Market Segmentation Made Easy: Using Surveys to Identify Your Ideal B2C Customer

In this guide, we’ll explore how surveys can simplify market segmentation. We’ll look at why segmentation is vital for B2C, outline how to design targeted questions that uncover consumer nuances, and offer practical tips for turning raw survey data into actionable strategies.

In this guide, we’ll explore how surveys can simplify market segmentation. We’ll look at why segmentation is vital for B2C, outline how to design targeted questions that uncover consumer nuances, and offer practical tips for turning raw survey data into actionable strategies. Whether you run a direct-to-consumer e-commerce shop or manage a SaaS platform, the principles remain the same - knowing your audience, in detail, is your best competitive advantage.

1. Introduction

Market segmentation is a cornerstone of modern B2C marketing and for good reason. When you know your audience segments, you can tailor messaging, pricing, and products to meet their unique needs, ultimately creating more meaningful connections and driving higher ROI. Yet, many brands still grapple with identifying the right segments or crafting campaigns that truly speak to their consumers. Enter surveys, one of the most straightforward yet powerful tools to gather the insights you need for effective segmentation.

In this guide, we’ll explore how surveys can simplify market segmentation. We’ll look at why segmentation is vital for B2C, outline how to design targeted questions that uncover consumer nuances, and offer practical tips for turning raw survey data into actionable strategies. Whether you run a direct-to-consumer e-commerce shop or manage a SaaS platform, the principles remain the same, knowing your audience, in detail, is your best competitive advantage.

