Stainless Steel 400 Series Market 2030: Exploring Key Players and Competition

The global stainless steel 400 series market was valued at USD 27.04 billion in 2021 and is expected to grow to USD 51.16 billion by 2030. This represents a compound annual growth rate (CAGR) of 7.3% from 2022 through 2030.

The global stainless steel 400 series market was valued at USD 27.04 billion in 2021 and is expected to grow to USD 51.16 billion by 2030. This represents a compound annual growth rate (CAGR) of 7.3% from 2022 through 2030. The market expansion is mainly fueled by rising demand for stainless steel 400 series products across sectors such as building & construction, consumer goods, and mechanical engineering & heavy industries. The series is valued in construction due to its properties including formability, weldability, corrosion resistance, and attractive appearance. Typical applications include architectural cladding, handrails, drainage and water systems, wall supports, roofing, as well as structural and fixing elements.

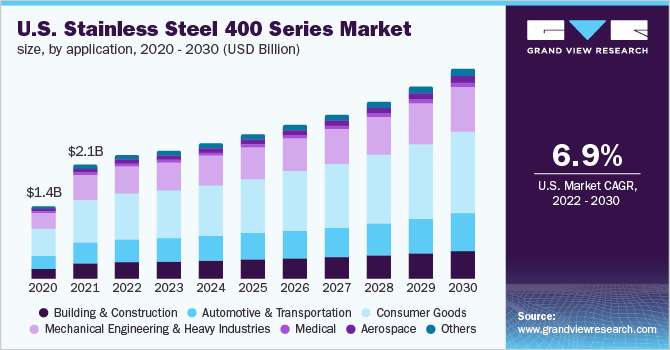

In the United States, the growth of the construction sector plays a significant role in driving demand for stainless steel 400 series. The U.S. Census Bureau reported that total construction spending, combining residential and non-residential projects, reached USD 1.811 trillion in September 2022, marking a 10.9% increase compared to September 2021. Additionally, the country's vehicle production is boosting product demand. According to the Federal Reserve Board, motor vehicle and parts production in the U.S. rose from 4.6% in February 2022 to 7.8% in March 2022. In March 2022, light truck and car assemblies increased to approximately 9.5 million units from 8.3 million in the previous month.

Order a free sample PDF of the Stainless Steel 400 Series Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights:

- By application, consumer goods accounted for the largest revenue share at over 37.0% in 2021, a trend expected to persist throughout the forecast period. The stainless steel 400 series is widely used in household and kitchen appliances such as refrigerators, air conditioners, washing machines, cookware, kettles, and knives.

- The mechanical engineering and heavy industries segment is anticipated to achieve a revenue CAGR of 7.0% during the forecast period. This growth is driven by increasing investments in the oil & gas sector, where stainless steel 400 series is applied in components like gas turbine exhaust silencers and related hardware.

- Regionally, Asia Pacific dominated the market with over 67.0% of the revenue share in 2021. This dominance is attributed to rising manufacturing activities and growing foreign investments in industries such as automotive, construction, and medical sectors. For example, passenger car production in the region increased by 7% from 2020 to 2021.

Market Size & Forecast:

- Market size in 2021: USD 27.04 billion

- Projected market size in 2030: USD 51.16 billion

- CAGR (2022-2030): 7.3%

- Asia Pacific: Largest regional market in 2021

Competitive Landscape & Market Players:

The stainless steel 400 series market is highly competitive, featuring numerous global players. Manufacturers not only compete among themselves but also face challenges from alternative materials such as aluminum, carbon fiber, and plastic. To maintain a competitive edge, companies focus on product innovation.

For instance, in September 2022, Yieh Corp. introduced a new nickel-free stainless steel 400 series variant, offering high corrosion resistance at a stable cost. Nickel price fluctuations impact stainless steel grades like 304 and 316, which rely on nickel in their production. Yieh Corp.’s new 400 series stainless steel is suitable for various uses, including sinks, water towers, curtain walls, solar panel brackets, industrial plant wire racks, and outdoor distribution boxes.

Conclusion

The stainless steel 400 series market is poised for robust growth, driven by expanding construction activities, rising consumer goods demand, and increasing industrial applications, especially in the Asia Pacific region. Innovations such as nickel-free alloys help manufacturers address cost volatility and meet diverse application needs. With ongoing investments in automotive, oil & gas, and infrastructure sectors, the demand for stainless steel 400 series products is expected to sustain its upward trajectory through 2030, reflecting strong opportunities for industry players worldwide.

Key Players

- Acerinox S.A.

- Aperam

- Baosteel Group

- Fushun Special Steel Co., Ltd.

- Jindal Stainless

- Outokumpu

- POSCO

- thyssenkrupp AG

- Yieh United Steel corp

Browse Horizon Databook for Global Stainless Steel 400 Series Market Size & Outlook

Conclusion

The Stainless Steel 400 Series (DME) market is growing due to the increasing prevalence of chronic diseases like cancer, cardiovascular, neurovascular, and urological disorders, leading to higher hospital admissions and demand. WHO reports that NCDs cause 17 million premature deaths annually, with 86% in low- and middle-income countries. Cardiovascular diseases account for 17.9 million deaths, followed by cancers (9.3 million), chronic respiratory diseases (4.1 million), and diabetes (2.0 million, including kidney-related deaths). COVID-19 disrupted DME supply chains through lockdowns, causing shortages in equipment such as oxygen systems, CPAPs, RADs, and nebulizers, impacting high-risk patients and driving up demand.