IoT Insurance Market 2030: The Evolution of Property and Casualty Insurance

global IoT insurance market, a landscape valued at USD 15.09 billion in 2023 and now surging with a projected annual growth of a remarkable 29.7% from 2024 to 2030.

Imagine a world where insurance policies are no longer static documents but living, breathing entities, adapting in real-time to the rhythm of our lives and the world around us. This is the transformative power of the global IoT insurance market, a landscape valued at USD 15.09 billion in 2023 and now surging with a projected annual growth of a remarkable 29.7% from 2024 to 2030. This isn't just about insuring things; it's about weaving a safety net powered by interconnected intelligence.

This electrifying growth is fueled by the insurance sector's embrace of innovation, birthing novel insurance models that were once the stuff of science fiction. The ever-expanding web of the Internet of Things (IoT) is playing a pivotal role, offering the promise of lower risks and, consequently, more personalized and potentially lower premiums. The march of technological progress – the rise of perceptive sensors, the learning prowess of machines, the vast insights hidden within big data, and the analytical tools that unlock them – is further amplifying this market's potential. Picture smart grids not just managing energy but also informing insurance risk in real-time – this is the anticipated acceleration of IoT utilities.

The insurance industry is recognizing the golden opportunity presented by cutting-edge technologies like artificial intelligence and machine learning, paving the way for even more sophisticated IoT-driven insurance solutions. Coupled with the growing reliance on cloud platforms and other value-added services, and the pervasive spread of IoT across both established and emerging economies, the stage is set for significant expansion. Insurance businesses are strategically investing more in IoT technology, not just for futuristic offerings, but to enhance their fundamental operational efficiency today.

Get a preview of the latest developments in the IoT Insurance Market; Download your FREE sample PDF copy today and explore key data and trends

Imagine insurance companies as bespoke tailors, now able to craft policies perfectly fitted to the unique contours of industries like manufacturing, healthcare, and agriculture – sectors where IoT devices are already deeply embedded. As IoT adoption continues its relentless march across these domains and geographical boundaries, insurers can offer truly customized coverage and rates, informed by the rich tapestry of individual data and behavior captured by these interconnected devices.

The traditional insurance landscape is undergoing a metamorphosis unlike any seen before, all thanks to the connective tissue of IoT. Insurance businesses are harnessing the power of vast data streams flowing from linked devices – think the insights gleaned from telematics in vehicles or the vital signs monitored through telemedicine – to derive meaningful intelligence. The giants of the insurance world, including State Farm Group, Allianz SE, and UnitedHealth Group, have already embarked on this journey, investing significantly in IoT technology to streamline their operations and unlock a future where insurance is smarter, more personalized, and deeply integrated into the fabric of our connected world.

Detailed Segmentation

End-use Industry Insights

The automotive and transportation segment led the market with the largest revenue share in 2023. Fleet management is streamlined by the widespread usage of IoT insurance services in the automobile and transportation industries. Car electronics track cargo conditions, driver conduct, and routes. It is advantageous for businesses and insurers as it can precisely analyze risk, increase productivity, and guarantee cargo integrity. IoT insurance is centered around telematics and has several applications in the car industry. These devices track driver behavior and provide location, speed, and brake information. Employing this information, insurers can lower rates for conscientious drivers, promote safe driving, and tailor policies.

Component Insights

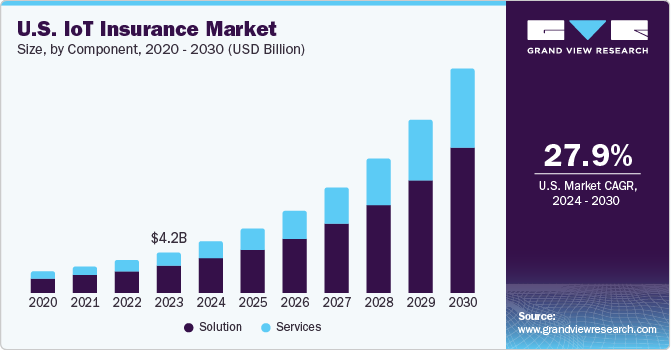

The solution segment led the market with the largest revenue share of 67.2% in 2023 and is expected to retain its dominance over the forecast period. The technology and software that facilitate data gathering, analysis, and usage are central to the exponential rise of IoT insurance solutions. Software programs, IoT devices, and data analytics platforms are some solutions. Insurance companies collect real-time data from wearables, sensors, and telematics devices using IoT technologies. Claims processing, insurance customization, and risk assessment are all aided by this data. With the help of IoT technology, insurers can provide creative, data-driven insurance products and improve client experiences by offering proactive risk management and individualized coverage.

Insurance type Insights

The life & health insurance segment held the largest revenue share in 2023. IoT technology encourages proactive health monitoring, which enhances life and health insurance. Wearables and connected health devices gather real-time data on policyholders' vital signs, fitness levels, and health habits. With this data, insurers can provide individualized policies that give benefits and discounts for leading healthier lives. IoT-enabled remote patient monitoring and telemedicine also lower costs and increase access to healthcare. IoT-enabled life and health insurance improves general well-being and gives policyholders financial stability.

Regional Insights

The North America IoT insurance market accounted for a dominant revenue share of 36.9% in 2023, owing to increased awareness and quicker uptake of IoT in the region. Numerous businesses, including State Farm, Progressive, and Liberty Mutual, are utilizing the IoT technology available in the area to improve the effectiveness of their risk assessments.

Key IoT Insurance Companies:

The following are the leading companies in the IoT insurance market. These companies collectively hold the largest market share and dictate industry trends.

- Oracle Corporation

- SAP SE

- IBM Corporation

- Microsoft Corporation

- Intel Corporation

- Telit Communications PLC

- Capgemini SE.

- Cognizant

- Cisco Systems Inc.

- Accenture PLC

- Verisk Analytics Inc.

- Wipro Limited

- Google LLC

- Synechron, Inc.

- Concirrus

IoT Insurance Market Segmentation

Grand View Research has segmented the global IoT Insurance market based on component, insurance type, end-use industry, and region:

IoT Insurance Component Outlook (Revenue, USD Million, 2018 - 2030)

- Solution

- Services

IoT Insurance Type Outlook (Revenue, USD Million, 2018 - 2030)

- Life and Health Insurance

- Property and Causality Insurance

- Others

IoT Insurance End-use Industry Outlook (Revenue, USD Million, 2018 - 2030)

- Automotive and Transportation

- Healthcare

- Agricultural

- Retail and Commercial

- Others

IoT Insurance Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Curious about the IoT Insurance Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In October 2023, Accenture plc announced the acquisition of the Hamburg, Germany-based insurance operations provider, ON Service GROUP. Accenture is currently better positioned to manage the whole supply chain and help clients leverage digital services to boost their operational effectiveness, flexibility, and potential for expansion.

- In November 2022, IBM Corporation announced a partnership with Bulgaria and Ablera to develop ABACUS, an AI-driven pricing and rating system designed for insurance firms. Through this agreement, ABACUS is likely to be able to operate at a speed and accuracy never before possible, eliminating the need for tedious, prone-to-error manual labor and opening up the use of advanced applied mathematics tools to a more extensive range of users.

- In August 2022, Telit, an international leader in the Internet of Things (IoT), announced the purchase of group assets from Mobilogix. This acquisition provides extensive equipment design resources and expertise focusing on original equipment manufacturing, regulatory approvals, operating certificates, and optimizing the migration of electronic manufacturing services.