Testing, Inspection and Certification Market: Key Players and Their Impact

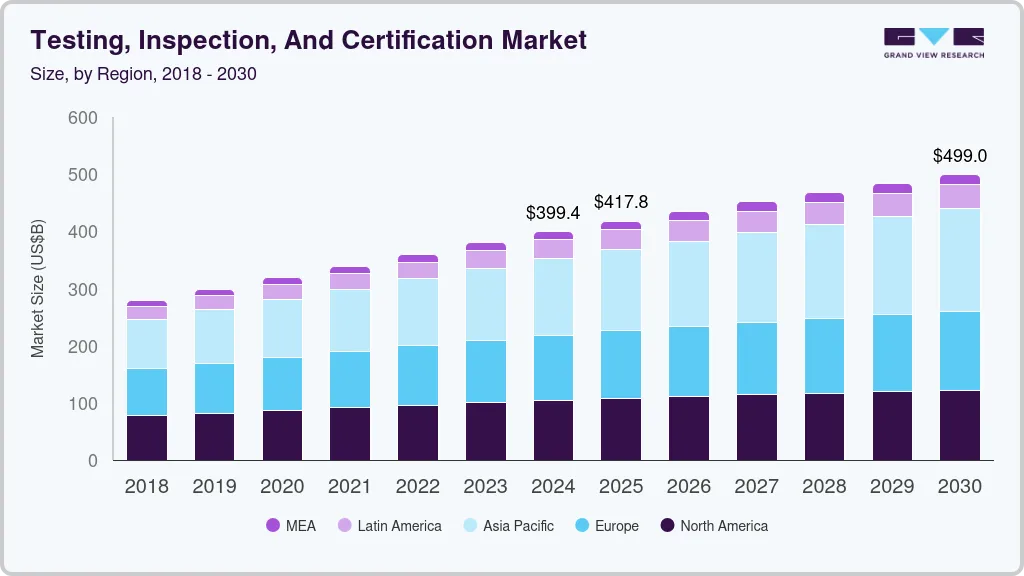

The global testing, inspection, and certification (TIC) market was valued at USD 399.39 billion in 2024 and is projected to reach USD 499.00 billion by 2030.

The global testing, inspection, and certification (TIC) market was valued at USD 399.39 billion in 2024 and is projected to reach USD 499.00 billion by 2030, expanding at a CAGR of 3.6% from 2025 to 2030. The market’s growth is primarily driven by stringent regulatory and compliance requirements, the increasing emphasis on product quality and safety, the expansion of global trade, and advancements in technology.

Governments and regulatory bodies across the world enforce strict safety, quality, and environmental standards, pushing organizations to comply with comprehensive testing and certification procedures. Industries such as automotive, healthcare, construction, and energy are facing rising compliance obligations, which is boosting the demand for TIC services. For example, in October 2024, Applus+ partnered with Four Hills Group to provide advanced testing and inspection services across Australia. This collaboration also aims to create employment opportunities for both Indigenous and non-Indigenous communities in the construction and mining sectors.

Enterprises increasingly seek safe, efficient, and well-structured TIC practices to maintain high-quality standards, improve productivity, and enhance operational efficiency. Through TIC services, companies can streamline supply chains, align processes with compliance requirements, and simplify overall business operations.

The rapid expansion of the transportation and logistics industry is also creating attractive growth opportunities. Increased global trade and the adoption of intelligent logistics systems strengthen the demand for TIC solutions to ensure efficient and timely delivery of goods while minimizing operational costs. Additionally, infrastructure development and renewable energy projects—such as solar and wind installations—require advanced TIC systems to verify the performance and safety of specialized components. Growing urbanization in both developed and developing regions further drives the adoption of TIC services to support safe and reliable infrastructure development.

Order a free sample PDF of the Testing, Inspection, And Certification Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America Market Share: North America held over 25% of the total market revenue in 2024. The region enforces some of the strictest safety, quality, and environmental regulations across industries like aerospace, automotive, healthcare, and food & beverages, resulting in high demand for TIC services to ensure regulatory compliance.

- Testing Segment Dominance: In 2024, the testing segment accounted for over 72% of total global revenue. Extensive use of testing across sectors such as automotive, energy & utilities, oil & gas, petroleum, and manufacturing supports its leading position. Practical product testing helps companies maintain quality benchmarks and fulfill customer expectations, motivating businesses to invest heavily in testing equipment and services.

- In-House TIC Services Leading: The in-house segment held the largest revenue share in 2024. Companies prefer in-house TIC operations to maintain direct oversight, allow customization of testing processes, and enhance control over internal quality management systems. In-house teams also provide deeper insights into an organization’s workflow and regulatory needs.

- Infrastructure as the Leading Application Segment: The infrastructure segment accounted for the largest market share in 2024. Factors such as rising infrastructure investments, strict safety regulations, increasing demand for sustainable construction, and urban development—including smart city projects—are driving this segment. Infrastructure projects across transportation, energy systems, water management, and urban planning require comprehensive TIC services to ensure regulatory compliance, durability, and safety.

Market Size & Forecast

- 2024 Market Size: USD 399.39 Billion

- 2030 Projected Market Size: USD 499.00 Billion

- CAGR (2025-2030): 3.6%

- North America: Largest market in 2024

Key Companies & Market Share Insights

Major companies in the TIC sector include SGS Societe Generale de Surveillance SA and Bureau Veritas.

- SGS Societe Generale de Surveillance SA: SGS is a leading global TIC provider, serving industries such as agriculture, automotive, oil & gas, and pharmaceuticals. With more than 2,600 offices and laboratories worldwide, SGS has strong capabilities in sustainability and digital inspection technologies. The company continues to innovate by integrating AI, IoT, and blockchain into its service offerings.

- Bureau Veritas: Operating in over 140 countries, Bureau Veritas maintains an extensive network of laboratories and technical experts. The company specializes in certification services, particularly in sustainability and energy transition fields. It is also focusing on digital transformation by offering remote inspection and certification solutions to meet evolving industry needs.

Key Players

- Applus+

- Bureau Veritas

- DEKRA SE

- Det Norske Veritas group

- Eurofins Scientific

- Intertek Group plc

- SGS Societe Generale de Surveillance SA

- TUV Rheinland

- TUV SUD

- UL LLC

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The testing, inspection, and certification market is poised for steady growth through 2030, supported by increasing regulatory requirements, heightened focus on product quality and safety, and expanding global trade. Technological advancements and the rise of intelligent logistics, renewable energy installations, and infrastructure development further strengthen the market outlook. North America remains a key market due to its rigorous standards, while the testing segment continues to dominate overall revenue. As industries adopt more sophisticated and digitalized processes, demand for reliable TIC services will continue to rise, solidifying the sector’s essential role in ensuring safety, compliance, and operational efficiency worldwide.