UAE Jewelry Market Expands with Surge in Gold and Diamond Demand

The UAE jewelry market size is anticipated to reach USD 7.65 billion by 2033 and is expected to expand at a CAGR of 5.8% during the forecast period

The UAE jewelry market size is anticipated to reach USD 7.65 billion by 2033 and is expected to expand at a CAGR of 5.8% during the forecast period, according to a new report by Grand View Research, Inc. The rise in disposable income among residents and tourists is expected to drive the market growth.

As the UAE continues positioning itself as a luxury destination, affluent consumers increasingly invest in fine jewelry as a symbol of status, personal style, and wealth. This trend is further amplified by the country’s thriving tourism sector, which attracts high-spending visitors from across the globe, many of whom seek premium jewelry as part of their shopping experience.

Cultural significance also plays a pivotal role in sustaining demand for jewelry in the UAE. Jewelry is deeply embedded in local customs, particularly in celebrations such as weddings, religious festivals, and family milestones. These occasions often involve gifting or purchasing gold, diamonds, and other precious ornaments, reinforcing jewelry’s role as both a cultural and financial asset. The presence of a large expatriate population further diversifies consumer tastes, encouraging retailers to offer a wide range of designs that blend traditional motifs with contemporary aesthetics.

The UAE’s strategic location as a global trade hub also enhances its appeal in the jewelry sector. Positioned at the crossroads of East and West, the country facilitates international trade and attracts global brands seeking to establish a presence in the Middle East. Favorable government policies, tax incentives, and a well-developed retail infrastructure further support the growth of the jewelry market. Additionally, increasing awareness of ethical sourcing and sustainability influences consumer choices, prompting brands to adopt responsible practices and promote certified, conflict-free products.

Further key findings from the report suggest:- Based on product, the rings segment accounted for the largest share of 37.4% of the revenue in 2024.

- By material, the gold jewelry segment held the largest share of 58.5% in 2024.

- The diamond segment in the UAE is expected to grow significantly at a CAGR of 6.4% during the forecast period.

- By distribution channel, the offline retail stores segment held the largest share of 84.9% in 2024.

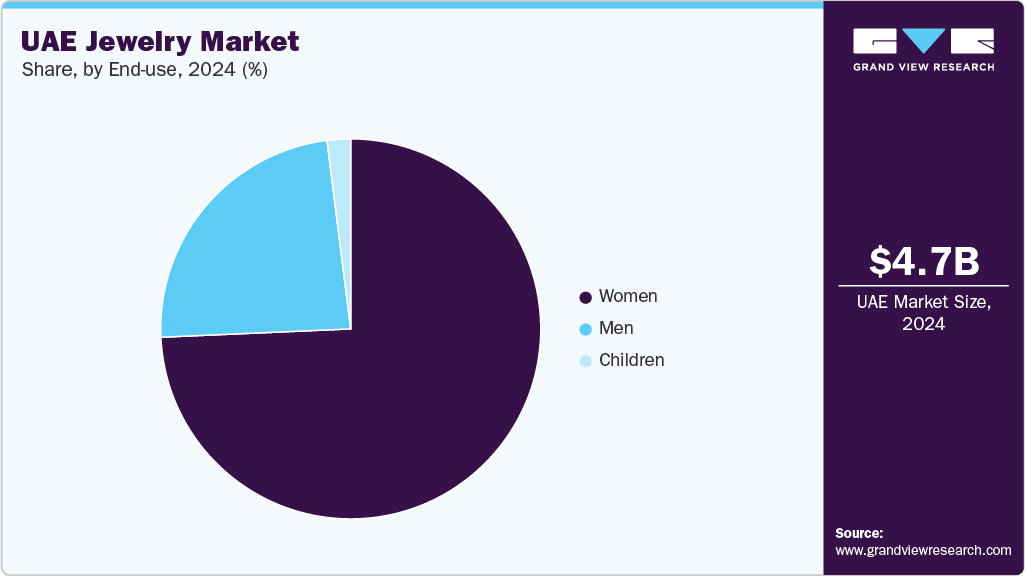

- By end use, women segment held the largest share of 74.3% of the UAE jewelry market in 2024.

Download a free sample PDF of the UAE Jewelry Market Intelligence Study from Grand View Research.

List of Key Players in the UAE Jewelry Market

The market players are focusing on various strategic initiatives such as mergers, acquisitions, and collaborations. For instance, in December 2024, Indian jewelry brand Tanishq, part of the Tata Group, launched its largest flagship boutique in the Dubai Gold Souk Extension, spanning 5,000 sq ft and showcasing over 10,000 meticulously crafted pieces, from everyday elegance to bespoke bridal collections.

- Titan Company Limited

- Gafla

- Malabar Gold & Diamonds Limited

- Damas Jewellery

- Liali Jewellery

- Pure Gold Jewellers

- Taiba Jewellery

- Amwaj Jewellery

- Al Romaizan Gold & Jewellery

- Cara Jewellers