Specialty Enzymes Market 2030: Navigating Regulatory Landscapes

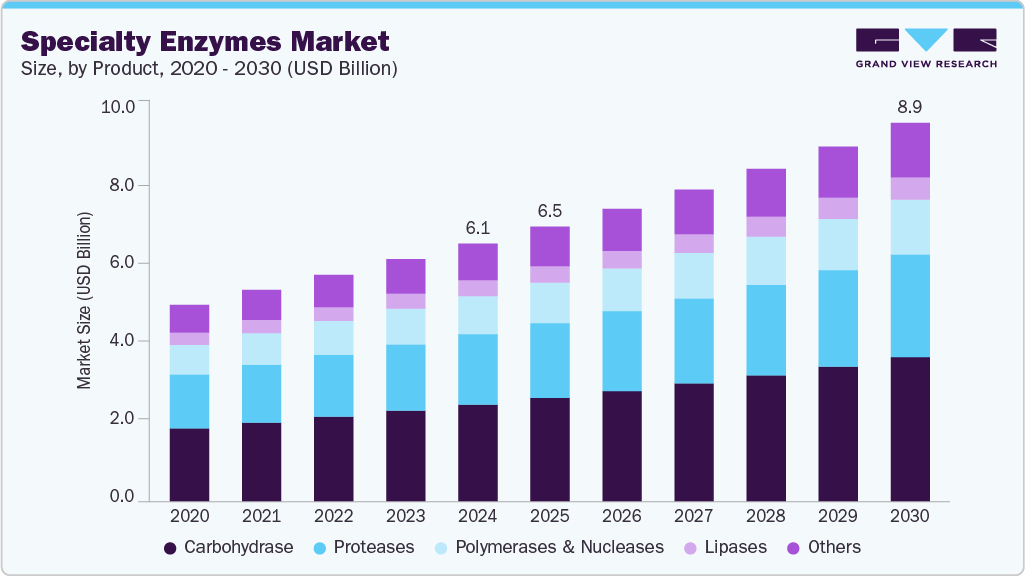

The global specialty enzymes market was valued at USD 6.05 billion in 2024 and is projected to reach USD 8.89 billion by 2030.

The global specialty enzymes market was valued at USD 6.05 billion in 2024 and is projected to reach USD 8.89 billion by 2030, expanding at a CAGR of 6.6% from 2025 to 2030. Market growth is primarily driven by the rising prevalence of chronic conditions such as cancer and rheumatoid arthritis. The expansion of the food industry also plays a major role in increasing demand for specialty enzymes. Enzymes including lipases, amylases, proteases, rennet, pectinases, invertases, cellulases, and glucose oxidase are essential in various food processing applications.

However, challenges related to biosimilar development may restrain market progress. Despite this, specialty enzymes continue to gain traction as they offer rapid and effective solutions across numerous industries. They are widely used in diagnostic procedures such as DNA modification and sequencing, and the expected decline in these technologies’ costs is likely to further stimulate enzyme demand in research, biotechnology, and medical fields. Additionally, the aging population in developed nations is anticipated to increase the use of specialty enzymes in healthcare.

Advances in diagnostic technologies, growing adoption of enzyme-based solutions in healthcare, and ongoing innovation remain key contributors to global market expansion. Nevertheless, limited consumer awareness—particularly in emerging markets—continues to pose challenges. Ethical and regulatory concerns also affect adoption rates. Even so, increasing industrialization and the introduction of advanced pharmaceutical technologies in developing regions are expected to create new opportunities for market participants in the coming years.

Order a free sample PDF of the Specialty Enzymes Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: North America held the largest revenue share at 41.9% in 2024, supported by a rising number of specialty enzyme product approvals and launches for disease treatment. Strong regulatory frameworks and advancements in biotechnology have accelerated the development of enzyme-based therapies, improving their accessibility across drug formulation, diagnostics, and personalized medicine. Enzymes such as proteases and polymerases are seeing increased use in these areas. The region’s robust pharmaceutical infrastructure and substantial R&D investments solidify North America’s leading role in global specialty enzyme development.

- Product Insights: The carbohydrase segment accounted for the largest share of 37.6% in 2024. Rising demand for digestive health products and dietary supplements is driving this segment’s expansion. Significant R&D efforts focused on improving enzyme yield, specificity, and stability through advanced fermentation techniques also support growth. Carbohydrases continue to dominate due to their wide-ranging applications in both biotechnology and food processing.

- Application Insights: The pharmaceutical segment held the largest revenue share in 2024, driven by a growing population, strong consumer demand, and rising awareness of chronic and infectious diseases. Enzymes frequently used in this sector include cysteine proteinases, streptokinase, asparaginase, deoxyribonuclease, glucocerebrosidase, urokinase, pegademase, and hyaluronidase. Specialty enzymes are essential for disease diagnosis, wound healing, and eliminating harmful pathogens. Increasing R&D investments are enabling their incorporation into drug formulations and advanced drug delivery systems.

- Source Insights: The microorganisms segment represented the largest market share in 2024. Microbial enzymes—such as amylases—are highly valued for their efficiency, stability, and cost-effectiveness, making them suitable for a wide variety of industrial applications. These enzymes are used in chemical manufacturing, fermentation, agriculture, pharmaceuticals, and food production. The ability of microorganisms to produce diverse and scalable enzyme solutions continues to reinforce this segment’s leading position.

Market Size & Forecast

- 2024 Revenue: USD 6.05 Billion

- 2030 Projected Market Size: USD 8.89 Billion

- CAGR (2025-2030): 6.6%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

Key Companies & Market Share Insights

Prominent companies operating in the specialty enzymes industry include Advanced Enzyme Technologies, Codexis, Inc., F. Hoffmann-La Roche Ltd., BASF, and Sanofi.

- BASF is a leading global chemical producer offering an extensive portfolio spanning chemicals, materials, industrial solutions, surface technologies, nutrition and care, and agricultural solutions.

- Sanofi specializes in the research, development, and manufacturing of prescription medicines, vaccines, and consumer healthcare products. Its wide-ranging portfolio covers immunology, oncology, neurology, diabetes, and rare disease therapies.

Key Players

- Advanced Enzyme Technologies

- Affymetrix Inc. (Thermo Fisher Scientific Inc.)

- Amano Enzyme Inc.

- BBI Solutions

- BASF

- Codexis, Inc.

- Nagase & Co., Ltd.

- Life Technologies (Thermo Fisher Scientific Inc.)

- F. Hoffmann-La Roche Ltd

- Sanofi

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The specialty enzymes market is poised for steady growth through 2030, supported by the increasing burden of chronic diseases, the accelerating expansion of the food industry, and rising adoption of enzyme-based solutions across healthcare and biotechnology. Although limited consumer awareness and ethical concerns may temper growth in some regions, technological advancements and expanding industrial applications continue to create substantial market opportunities. With strong demand across pharmaceuticals, diagnostics, and food processing, specialty enzymes are expected to remain integral to innovation and development within multiple global industries.