2. Why Market Segmentation Matters in B2C

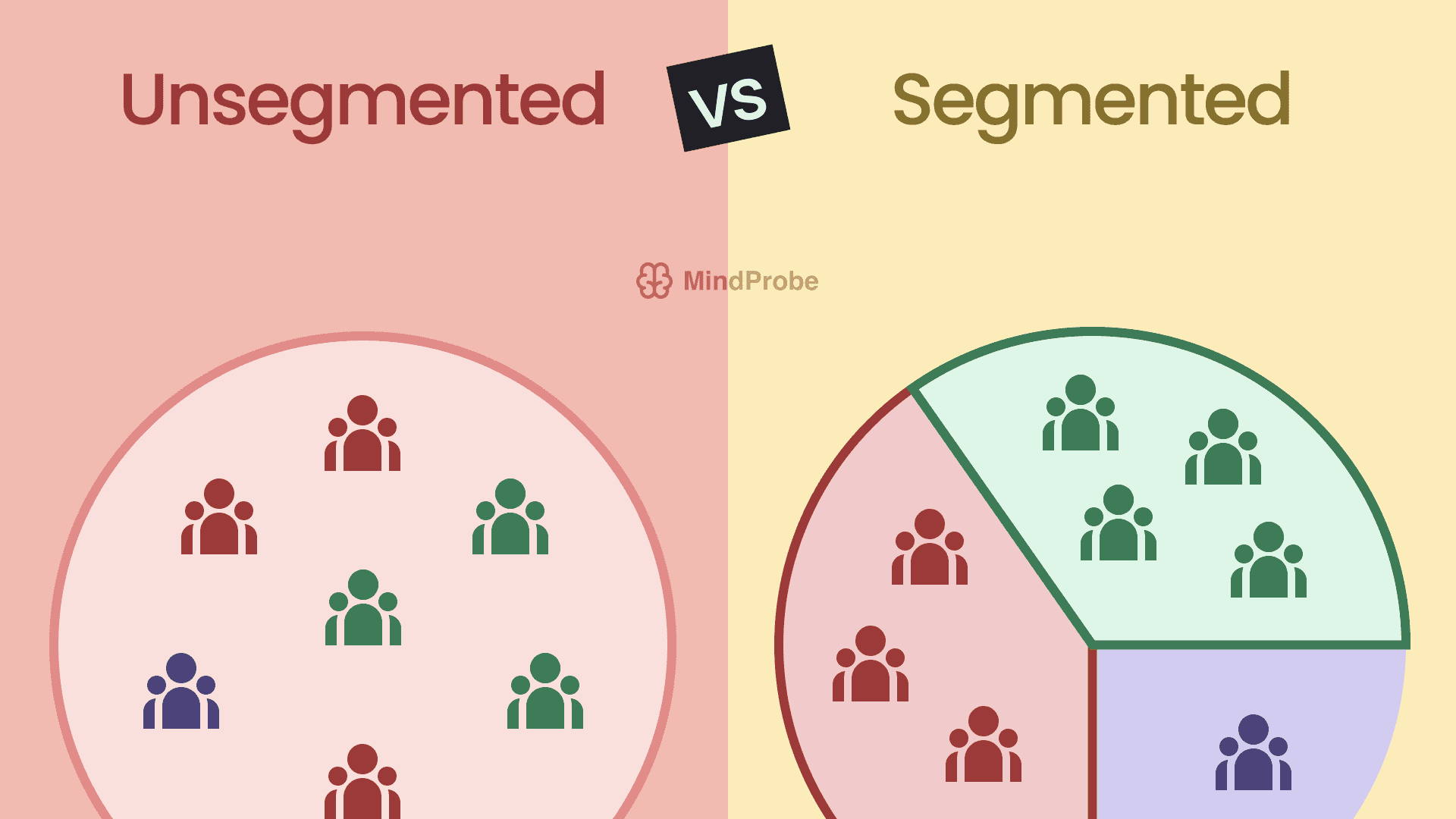

Picture this: you have a product lineup with something for everyone, yet your promotions and campaigns fall flat. Often, the issue isn’t with the product itself but with the messaging. Different customers respond to different triggers - some might be price-sensitive, while others prioritise aesthetics or brand image.

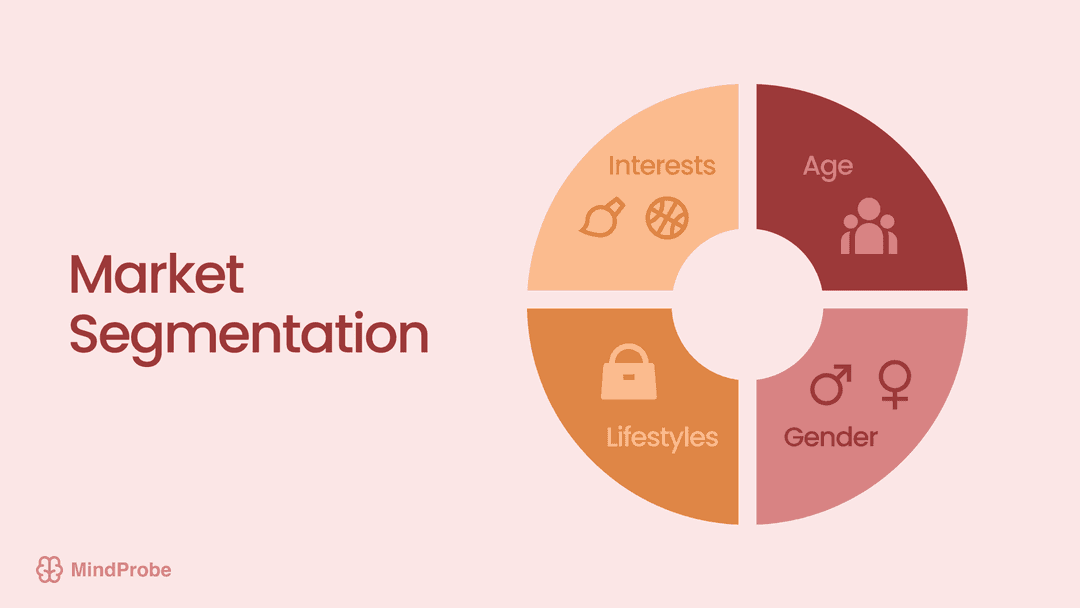

Market segmentation is the process of dividing a broad consumer base into smaller subgroups that share similar traits (e.g., demographics, behaviours, or psychographics). For instance:

- Demographic segmentation might group consumers by age, gender, or income.

