Interleukin Inhibitors Market Regional Focus by Treatment Adoption

The global interleukin inhibitors market is poised for robust and sustained growth, driven by the rising burden of autoimmune and inflammatory diseases and increasing adoption of targeted biologic therapies.

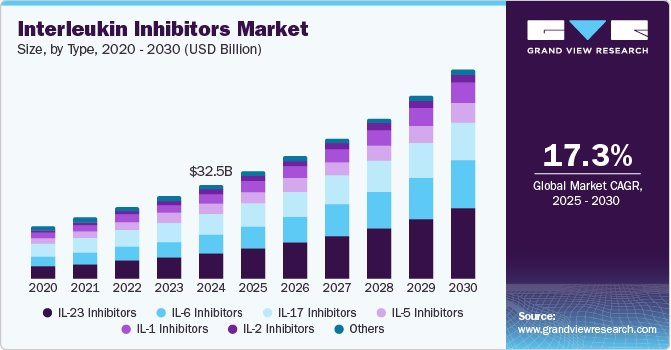

The global interleukin inhibitors market was valued at USD 32.5 billion in 2024 and is projected to reach USD 72.2 billion by 2030, expanding at a CAGR of 17.3% from 2025 to 2030. Market growth is primarily driven by the rising prevalence of chronic inflammatory and autoimmune disorders, including rheumatoid arthritis (RA), psoriasis, and inflammatory bowel disease (IBD). The increasing incidence of these conditions highlights the growing need for targeted immunomodulatory therapies, positioning IL inhibitors as a critical treatment class and a key catalyst for market expansion.

Pharmaceutical companies are making substantial investments to explore new therapeutic indications, combination therapies with immuno-oncology agents, and next-generation biologics, unlocking significant growth potential. In parallel, regulatory approvals for innovative treatments—such as AbbVie’s SKYRIZI—reflect strong clinical momentum and expanding treatment adoption. Moreover, the growing acceptance of biosimilars is expected to intensify competition, reduce treatment costs, and improve patient access, further supporting long-term market growth.

Key Market Trends & Insights

- North America dominated the interleukin inhibitors market in 2024, accounting for a 37.5% revenue share, supported by advanced healthcare infrastructure and high biologics adoption.

- By type, the IL-23 inhibitors segment led the market with a 27.5% revenue share in 2024, driven by strong efficacy in autoimmune disease management.

- By route of administration, the subcutaneous segment held the largest share at 61.7% in 2024, owing to patient convenience and improved adherence.

- By application, the psoriasis segment dominated the market, accounting for 37.0% of total revenue in 2024.

- By end use, hospitals remained the primary point of care, generating a 62.7% revenue share in 2024.

Download a free sample PDF of the Interleukin Inhibitors Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 32.5 Billion

- 2030 Projected Market Size: USD 72.2 Billion

- CAGR (2025–2030): 17.3%

- North America: Largest market in 2024

Competitive Landscape

The interleukin inhibitors market is highly competitive and innovation-driven, with leading pharmaceutical companies collectively shaping industry trends through robust pipelines, global commercialization strategies, and continuous investment in R&D.

Key Players Include:

- Novartis AG

- AbbVie Inc.

- Eli Lilly and Company

- Regeneron Pharmaceuticals Inc.

- Johnson & Johnson Services, Inc.

- F. Hoffmann-La Roche Ltd

- AstraZeneca

- Bausch Health Companies Inc.

- GlaxoSmithKline plc

- Teva Pharmaceutical Industries Ltd

Recent Developments

- In September 2024, Eli Lilly’s EBGLYSS (lebrikizumab) received FDA approval for adults and children aged 12 years and older with moderate-to-severe atopic dermatitis inadequately controlled by topical therapies, offering significant symptom relief.

- In August 2024, Regeneron Pharmaceuticals Inc. presented 20 scientific abstracts at the ERS Congress highlighting advancements in Dupixent and itepekimab for respiratory conditions including COPD, asthma, and chronic rhinosinusitis with nasal polyps.

- In June 2024, Johnson & Johnson announced positive Phase 3 GRAVITI study results for TREMFYA (guselkumab), demonstrating its potential as the only IL-23 inhibitor offering both subcutaneous and intravenous induction options.

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The global interleukin inhibitors market is poised for robust and sustained growth, driven by the rising burden of autoimmune and inflammatory diseases and increasing adoption of targeted biologic therapies. Continued innovation, expanding therapeutic indications, and the growing availability of biosimilars are expected to enhance treatment accessibility and affordability. With strong clinical pipelines, favorable regulatory momentum, and increasing demand across major regions, interleukin inhibitors will remain a cornerstone of immunology therapeutics throughout the forecast period.