Network Security Market 2033: The Evolution of Compliance and Privacy

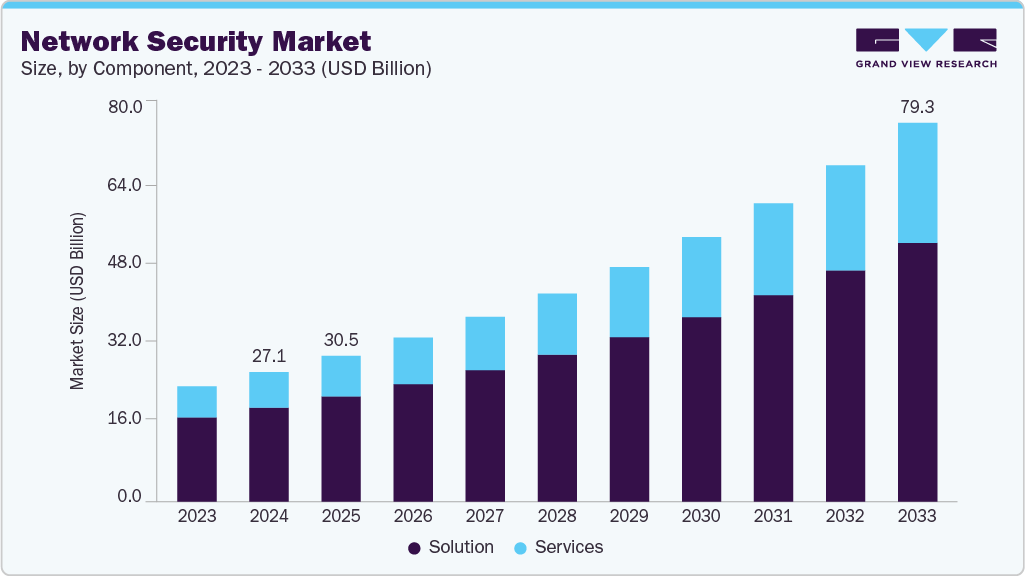

The global network security market was valued at USD 27.11 billion in 2024 and is expected to reach USD 79.29 billion by 2033.

The global network security market was valued at USD 27.11 billion in 2024 and is expected to reach USD 79.29 billion by 2033, growing at a CAGR of 12.7% from 2025 to 2033. The market's steady growth is primarily driven by increasing demand for smart warehousing, autonomous delivery, and last-mile logistics solutions.

As incidents of unsecured devices compromising organizational networks and violating privacy laws rise, businesses are increasingly allocating significant resources to bolster network security. Network security solutions provide enhanced authorization, authentication, and compliance policies across users' networks. Additionally, they enable users to instantly identify and block unauthorized devices, endpoints, and users, thus preventing unwanted connections. These solutions offer robust protection against security breaches, safeguard critical data, minimize malicious activities, and enhance visibility of connected devices' security status.

The growing adoption of IoT devices, web applications, and industrial software across industries like IT, BFSI (Banking, Financial Services, and Insurance), and healthcare—sectors that handle sensitive information about vendors, customers, and employees—requires strict adherence to security regulatory compliance. As such, these organizations are investing heavily in network security solutions. For example, in June 2023, Fortinet, a leading provider of network and security solutions, announced that its Secure SD-WAN solution was adopted by 11 renowned managed security service providers, including STC, Claro Empresas, KT Corporation, and others, to enhance security outcomes without compromising performance.

Order a free sample PDF of the Network Security Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: North America dominated the global network security market in 2024 with a share of 35.9%. This dominance is attributed to the high demand for network security solutions across industries such as BFSI, government, healthcare, education, IT, and telecom. These sectors are frequent targets of cybercriminals, seeking to exploit sensitive organizational networks and devices, leading to significant financial and data losses.

- Component Segment: The solution segment held the largest market share of 72.6% in 2024. This segment includes various security solutions such as network access control, unified threat defense, data loss prevention, IDS/IPS, firewalls, antivirus, wireless security, DDoS protection, and VPNs, offering dynamic security functionalities and high-performance capabilities.

- Deployment Model: Cloud-based network security led the market in 2024. Cloud-based solutions typically follow a pay-per-use or subscription model, providing organizations with a cost-effective and flexible approach to securing their networks. This deployment method is becoming increasingly popular as it allows businesses to scale security according to demand.

- Enterprise Size: Large enterprises were the dominant segment in 2024, driven by the increasing frequency of data breaches, cyberattacks, and security vulnerabilities due to the widespread use of connected devices, remote work environments, and unsecured networks. These factors are particularly concerning for large organizations in industries such as IT, banking, healthcare, and government.

- Industry Vertical: The BFSI sector accounted for over 20.0% of the market share in 2024. The banking and financial services industry is especially vulnerable to cybersecurity breaches, such as data theft, network hijacking, and device compromises. These industries are heavily investing in IT technologies, web-based applications, and IoT devices, which increases their exposure to security threats.

Market Size & Forecast

- 2024 Market Size: USD 27.11 Billion

- 2033 Projected Market Size: USD 79.29 Billion

- CAGR (2025-2033): 12.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Leading players in the network security market include Palo Alto Networks and Fortinet.

- Palo Alto Networks: Known for its Next-Generation Firewall (NGFW) platform, Strata, Palo Alto Networks integrates deep packet inspection, advanced intrusion prevention, and machine learning-based threat detection in real-time. The company offers both hardware (PA-Series) and virtual/cloud-based firewalls (VM- and CN-Series), providing unified policy management across data centers, branch offices, and public cloud environments.

- Fortinet: A leader in network security, Fortinet's flagship product, the FortiGate next-generation firewall, offers a comprehensive security platform. The company has expanded into Secure Access Service Edge (SASE) and Security Operations (SecOps), integrating SD-WAN with cloud-delivered security services for hybrid workforces.

Emerging players in the market include Trellix and Rapid7.

- Trellix: Specializing in advanced network security solutions, Trellix offers next-gen firewalls, intrusion prevention systems (IPS), secure web gateways, and network traffic analysis tools. Building on the legacy of FireEye’s threat intelligence and McAfee’s endpoint security, Trellix provides robust protection against known and unknown threats.

- Rapid7: Known for its innovative approach to network security, Rapid7 offers vulnerability management, threat intelligence, and extended detection and response (XDR) solutions. Its flagship product, InsightIDR, is a cloud-native platform combining network traffic analysis, user behavior analytics, and endpoint detection to identify threats early in the attack chain.

Key Players

- Akamai Technologies

- Broadcom

- Check Point

- Cisco Systems Inc.

- CrowdStrike

- Fortinet

- IBM Corporation

- Microsoft Corporation

- Palo Alto Networks, Inc.

- Proofpoint, Inc.

- Rapid7

- Sophos

- Trellix

- Trend Micro

- VMware

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The network security market is experiencing robust growth driven by rising threats to sensitive organizational data, the widespread adoption of IoT devices, and the increasing need for regulatory compliance across various industries. With a CAGR of 12.7% from 2025 to 2033, the market is poised for continued expansion, particularly in regions like North America and Asia Pacific. As cyberattacks become more sophisticated, organizations—especially large enterprises in industries like BFSI, healthcare, and government—are investing heavily in advanced network security solutions to safeguard their operations. Key players such as Palo Alto Networks and Fortinet are leading the way, while emerging companies like Trellix and Rapid7 are contributing to the innovation and competition in this dynamic market. As organizations prioritize cybersecurity, the market for network security solutions will continue to grow, providing greater protection against evolving cyber threats.