- Psychographic segmentation focuses on lifestyles, interests, or values.

- Behavioural segmentation could look at purchase history, brand loyalty, or usage patterns.

Segmentation matters because it allows you to speak directly to each group’s motivations, pain points, and preferences. This leads to more efficient marketing spend, better product fit, and a higher likelihood of long-term brand loyalty.

3. The Role of Surveys in Segmentation

Surveys act like a microphone, giving you direct feedback from the people who matter most: your customers (or potential customers). While sales data or website analytics can tell you the “what,” surveys often reveal the crucial “why", i.e. why a certain demographic tends to buy your premium line, or why some customers churn after three months.

Core Benefits of Survey-Based Segmentation

- Deeper Insights: Beyond numeric metrics, open-ended questions provide a window into the emotional or subjective reasons people buy (or don’t buy).

- Flexibility: You can tailor questions to specific concerns - like testing price sensitivity or gauging interest in a hypothetical product.

- Scalability: Online survey tools allow you to reach large audiences quickly, collecting robust data that can be segmented further.

Key Thought: Surveys can gather qualitative and quantitative data, making them particularly potent for unveiling the underlying psychological drivers behind consumer behaviour.

4. Defining Your Segmentation Goals

Before you even draft a single question, clarify what you want to achieve with segmentation. Are you trying to:

- Expand into a new market?

- Refine your product offerings?

- Improve customer retention?

- Test different price tiers?

The goal you set will shape everything, your survey design, sampling method, and how you’ll eventually analyse the data. If, for example, you’re testing a new product concept, you might focus on purchase intent or feature preferences. Conversely, if retention is your priority, your questions might explore pain points, customer satisfaction, and reasons for churn.

5. Designing Effective B2C Surveys for Segmentation

A well-structured survey can be your secret weapon. Here’s how to get it right:

5.1 Choosing the Right Question Types

- Demographic Questions

- Age, income, gender, location - these help you later slice the data to see if certain groups behave differently.

- Psychographic or Lifestyle Questions

- “How do you spend your free time?” or “Which statement best describes your attitude toward sustainability?”

- Behavioural Questions

- Purchase frequency, brand loyalty, usage context. These insights can be invaluable for product positioning or promotional strategies.

5.2 Mixing Quantitative and Qualitative Approaches

-

Closed-Ended: Multiple choice, Likert scales, or yes/no questions for quick, comparable stats.

-

Open-Ended: Rich narratives, letting people elaborate on “why.” Tools with auto-tagging or sentiment analysis can quickly process these responses, highlighting recurring themes.

5.3 Avoiding Leading Questions

-

Biased: “Don’t you love our new eco-friendly packaging?”

-

Neutral: “How would you rate the convenience and environmental impact of our new packaging?”

Tip: Always pilot test your survey to catch any biased wording or unclear phrasing before sending it to a larger audience.

