Single-use Assemblies Market Analysis: Challenges and Solutions

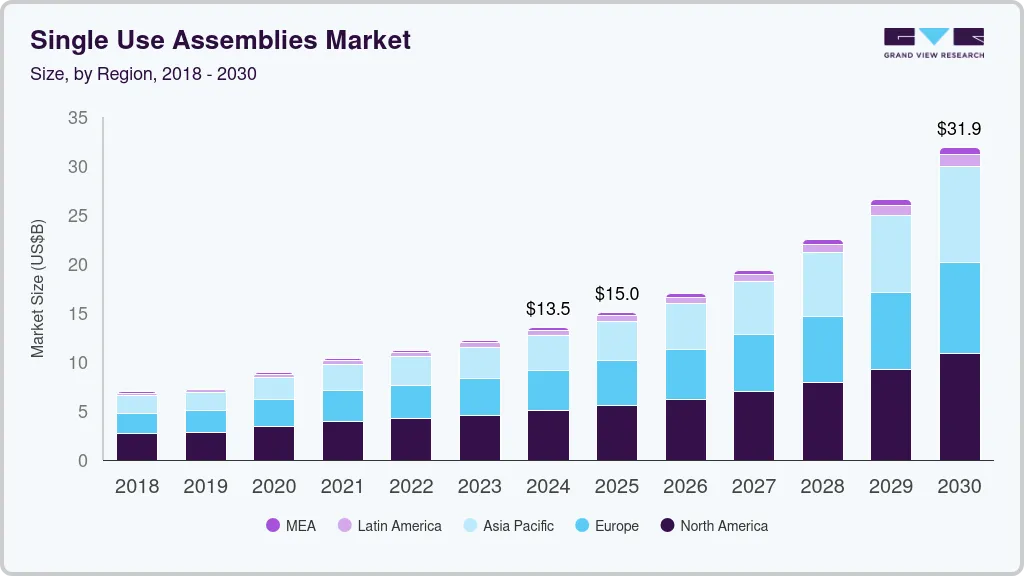

The global single-use assemblies market was valued at USD 13.47 billion in 2024 and is expected to reach USD 31.87 billion by 2030.

The global single-use assemblies market was valued at USD 13.47 billion in 2024 and is expected to reach USD 31.87 billion by 2030, expanding at a CAGR of 16.24% from 2025 to 2030. Single-use (SU) assemblies refer to preassembled plastic fluid pathways and self-contained components designed for bioprocessing.

Market growth is being driven by the expansion of the biologics sector, ongoing technological advancements in bioprocessing, rising biopharmaceutical R&D activities, and increasing adoption of single-use assemblies by numerous contract manufacturing organizations (CMOs). However, concerns related to extractables and leachables, waste management challenges, and the availability of traditional multi-use systems may restrict market penetration to some extent.

The COVID-19 pandemic further accelerated the demand for disposable assemblies due to their ability to facilitate rapid development and production of vaccines and therapies while improving operational efficiency. For example, Entegris, Inc.’s Aramus single-use bag assembly was used for storing COVID-19 vaccines, which require extremely low temperatures. These patented disposable bags, known for their low extractability and leachability and wide operating-temperature range, proved well-suited for cold-chain applications.

Order a free sample PDF of the Single-use Assemblies Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: North America held 37.19% of the market in 2024, supported by pharmaceutical and biotechnology industry growth, product innovation, rising cancer incidence, and substantial investments in drug discovery. As an example, Thermo Fisher Scientific opened a new single-use technology manufacturing facility in Greater Nashville in August 2022—a 400,000-square-foot, USD 105 million site designed to meet rising demand for bioprocessing materials used in innovative therapies and vaccines.

- By Product: Filtration assemblies represented the largest product segment in 2024, accounting for 28.87% of revenue. Their growing adoption is linked to stringent regulatory requirements and the need to reduce contamination risks. Compared to stainless-steel systems, single-use filtration assemblies eliminate sterilization procedures and reduce validation burdens, providing greater flexibility and efficiency.

- By Application: The filtration segment led the market in 2024 with the highest revenue share of 28.87%. Adoption of single-use technologies (SUTs) for filtration is rapidly increasing due to significant reductions in costs, time, integrity testing, sterile connections, and tubing efforts. Since single-use filtration systems are ready to use, they shorten process timelines. As demand for biopharmaceuticals grows, manufacturers are turning to single-use facilities to accelerate production turnaround and accommodate multiple product workflows within a single site.

- By Solution: Customized solutions were the leading segment in 2024, accounting for 71.71% of global revenue, and are projected to grow at the fastest rate through 2030. These solutions enable pharmaceutical companies and laboratories to integrate systems seamlessly into their operations while avoiding the complications of sterilization and cleaning. Many industry players provide tailored assemblies, such as MilliporeSigma’s Mobius single-use assemblies, which enhance drug development and manufacturing timelines.

- By End Use: Biopharmaceutical and pharmaceutical companies dominated the market in 2024 with 49.45% of total revenue. The expansion of biopharmaceutical manufacturing facilities continues to support the demand for single-use assemblies. For instance, Alexion invested USD 70 million in June 2022 to enhance its manufacturing capabilities in Ireland, aiming to strengthen its biologics drug substance portfolio.

Market Size & Forecast

- 2024 Market Size: USD 13.47 Billion

- 2030 Projected Market Size: USD 31.87 Billion

- CAGR (2025-2030):16.24%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Heat map analysis shows that Danaher (through Cytiva and Pall) and Thermo Fisher Scientific are the leading global players, supported by broad product portfolios and strong manufacturing capabilities across upstream and downstream applications. Sartorius maintains a robust position, especially in Europe and Asia, leveraging its integrated bioprocessing solutions and strategic partnerships. Merck (MilliporeSigma) remains influential in filtration and material science due to its focus on innovation and regulatory expertise. Other companies—such as Saint-Gobain, Avantor, and Repligen—serve important niche markets and are expanding regionally. Competitive intensity is highest in North America and Europe, while Asia-Pacific is evolving into a major growth hub driven by increasing investments in local biomanufacturing.

Key Players

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Sartorius AG

- Danaher Corporation

- Avantor

- Lonza

- Saint-Gobain

- Corning Incorporated

- Entegris

- KUHNER AG

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The single-use assemblies market is on a strong growth trajectory, fueled by the rapid expansion of biologics, rising biopharmaceutical R&D, and the operational advantages of disposable technologies. While regulatory concerns and environmental considerations pose challenges, the overall industry outlook remains highly positive. Market leaders continue to expand their capabilities, and emerging regional manufacturing hubs—particularly in Asia-Pacific—are expected to accelerate adoption. With a projected increase from USD 13.47 billion in 2024 to USD 31.87 billion by 2030, single-use assemblies will remain integral to advancing bioprocessing efficiency, flexibility, and scalability in the years ahead.