South Korea Endoscopy Devices Market: Trends in Healthcare Expenditure

The South Korea endoscopy devices market was valued at USD 368.09 million in 2023 and is projected to reach USD 694.83 million by 2030.

South Korea Endoscopy Devices Market Overview

The South Korea endoscopy devices market was valued at USD 368.09 million in 2023 and is projected to reach USD 694.83 million by 2030, growing at a compound annual growth rate (CAGR) of 9.48% from 2024 to 2030. This growth is largely driven by advancements in minimally invasive surgical (MIS) technologies, which have heightened the demand for endoscopic procedures. Innovations such as capsule endoscopy and robot-assisted techniques are supporting this shift by offering less invasive alternatives to traditional surgeries.

In addition, ongoing developments in endoscopic visualization systems and operative tools are expected to further propel market expansion. The increase in healthcare facilities—including hospitals, cancer treatment centers, and specialty oncology clinics—has also contributed to the rising demand for advanced endoscopy equipment. Upgrades in healthcare infrastructure and the adoption of cutting-edge endoscopic technologies are further supporting the market’s upward trajectory.

The use of endoscopic devices for both diagnostic and therapeutic applications is growing rapidly. These tools facilitate minimally invasive procedures, enabling faster patient recovery, shorter hospital stays, and reduced postoperative complications. By minimizing tissue damage and blood loss, endoscopy devices provide safer, more cost-effective alternatives to open surgeries.

Following the introduction of the National Health Insurance Service (NHIS) in 1989, healthcare expenditure per capita in South Korea has steadily increased. According to OECD Health at a Glance (2023), South Korea now spends USD 4,570 per capita on healthcare. Despite these rising expenditures, the country’s healthcare costs remain relatively low from the provider’s perspective. The emphasis on high-quality care at reduced costs enhances accessibility for patients while ensuring sufficient reimbursement for providers, which in turn supports overall market growth.

Order a free sample PDF of the South Korea Endoscopy Devices Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Product: In 2023, endoscopy visualization components accounted for the largest revenue share at 36.07%. This dominance stems from South Korea’s significant investment in R&D, leading to high-quality medical devices. Innovations such as high-definition cameras, advanced lighting systems, and precision monitors contribute to more accurate diagnostics and improved outcomes.

- By Application: The gastrointestinal (GI) endoscopy segment led the market with a 55.52% revenue share. South Korea has a relatively high prevalence of GI disorders, including gastric and colorectal cancers. As reported by the Annals of Coloproctology (2022), around 29,030 new colorectal cancer cases are diagnosed annually. Furthermore, the mortality rate due to colorectal cancer increased from 8.78 per 100,000 in 2000 to 17.27 per 100,000 in 2022.

- By End-Use: The hospital segment held the largest market share at 46.73% in 2023. This is attributed to the high number of surgical procedures performed in hospitals and the country's well-established healthcare infrastructure. Moreover, the high costs of advanced endoscopic procedures often necessitate hospital-based access.

Market Size & Forecast

- 2023 Market Size: USD 368.09 Million

- 2030 Projected Market Size: USD 694.83 Million

- CAGR (2024-2030): 9.48%

Key Companies & Market Share Insights

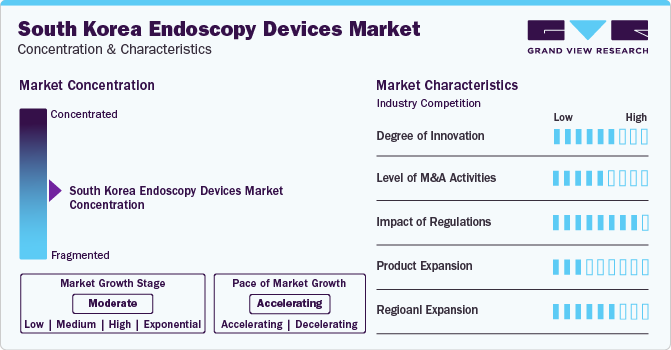

The South Korea endoscopy devices market is fragmented, with several major players holding a significant market share. Leading companies includes, Olympus Corporation, PENTAX Medical, KARL STORZ SE & Co. KG and FUJIFILM Holdings Corporation.

To remain competitive, these firms are pursuing strategies such as mergers and acquisitions, increased R&D investments, and product innovations or enhancements. Strategic collaborations are also playing an essential role in expanding market presence across the country.

Key Players

- Olympus Corporation

- FUJIFILM Holdings Corporation

- KARL STORZ SE & Co. KG

- Stryker Corporation

- Medtronic plc

- Conmed Corporation

- Boston Scientific Corporation

- Smith & Nephew plc

- Richard Wolf GmbH

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The South Korean endoscopy devices market is poised for substantial growth through 2030, fueled by technological innovations, increasing demand for minimally invasive procedures, and improvements in healthcare infrastructure. The strong presence of leading market players, coupled with rising per capita healthcare expenditure and government support, positions the country as a promising environment for endoscopy advancements. As clinical needs evolve and new technologies emerge, the market is expected to continue its upward momentum, making it a key sector within South Korea's broader medical device landscape.