Mexico Medical Cannabis Market 2030: The Rise of Medical Tourism

The Mexico medical cannabis market was valued at USD 4.8 million in 2022 and is expected to grow significantly, reaching USD 117.7 million by 2030.

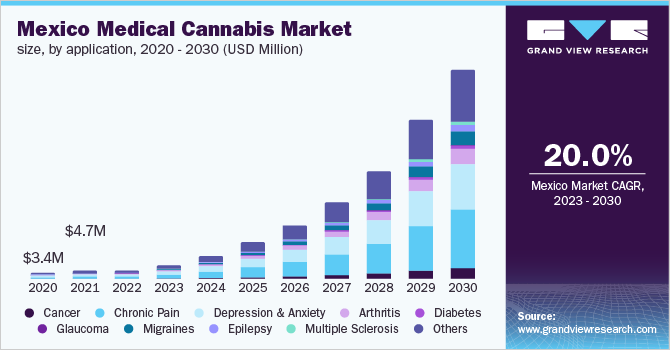

The Mexico medical cannabis market was valued at USD 4.8 million in 2022 and is expected to grow significantly, reaching USD 117.7 million by 2030, with a CAGR of 20% from 2023 to 2030. The liberalization of marijuana and hemp regulations in various countries is anticipated to drive market expansion. Legalizing cannabis for adult use is expected to create new employment opportunities and generate substantial economic revenue. Industries such as tourism, food, and transportation are poised to benefit from this legalization. The growing acceptance of cannabis for medical purposes is projected to boost demand for medical cannabis, thereby reducing the illegal market.

In January 2021, Mexico’s health ministry introduced regulations to govern the use of medical cannabis. These rules permit cannabis cultivation for research and the production of pharmaceutical products, applicable to both public and private research entities. The regulations also include quality control and good manufacturing practices for cannabis-containing products. These measures are expected to enhance medical tourism, generating additional revenue for the government and further propelling market growth.

A key factor driving the Mexican medical cannabis market is the high prevalence of cancer. According to the American Cancer Society, approximately 11,030 new cancer cases were diagnosed in Mexico in 2022. Research has demonstrated cannabis’s anti-cancer properties, leading to its increased adoption in cancer treatment. The rising burden of diseases and the growing use of cannabis for medical purposes are expected to fuel product demand over the forecast period.

Order a free sample PDF of the Mexico Medical Cannabis Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Application: Chronic pain is projected to be the most lucrative segment, holding a revenue share of 26.3% in 2022. This category includes conditions such as neurogenic pain, cancer pain, lower back pain, arthritis, neck pain, headaches, and facial discomfort. The association of chronic pain with various medical conditions is expected to increase the use of cannabis for pain relief, driving market growth.

- By Product: In 2022, oils and tinctures dominated the market with a revenue share of 50.8% and are expected to grow at the fastest rate of 49.5%. Tinctures, made by dissolving cannabis in alcohol and administered sublingually, offer a faster onset of effects (15 minutes) compared to oils, which take about 45 minutes to take effect.

Market Size & Forecast

- 2022 Market Size: USD 4.8 Million

- 2030 Projected Market Size: USD 117.7 Million

- CAGR (2023-2030): 20%

Key Companies & Market Share Insights

The market is moderately competitive, with only a few organizations possessing the technology, financial resources, and legal approvals for large-scale cannabis cultivation. The availability of research funding is crucial for encouraging new entrants to introduce innovative products in the Mexican market. For example, in July 2020, Ikänik Farms became the first company to claim "Hecho en Mexico" for hemp and cannabis products through its complete acquisition of D9C Mexico S.A. DE C.V.

Key Players

- Aurora Cannabis

- CANOPY GROWTH CORPORATION

- GW Pharmaceuticals, plc

- Jazz Pharmaceuticals, Inc.

- CBD Life

- HempMeds

- Isodiol International Inc.

- PharmaCielo.com

- Elixinol

- ENDOCA

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The Mexico medical cannabis market is poised for significant growth, driven by regulatory advancements, increasing acceptance of cannabis for medical purposes, and the high prevalence of chronic conditions like cancer. With a projected market size of USD 117.7 million by 2030 and a robust CAGR of 20%, the market is supported by favorable regulations and growing medical tourism. Chronic pain applications and cannabis oils/tinctures are key growth drivers, while competitive dynamics and research funding will shape the market’s evolution, fostering innovation and economic opportunities.