6. Applying Survey Insights to Refine Your Segments

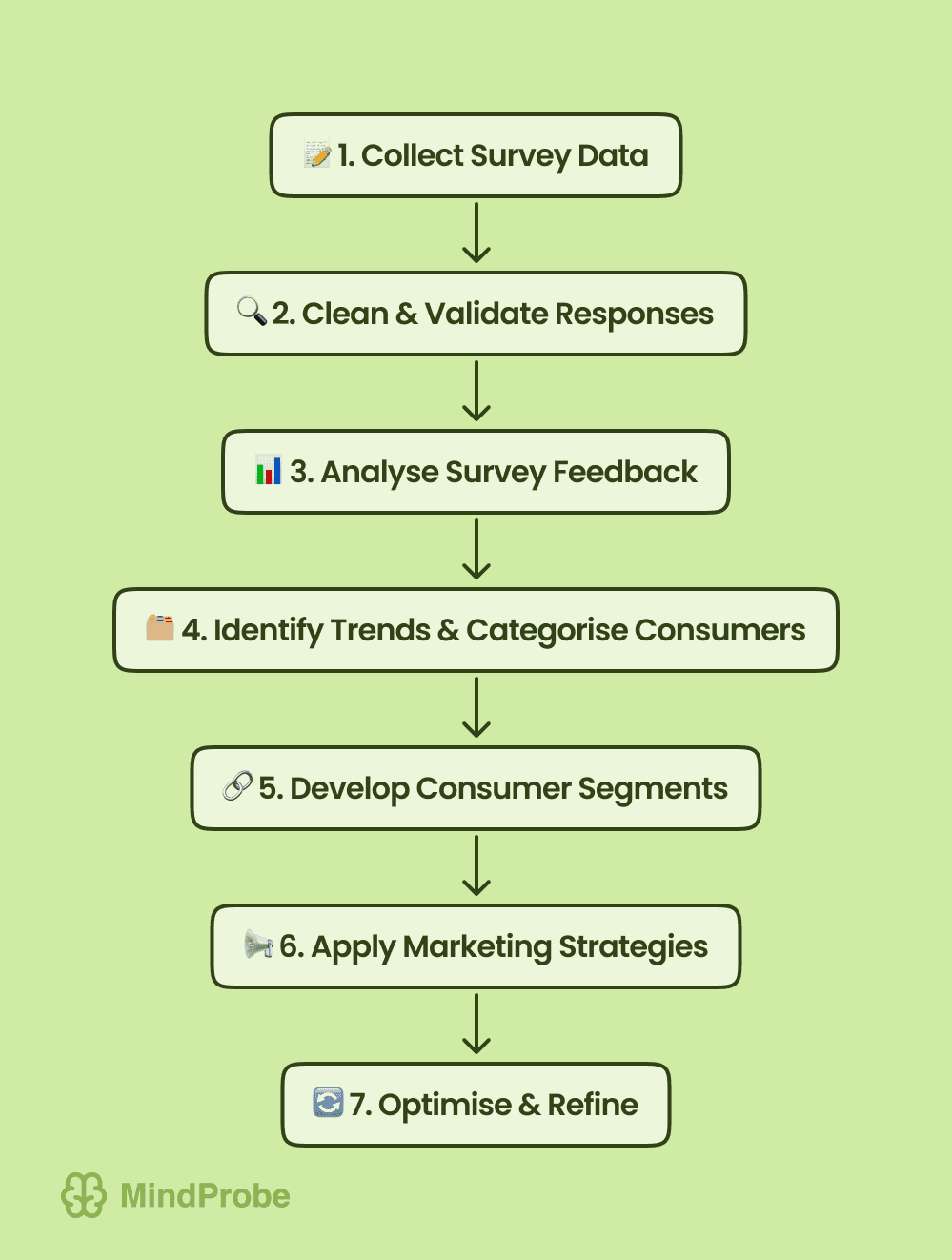

Once responses roll in, the real work begins, analysing, sorting, and using the data to define or refine segments.

6.1 Identifying Patterns and Trends

-

Group by Demographics: See if older vs. younger consumers differ in brand perception or usage habits.

-

Check for Psychographic Clusters: Are there distinct lifestyle groups (e.g., fitness enthusiasts, budget-conscious families)?

-

Find Overlaps: Maybe a portion of your audience values premium materials and advanced product features. That’s a unique segment to consider.

6.2 Testing Hypotheses and Adjusting Segments

You might hypothesise that rural customers are more price-sensitive, but survey data could show that location doesn’t impact price sensitivity as much as income or household size. Keep an open mind, surveys can debunk assumptions and steer you toward more accurate segmentation models.

6.3 Integrating with Other Data Sources

If you have CRM records or web analytics, cross-reference them with the new survey results. For instance, does a user who claims eco-friendly values actually purchase your sustainable product lines? Identifying any mismatch between stated and real behaviour can refine your segments further, making them more actionable.

