Release Liner Market 2030: Exploring Emerging Applications

The global release liner market was valued at USD 17.08 billion in 2023 and is projected to reach USD 28.52 billion by 2030.

The global release liner market was valued at USD 17.08 billion in 2023 and is projected to reach USD 28.52 billion by 2030, expanding at a CAGR of 6.6% from 2024 to 2030. This growth is primarily driven by increasing demand from key end-use industries, including medical, industrial, packaging and labeling, and hygiene applications.

Rising demand for labeling across sectors such as food and beverages, pharmaceuticals, and logistics has been a major factor supporting the adoption of release liners. In addition, the growing need for advanced wound care products and medical adhesives is contributing to market expansion. The use of release liners is also increasing in automotive, electronics, and construction industries, where pressure-sensitive tapes and adhesive products are widely used. Economic growth in regions such as Asia Pacific has led to higher levels of construction and industrial activity, particularly in automotive and electronics manufacturing, further driving global demand for release liners.

The shift toward pressure-sensitive labels in packaging, logistics, and branding applications is another important growth driver. These labels are preferred for their ease of application, flexibility, and performance, which in turn increases the demand for high-quality release liners. Moreover, the rapid expansion of e-commerce has significantly boosted the need for efficient packaging and labeling solutions. Release liners play a critical role in maintaining label quality, durability, and performance, thereby supporting market growth.

However, fluctuations in the prices of raw materials such as silicone and paper can affect production costs and profit margins for manufacturers. Environmental concerns related to the disposal and recycling of release liners also pose challenges, as increasing regulatory pressure aims to reduce waste and improve recyclability. Additionally, the growing adoption of digital labeling and printing technologies may limit demand for traditional release liners in certain applications.

Order a free sample PDF of the Release Liner Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Asia Pacific dominated the release liner market in 2023, accounting for a revenue share of 34.6%, and is expected to continue growing at a strong pace over the forecast period. Increased infrastructure development and technological advancements in the region have led to higher consumption of release liners across applications such as self-adhesive products and high-performance films.

- By Material Type, the silicone segment held the largest market share of 63.6% in 2023 and is anticipated to grow significantly over the forecast period. Silicone-based release liners offer consistent and reliable release performance and can withstand high temperatures and chemical exposure. These properties make them well-suited for pressure-sensitive labels, adhesive tapes, and medical adhesive products, where stability and hypoallergenic characteristics are critical.

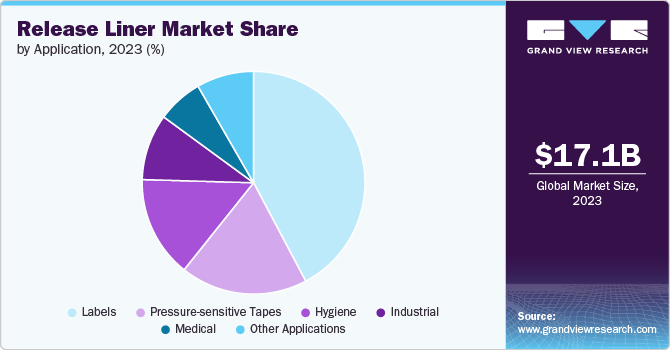

- By Application, the label segment accounted for the largest revenue share of 41.4% in 2023 and is expected to grow at the fastest rate during the forecast period. Release liners used in labeling applications are widely utilized across food and beverages, personal care, and household products. Demand is driven by the need for durable, visually appealing labels that can withstand various environmental conditions, while release liners help preserve label integrity during storage and application.

Market Size & Forecast

- 2023 Market Size: USD 17.08 Billion

- 2030 Projected Market USD 28.52 Billion

- CAGR (2024-2030): 6.6%

- Asia Pacific: Largest market in 2023

Key Companies & Market Share Insights

Major companies operating in the release liner market include 3M, Dow, and Ahlstrom.

- 3M operates through four primary business segments: safety and industrial, transportation and electronics, healthcare, and consumer. The company has manufacturing and sales operations in more than 70 countries across North America, Europe, Asia Pacific, and the Middle East & Africa. Founded in 1929, 3M is headquartered in the United States.

- Dow manufactures a wide range of chemicals, plastics, and agricultural products and serves markets such as agriculture, automotive, building and construction, energy and water, electronic materials, packaging, industrial, and infrastructure. The company operates through 32 subsidiaries, including Arabian Chemical Company Ltd., Blue Cube Holding LLC, CD Polymers, DOCOMO, Inc., Dow Business Services, and Dow Chemical China Holdings Pte. Ltd.

Emerging participants in the market include Mondi and Felix Schoeller.

- Mondi produces containerboard and converted corrugated solutions, along with a diverse portfolio that includes flexible packaging, bags and pouches, release liners, functional films, industrial bags, barrier coatings, specialty kraft paper, and printing papers.

- Felix Schoeller focuses on the production, development, and marketing of specialty papers for digital printing, self-adhesive applications, photographic uses, and packaging. Its product portfolio includes décor papers, photographic and digital printing papers, release liners, sublimation papers, and other specialty paper solutions.

Key Players

- Dow

- Loparex

- 3M

- Mondi

- Ahlstrom

- Elkem ASA

- Felix Schoeller

- Gascogne Group

- LINTEC Corporation

- Sappi Group

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The release liner market is expected to experience steady growth through 2030, supported by rising demand from packaging, labeling, medical, and industrial sectors. Strong growth in Asia Pacific, increasing adoption of pressure-sensitive labels, and the expansion of e-commerce are key factors driving market expansion. While raw material price volatility and environmental concerns pose challenges, ongoing innovation in recyclable and biodegradable materials is creating new opportunities. As sustainability becomes a central focus across industries, the development of eco-friendly release liners is likely to play a crucial role in shaping the future of the global market.