Maritime Safety System Market 2033: The Role of Cybersecurity in Marine Operations

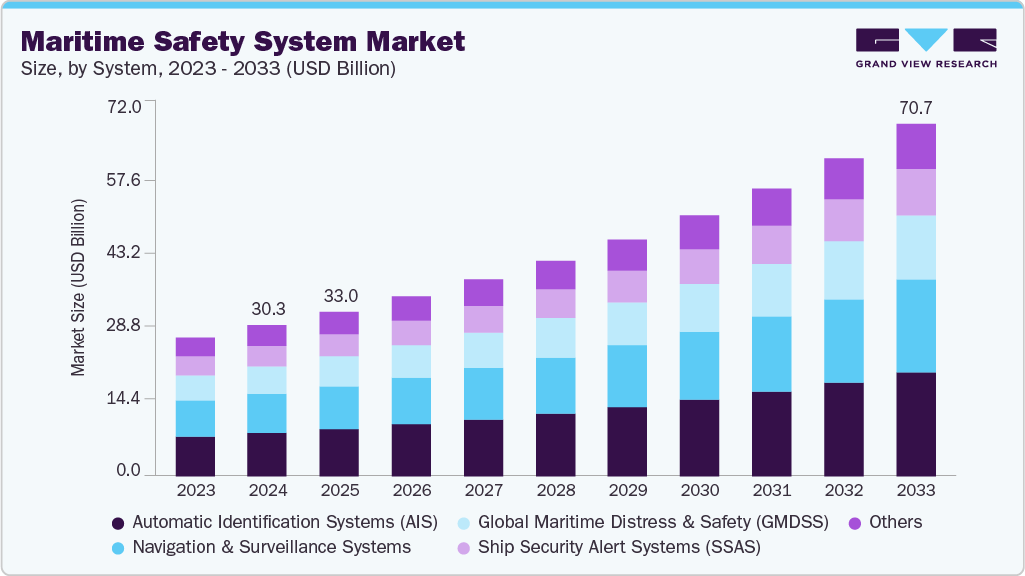

The global maritime safety system market was valued at USD 30.31 billion in 2024 and is projected to reach USD 70.68 billion by 2033.

The global maritime safety system market was valued at USD 30.31 billion in 2024 and is projected to reach USD 70.68 billion by 2033, growing at a CAGR of 10.0% from 2025 to 2033. Growth in this sector is driven by the integration of advanced cybersecurity protocols, AI-powered navigation systems, and the overall digital transformation of maritime operations.

A significant market driver is the rising concern over cyber threats and the increasing need for secure, autonomous maritime operations. This has led to widespread adoption of digital tools for navigation, surveillance, and communication. The International Maritime Organization (IMO)’s e-navigation strategy has further accelerated this transformation by promoting seamless information exchange and harmonized marine data analytics.

The IMO’s Strategy Implementation Plan (SIP)—especially the RCO 6 initiative ("Improved Shore-Based Services")—has catalyzed investments in port digital infrastructure. These initiatives enhance real-time ship-shore data exchange, improve decision-making, and minimize collision risks, making e-navigation a fundamental component of modern maritime safety.

Another major development has been the rapid adoption of the Long Range Identification and Tracking (LRIT) system. With over 90% coverage among eligible SOLAS vessels by 2025, LRIT has significantly improved offshore monitoring up to 1,000 nautical miles. Managed by the U.S. Coast Guard’s National Data Center, LRIT is especially valuable in regions like the South China Sea and the Arctic, where terrestrial coverage is limited. It supports surveillance, detects non-compliant or AIS-disabled vessels, and plays a vital role in national security and fisheries enforcement.

Order a free sample PDF of the Maritime Safety System Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America accounted for the largest market share of 34.1% in 2024 and is projected to register the fastest CAGR over the forecast period. This leadership is due to the region’s advanced maritime infrastructure, rigorous safety standards, and increasing adoption of technologies such as Automatic Identification Systems (AIS) and real-time monitoring platforms.

- By System: The AIS segment held the largest market share of 28.7% in 2024. Growing global efforts to enhance vessel monitoring, ensure regulatory compliance, and expand satellite-based tracking have driven retrofitting of AIS systems, particularly across older fleets.

- By Component: The hardware segment led the market in 2024. High demand for VHF antennas, GNSS receivers, marine radars, and encrypted AIS transponders—especially in retrofitting initiatives—has supported growth as fleets adapt to e-navigation standards.

- By Application: The port and vessel security segment was the top application area in 2024. Rising threats such as cargo theft, cyberattacks, and geopolitical disruptions have pushed ports to invest in AI-based surveillance, biometric access control, and integrated anomaly detection systems.

- By End Use: The commercial shipping sector dominated in 2024 and is expected to continue leading with the fastest CAGR. Regulatory compliance, ESG reporting, and fuel cost optimization through data-driven route safety are key growth factors.

Market Size & Forecast

- 2024 Market Size: USD 30.31 Billion

- 2033 Projected Market Size: USD 70.68 Billion

- CAGR (2025-2033): 10.0%

- North America: Largest market in 2024

Key Companies & Market Share Insights

Key players in the maritime safety system market include Anschütz, BAE Systems, Elbit Systems Ltd., Honeywell International Inc., and L3Harris Technologies, Inc. These companies deliver advanced maritime safety technologies such as radar systems, navigation aids, communication networks, and emergency response platforms. Their offerings are widely adopted across commercial, defense, and coastal surveillance applications due to their compliance with international safety standards and proven performance.

- Honeywell International Inc. - Honeywell provides robust maritime safety technologies leveraging its expertise in automation, sensing, and environmental control systems. Its marine solutions cater to both defense and commercial sectors, focusing on integrated fire detection, environmental monitoring, and shipboard automation, ensuring compliance and operational efficiency.

- Smiths Group plc - Through its subsidiary Smiths Detection, the company plays a critical role in port and vessel security. It offers advanced threat detection systems using X-ray imaging, trace detection, and material analysis technologies. Its proven record in homeland security and infrastructure protection makes it a key contributor to maritime domain awareness.

Key Players

- Anschütz

- BAE Systems

- Elbit Systems Ltd.

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Northrop Grumman

- OSI MARITIME SYSTEMS

- Saab Group

- Smiths Group plc

- Thales

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global maritime safety system market is undergoing a transformative shift driven by digitization, security demands, and the push for autonomous navigation technologies. With the market expected to more than double from USD 30.31 billion in 2024 to USD 70.68 billion by 2033, key areas of growth include e-navigation systems, satellite-based tracking (LRIT), AIS expansion, and port surveillance modernization.

North America currently leads the market, while other regions, particularly Asia Pacific and Europe, are expected to accelerate adoption due to regulatory mandates and technological upgrades. As maritime stakeholders continue to prioritize situational awareness, cybersecurity, and environmental compliance, demand for comprehensive safety systems will remain strong.