tasks autonomously or via remote control. They are utilized in a wide range of applications, including surveillance, dam and nuclear facility inspections, operations in hazardous chemical zones, bomb disposal in conflict areas, and search and rescue missions during emergencies or natural disasters.

The growing deployment of robots in high-risk environments—such as areas contaminated by biological, radiological, nuclear, or chemical threats—is expected to significantly boost UGV market growth. These systems are particularly effective in mitigating dangers from explosive ordnance (EO), including landmines and improvised explosive devices (IEDs). As such threats remain prevalent, the demand for unmanned ground vehicles is anticipated to grow substantially throughout the forecast period.

Order a free sample PDF of the Unmanned Ground Vehicles Market Intelligence Study, published by Grand View Research.

The COVID-19 pandemic had a notable impact on the UGV market, presenting several challenges including decreased defense budgets in various regions, logistical hurdles, and disruptions in raw material supply chains. In response, many defense contractors and service providers scaled back on expansion efforts and R&D spending to manage declining revenues. Production slowdowns and delayed procurement further hindered market performance during the pandemic.

Key Market Trends & Insights

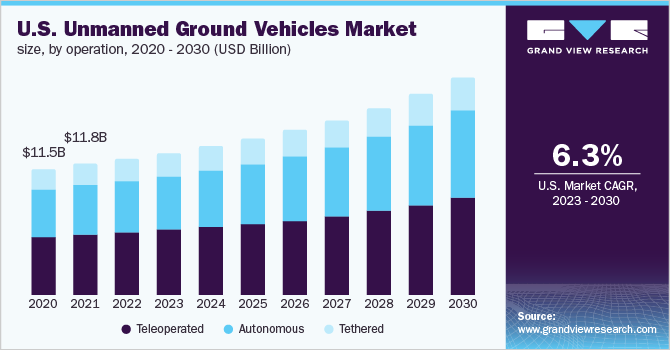

- North America held the largest market share, exceeding 40% in 2022. This can be attributed to factors including the growing defense budget and increasing investments in the procurement of next-generation military UGVs for numerous countries in the area, notably the U.S.

- Based on the mobility segment, the market is divided into wheels, tracks, legs, and hybrid. The tracks segment was valued at over USD 1.29 billion million in 2022 and is expected to emerge as the dominant segment during the forecast period owing to the increasing defense spending along with the procurement of next-generation tracked UGVs from various countries.

- On the basis of size, the global market has been fragmented into small, medium, large, and very large. The small-size segment witnessed a significant market share of over 23% in 2022.

- The system segment is classified into payloads, navigation and control systems, power system, and others. Over the forecast period, the navigation and control segment is expected to witness a considerable CAGR of 8.0%.

- Based on application segments, the market is differentiated into commercial, military, and government & law enforcement. The military segment accounted for the largest market share and is expected to continue its dominance during the forecast period.

Market Size & Forecast

- 2022 Market Value: USD 2.92 Billion

- 2030 Projected Value: USD 5.62 Billion

- CAGR (2023–2030): 8.8%

- Largest Market (2022): North America

- Fastest Growing Region: Asia Pacific

Competitive Landscape

Key players in the UGV market are actively expanding their product portfolios through R&D investments and competitive pricing strategies, intensifying market competition. For example, in May 2022, BAE Systems plc showcased its Robotic Technology Demonstrator (RTD), a modified M113 armored vehicle platform, developed to meet the U.S. Army’s requirements for the Robotic Combat Vehicle-Medium (RCV-M).

Technological advancements are enabling companies to enhance efficiency and reduce costs, making UGVs more accessible and standardized globally. Continued innovation and investment are accelerating the adoption of unmanned ground vehicles across diverse sectors. Prominent market players include:

- BAE Systems plc

- General Dynamics Corporation

- Hexagon AB

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Northrop Grumman Systems Corporation

- Oshkosh Defense LLC

- QinetiQ Group Plc

- Raytheon Technologies Corporation

- Rheinmetall AG

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The unmanned ground vehicles market is poised for substantial growth over the coming years, fueled by heightened demand across defense and civilian sectors, expanding technological capabilities, and broader global adoption. Despite temporary setbacks due to the COVID-19 pandemic, the sector is recovering strongly, with innovation and strategic investments driving long-term expansion. As threats become more complex and the need for automated, risk-mitigating solutions increases, UGVs will play an increasingly vital role in both commercial and military landscapes worldwide.