Smart Label Market 2030: Boosting Brand Loyalty Through Transparency

The global smart label market was valued at USD 39.1 billion in 2023 and is expected to reach USD 55.6 billion by 2030.

The global smart label market was valued at USD 39.1 billion in 2023 and is expected to reach USD 55.6 billion by 2030, growing at a CAGR of 5.0% from 2024 to 2030. Smart labels are advanced electronic devices integrated into products, typically in the form of identification slips. These labels contain chips, antennas, and bonding wires that enable real-time tracking of assets and goods. They offer several advantages over traditional barcode systems, such as automated reading, quick identification, re-programmability, high tolerance, and reduced errors. These features make smart labels particularly popular in industries like retail, FMCG, and logistics. They are primarily made from materials like plastics, paper, and fibers.

The U.S. has been a significant consumer of smart labels, driven by improvements in inventory management, asset tracking, and consumer goods distribution. Smart labels facilitate the collection, recording, and transmission of digital information, significantly reducing the time spent on tracking. As industries increasingly adopt these technologies, they are helping to minimize human intervention and errors, enhancing operational efficiency and accuracy.

Smart labels are also highly effective in addressing challenges faced by retailers and manufacturers, particularly in preventing theft and shoplifting. As companies invest in enhanced anti-theft systems to reduce revenue loss and inventory damage, the demand for smart labels is expected to rise in the coming years.

Order a free sample PDF of the Smart Label Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Asia Pacific dominated the global smart label market with a revenue share of 33.4% in 2023. The region's growing disposable income and rapid urbanization have spurred the growth of retail, logistics, and FMCG sectors, driving increased demand for smart labels in end-user industries.

- By technology, the RFID labels segment led the market with a share of 50.7% in 2023. RFID labels are popular due to their long-term cost-saving benefits, including improved operational efficiency, reduced labor costs, and minimized errors. RFID labels offer real-time tracking capabilities, making them cost-effective solutions for businesses, especially in supply chains, warehouses, and retail stores. RFID tags can store more data than basic product details, which enhances inventory management. According to Nexqo Technology Co., Ltd., RFID tags can store between 2 Kilobytes and 128 Kilobytes of data, depending on the type and manufacturer.

- By component, the batteries segment held the largest revenue share of 29.1% in 2023. Advances in technology, particularly miniaturization and wireless communication, have enabled the integration of batteries into smart labels. These batteries power critical label functions such as data storage, sensing, and wireless communication. Compact, long-lasting batteries have enabled smart labels to operate over extended periods without frequent replacements.

- By application, the retail inventory segment dominated with a revenue share of 22.8% in 2023. Retailers' efforts to protect against theft and shoplifting are expected to significantly boost demand in this application over the forecast period.

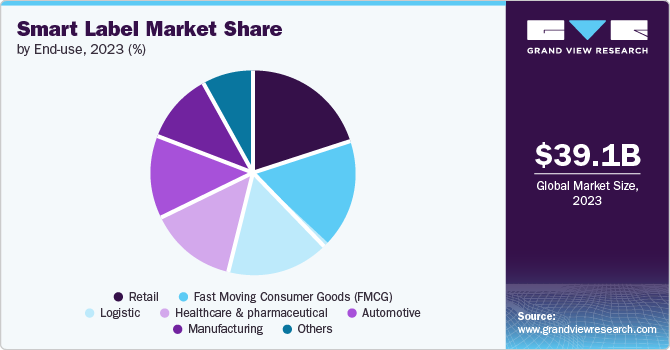

- By end-use, the retail segment led the market with the largest revenue share of 20.2% in 2023. Smart labels offer several benefits that make them highly attractive to the retail industry. Key advantages include improved operational efficiency, automation of processes like inventory management and price updates, and enhanced product traceability throughout the supply chain. This reduces human errors, saves time, and lowers operational costs. Additionally, smart labels help retailers enhance visibility and manage product recalls more efficiently in the event of quality issues or safety concerns.

Market Size & Forecast

- 2023 Market Size: USD 39.1 Billion

- 2030 Projected Market Size: USD 55.6 Billion

- CAGR (2024-2030): 5.0%

- Asia Pacific: Largest market in 2023

Key Companies & Market Share Insights

Leading players in the smart label market focus on expanding their product portfolios and production capacities. These companies are heavily investing in research and innovation to develop products tailored for specific applications. Many manufacturers are also strengthening their presence in emerging markets and entering into partnerships or joint ventures to expand their market shares.

- AVERY DENNISON CORPORATION is a key player specializing in smart labels using RFID technology, which enhances connectivity and operational efficiency across sectors such as retail apparel, cosmetics, aviation, food, and pharmaceuticals. Avery Dennison offers a range of solutions, including UHF, HF, and NFC smart labels, designed for applications like inventory management, loss prevention, and consumer engagement.

Key Players

- AVERY DENNISON CORPORATION

- CCL Industries

- Zebra Technologies Corporation

- Alien Technology, LLC.

- Checkpoint Systems, Inc.

- Impinj, Inc.

- MPI Labels

- Invengo Information Technology Co., Ltd.

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global smart label market is expected to grow steadily from USD 39.1 billion in 2023 to USD 55.6 billion by 2030, driven by advancements in RFID technology, increased adoption in retail and logistics, and the growing need for efficient asset tracking and theft prevention. With rapid urbanization in regions like Asia Pacific and continued technological developments, the market is poised for significant expansion. Smart labels' ability to automate inventory management, enhance supply chain visibility, and prevent theft positions them as an indispensable tool for modern retail, FMCG, and logistics operations. As companies continue to invest in smart label technologies, the market's growth prospects remain robust.