7. Real-World Examples: From Data to Action

7.1 E-Commerce Fashion Retailers

Scenario: An online clothing store suspects it has two main segments, trend-chasers and budget-conscious buyers. A targeted survey collects data about fashion priorities, preferred price ranges, and purchase frequency.

Outcome: Findings confirm two key segments plus a surprise third: eco-conscious shoppers who value sustainable materials above all else. By tailoring product lines and marketing messages to each of these three segments, the retailer sees a notable lift in both conversion rates and average order value.

7.2 Subscription Box Services

Scenario: A monthly snack box service sees high churn. A survey explores reasons - are customers bored with limited variety, finding it too pricey, or preferring healthier options?

Outcome: Responses reveal a strong preference for health-centric snacks among a subset of subscribers. This new segment receives curated boxes featuring low-sugar, high-protein items, resulting in a significant drop in churn among that group.

7.3 SaaS Platforms

Scenario: A project management tool uses a survey to see what features different user personas (e.g., freelancers, SMB owners, enterprise admins) value most.

Outcome: Data shows freelancers value quick set-up and minimal monthly costs, while enterprise clients emphasise security and advanced reporting. The SaaS provider develops feature tiers accordingly, improving both upsell potential and user satisfaction.

8. Technology and Tools to Streamline Segmentation

Modern platforms can reduce the time spent collecting and analysing survey data. Solutions that offer AI-driven insights like MindProbe can quickly highlight recurring words or sentiment in open-ended fields. For instance, if hundreds of respondents mention “delivery delays,” you’ll see that theme emerge clearly, aiding swift action.

Key Features to Look For:

- Automated Distribution: Schedule surveys at specific customer touchpoints (e.g., post-purchase or renewal).

- Branching Logic: Show each respondent relevant questions, reducing clutter and boosting quality.

- Real-Time Dashboards: Monitor data as it arrives, so you can pivot or dig deeper immediately if a surprising trend emerges.

- Segmentation Analytics: Some platforms offer integrated segmentation features, letting you slice the data by region, age group, or other criteria instantly.

Why It Matters: In fast-paced B2C environments, the ability to interpret and act on feedback rapidly often sets thriving brands apart from those struggling to keep up with consumer shifts.

9. Overcoming Common Segmentation Pitfalls

9.1 Survey Fatigue

Issue: Overly long surveys or too-frequent questionnaires can lead to lower response rates or rushed, superficial answers.

Solution: Keep surveys concise, use skip logic to show only relevant questions, and consider offering small incentives or follow-up content for participants.

9.2 Biased or Ambiguous Questions

Issue: Leading wording (“Don’t you think our product is great?”) can skew data.

Solution: Maintain neutral phrasing, pilot test questions, and gather peer feedback before deploying a large-scale survey.

9.3 Over-Segmentation

Issue: Creating too many micro-segments can complicate your marketing and product strategies, diluting focus.

Solution: Focus on the most impactful clusters. Consider merging very small segments if they don’t warrant standalone strategies.

10. Conclusion

Market segmentation isn’t just a buzzword, it’s a pragmatic technique for speaking your customer’s language, tailoring products and campaigns that resonate deeply with each unique subgroup. Surveys are a versatile and powerful way to illuminate those differences, bridging gaps between raw data and genuine consumer insights.

By crafting thoughtful survey questions, you can quickly glean who your customers are, why they buy, and how they perceive your brand. From there, segmentation transforms generic marketing into targeted messaging, reduces acquisition costs by focusing on high-yield segments, and can even lead to product innovations tailored to real needs. Leveraging AI-powered tools, like MindProbe, further accelerates the process, helping you parse large volumes of open-ended feedback for immediate, theme-based insights.

Remember, however, that no segmentation effort is static. Consumer preferences evolve, new competitors enter the market, and cultural shifts can redefine entire segments overnight. By iterating on your approach, maintaining open feedback channels, and updating your surveys periodically, your segments will stay accurate, and your brand will remain agile enough to keep pace with the ever-shifting B2C landscape.