Tax Management Software Market Projections: Forecasting Until 2030

The global tax management software market was valued at USD 18.74 billion in 2022 and is expected to reach USD 39.71 billion by 2030.

The global tax management software market was valued at USD 18.74 billion in 2022 and is expected to reach USD 39.71 billion by 2030, growing at a CAGR of 10.1% from 2023 to 2030. The growth of the market is driven by factors such as evolving tax regulations and frequent changes in tax laws, which demand up-to-date solutions for tax compliance and preparation.

To address these challenges, businesses and professionals are increasingly relying on tax management software to ensure real-time compliance monitoring, automated tax calculations, and accurate tax preparation. This helps minimize errors and penalties. Additionally, the widespread adoption of cloud computing has significantly contributed to the market's growth. Cloud-based platforms provide scalability, flexibility, and remote accessibility, allowing users to securely store their tax data and integrate seamlessly with other financial systems. As more businesses adopt cloud technology, the demand for cloud-based tax management software is expected to increase.

Technological advancements in Artificial Intelligence (AI) and Machine Learning (ML) have also transformed tax management software. These technologies enable the automation of routine tasks, data analysis, and the provision of valuable tax planning and optimization insights. As a result, tax management software has become more intelligent and effective, leading to broader adoption in the global business landscape. Furthermore, the increasing penetration of the internet and smartphones worldwide is expected to further accelerate market growth. The growing focus on compliance and risk management is also acting as a catalyst for the expansion of tax management software.

Order a free sample PDF of the Tax Management Software Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America dominated the market with a 27% revenue share in 2022, driven by the presence of key players like Wolters Kluwer N.V., Thomson Reuters, and Intuit, Inc. The region's growth is further supported by the continuous launch of new tax management software solutions.

- By component, the software segment held the largest revenue share of over 72% in 2022. The COVID-19 pandemic accelerated the adoption of digital solutions, including tax management software, as remote work and digital collaboration became the norm. The launch of new products and pilot programs is expected to drive further growth in this segment.

- By type, the tax compliance software segment led the market with over 26% of the share in 2022. The increasing complexity of tax regulations and reporting requirements has made tax compliance software essential for businesses to ensure adherence to constantly evolving tax laws.

- By tax type, the direct tax segment held the largest share of over 53% in 2022. This segment is growing due to the increasing complexity of tax regulations and the need for efficient and accurate management of direct taxes.

- By deployment, the on-premise segment dominated with over 51% of the revenue share in 2022. On-premise solutions provide businesses with greater control over their data, making them a preferred choice for many enterprises seeking secure and managed data storage.

- By end-user, large enterprises accounted for over 63% of the market share in 2022. These organizations use tax management software to streamline and automate complex tax processes, as manual tax management is often inefficient and prone to errors.

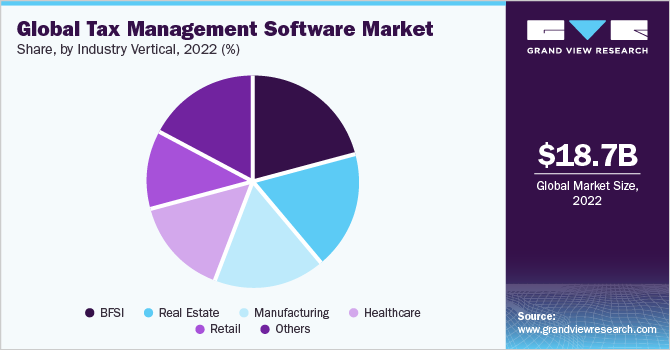

- By industry vertical, the BFSI (banking, financial services, and insurance) sector led with over 21% of the market share in 2022. The BFSI sector's swift adoption of tax management software is driven by the industry's highly regulated environment and the need to ensure compliance with complex tax laws.

Market Size & Forecast

- 2022 Market Size: USD 18.74 Billion

- 2030 Projected Market Size: USD 39.71 Billion

- CAGR (2023–2030): 10.1%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

The tax management software market is somewhat fragmented due to the presence of several major players. These companies are focusing on strategic initiatives, such as product launches, partnerships, and collaborations, to enhance their market position. Some key developments include:

- In April 2023, Vestmark, Inc., a provider of wealth management software and services, launched VAST, an outsourced portfolio management service offering personalization at scale. This solution includes comprehensive tax management, flexible investment options, streamlined implementation, and time savings for customers.

- In February 2023, BitPay, a cryptocurrency payment platform, partnered with ZenLedger, a crypto tax management software provider. This collaboration aims to simplify cryptocurrency tax filing for BitPay users, reflecting the growing demand for tax management solutions in the cryptocurrency space.

Key Players

- Wolters Kluwer N.V

- SAP SE

- Thomson Reuters

- Intuit, Inc.

- Corvee, LLC

- HRB Digital LLC

- TaxJar

- Vertex, Inc.

- TaxSlayer LLC

- Avalara, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The tax management software market is on a strong growth trajectory, driven by the increasing complexity of tax laws, the adoption of cloud computing, and the integration of AI and ML technologies. Businesses across the globe are turning to tax management software to streamline their operations, ensure compliance, and minimize errors. As cloud-based solutions gain popularity, the market is expected to expand significantly, with North America leading in market share and Asia Pacific emerging as the fastest-growing region. Additionally, sectors like BFSI and large enterprises are key drivers of market adoption, contributing to the increasing demand for efficient, automated, and scalable tax management solutions.