South Africa Dietary Supplements Market Advances with Personalized Nutrition

The South Africa dietary supplements market is experiencing steady growth, driven by rising health consciousness, a proactive approach to preventive care, and an aging population seeking solutions for age-related conditions.

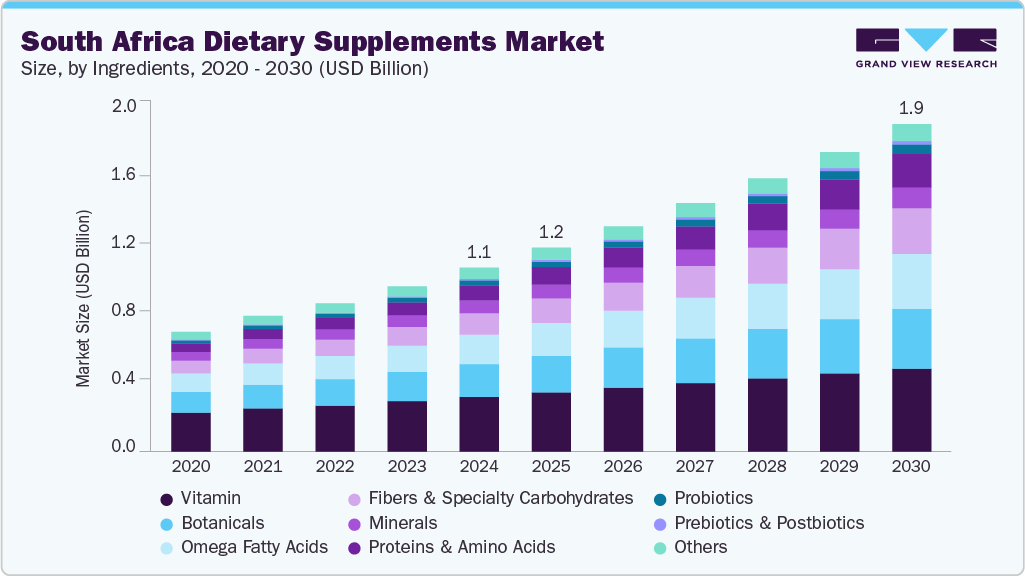

The South Africa Dietary Supplements Market was valued at USD 1.06 billion in 2024 and is expected to reach USD 1.88 billion by 2030, expanding at a CAGR of 9.9% from 2025 to 2030. This growth is fueled by rising health consciousness and a shift toward preventive healthcare. Consumers are increasingly aware of the role nutrition plays in supporting immune function and overall wellness, moving from reactive treatment toward proactive disease prevention. This trend is particularly significant given the country’s high incidence of chronic conditions such as obesity, cardiovascular diseases, and diabetes. Additionally, the aging population is driving demand for supplements targeting age-related concerns, including osteoporosis, arthritis, and heart disease, reinforcing the market’s focus on long-term health solutions.

The steady rise in disposable income and an expanding middle class have also boosted investment in health and wellness products. As reported by CNBC Africa in February 2025, South Africa saw an 11.9% increase in average take-home pay between December 2023 and December 2024, enhancing consumer purchasing power. This economic uplift allows for greater spending on premium dietary supplements. Moreover, the growing preference for natural, organic, and plant-based products aligns with the global clean-label movement, prompting manufacturers to innovate sustainable, chemical-free formulations.

Key Market Insights:

- By form: Tablets accounted for the largest revenue share at 31.3% in 2024, particularly favored by older consumers and healthcare professionals.

- By type: The OTC segment led with a 78.0% revenue share in 2024, offering convenience without requiring medical prescriptions—an attractive option for younger adults and busy professionals.

- By application: Immunity-related supplements dominated in 2024, with high demand for Vitamin C, Zinc, elderberry, and echinacea across age groups.

- By end-use: Adults aged 25–55 represented the largest consumer group, using supplements for chronic health conditions, fitness goals, beauty enhancement, and stress management.

- By distribution channel: Offline channels remained dominant in 2024, with trusted pharmacy chains like Clicks and Dis-Chem providing professional guidance, and supermarkets ensuring accessibility to everyday health products.

Order a free sample PDF of the South Africa Dietary Supplements Market Intelligence Study, published by Grand View Research.

Market Size & Forecast:

- 2024 Market Size: USD 1.06 Billion

- 2030 Projected Market Size: USD 1.88 Billion

- CAGR (2025–2030): 9.9%

Key Companies & Market Share Insights:

Prominent market players include Amway Corp.; Herbalife International, Inc.; Abbott; Bayer AG; Centrum (Haleon South Africa (Pty) Ltd.); Pfizer Inc.; GNC Holdings Inc.; Nestlé Health Science; Nature's Sunshine Products, Inc.; and NOW Foods.

- Herbalife International, Inc. operates through a direct-selling MLM model with around 670,000 independent distributors worldwide. The brand specializes in weight management, sports nutrition, and energy supplements such as protein shakes and herbal teas, distributed via local representatives and wellness coaches.

- Centrum, managed by Haleon South Africa, offers multivitamins tailored to local needs. Widely available in pharmacies, supermarkets, and online, Centrum products—such as Adult, Select 50+, and Immune Support—emphasize energy, immunity, and bone health through scientifically balanced formulations.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The South Africa dietary supplements market is experiencing steady growth, driven by rising health consciousness, a proactive approach to preventive care, and an aging population seeking solutions for age-related conditions. Increasing disposable incomes and a growing middle class are enabling greater investment in health and wellness products, while consumer preference for natural, organic, and clean-label supplements is shaping product innovation. Tablets remain the most preferred form, with OTC supplements dominating due to convenience and accessibility. Immunity support products are particularly popular across age groups, and adults form the largest consumer segment. Pharmacies and supermarkets continue to play a pivotal role in product distribution, ensuring trust, accessibility, and variety for consumers.