Insurance Telematics Market: Merging Mobility with Security

The global insurance telematics market was valued at USD 4.45 billion in 2024 and is expected to reach USD 14.74 billion by 2030.

The global insurance telematics market was valued at USD 4.45 billion in 2024 and is expected to reach USD 14.74 billion by 2030, expanding at a CAGR of 22.2% from 2025 to 2030. Market growth is being driven by rising awareness of connected vehicles and the introduction of laws and regulations focused on improving driver safety.

Advancements in technologies such as artificial intelligence (AI), the Internet of Things (IoT), and 5G have accelerated innovation in the automotive and insurance sectors. These technologies have created new opportunities to enhance user experience and enable data monetization. A major factor supporting market expansion is the increasing adoption of usage-based insurance (UBI) models across key global economies. These policies allow insurers to offer highly personalized coverage while encouraging safer driving behavior and reducing accident risks.

Insurers are increasingly integrating telematics solutions directly with connected car systems to gain access to real-time vehicle data from onboard systems. This integration enables the delivery of value-added services such as vehicle tracking, emergency assistance, and remote diagnostics, thereby enhancing customer experience. Rising road accident rates have further reinforced the need for telematics adoption. According to the U.S. National Highway Traffic Safety Administration (NHTSA), around 19,000 fatalities occurred in vehicle crashes during the first half of 2024. Telematics has emerged as an effective tool for reducing accident risks, particularly for fleet drivers, contributing to market growth.

Order a free sample PDF of the Insurance Telematics Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: North America led the insurance telematics market with a 28.0% revenue share in 2024. Strong demand for connected solutions, advanced technological infrastructure, and intense competition among insurers have driven the deployment of cloud-based telematics platforms. Government initiatives in the U.S. and Canada aimed at reducing road accidents and promoting safer driving have further encouraged the use of telematics data.

- By Offering: The software segment dominated the market with a revenue share of 74.6% in 2024 and is expected to maintain its leadership. Continuous requirements for bandwidth upgrades, connectivity improvements, and real-time data processing are driving demand. Telematics software enables live vehicle monitoring, predictive maintenance, and seamless integration with IoT devices, enhancing data-driven decision-making.

- By Type: The pay-as-you-drive (PAYD) segment accounted for the largest revenue share in 2024. This model benefits both insurers and policyholders by aligning premiums with actual driving behavior. Real-time monitoring helps reduce accidents and claims, while drivers—especially younger and cost-conscious consumers—benefit from lower premiums based on reduced driving frequency and safer habits.

- By Deployment: The cloud segment is expected to grow rapidly from 2025 to 2030. Cloud-based platforms support large-scale data collection and real-time analysis, improving underwriting accuracy, risk assessment, and claims processing. Insurers are also using cloud solutions to offer mobile apps and dashboards that enhance customer engagement and satisfaction.

- By Enterprise Size: Large enterprises accounted for the highest revenue share in 2024. These organizations rely on telematics to reduce costs, enhance safety, and improve fleet efficiency. Early adoption of advanced technologies such as AI, predictive analytics, and IoT-based monitoring continues to support growth in this segment.

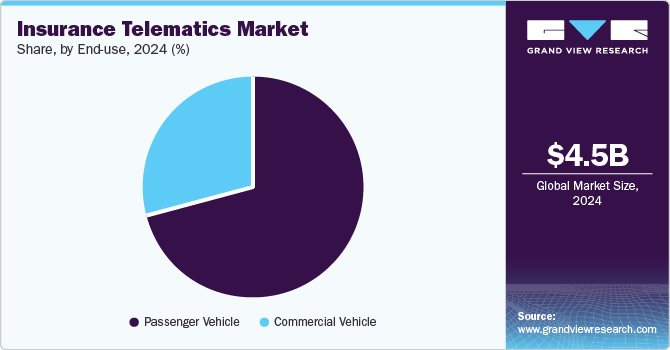

- By End Use: The passenger vehicle segment dominated the market in 2024 and is expected to retain its position during the forecast period. Growing consumer interest in personalized insurance plans, widespread smartphone usage, and advancements in connected vehicle technologies are driving adoption. The rising popularity of electric vehicles further supports the integration of telematics solutions in this segment.

Market Size & Forecast

- 2024 Market Size: USD 4.45 Billion

- 2030 Projected Market Size: USD 14.74 Billion

- CAGR (2025-2030): 22.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Key players operating in the insurance telematics market include Aplicom, Trak Global Solutions Holdings (Canada) Inc., and Octo Group S.p.A., among others.

- Aplicom specializes in telematics solutions for vehicle tracking, fleet management, and data analytics. Its offerings include real-time tracking, vehicle diagnostics, route optimization, predictive maintenance, driving behavior analysis, and traffic safety solutions, helping organizations enhance operational efficiency and reduce costs.

Key Players

- Agero, Inc.

- Aplicom

- Trak Global Solutions Holdings (Canada) Inc.

- Masternaut Limited

- META SYSTEM S.P.A.

- MiX by Powerfleet

- Octo Group S.p.A

- Bridgestone Mobility Solutions B.V.

- Trimble

- Sierra Wireless S.A.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The insurance telematics market is set for strong growth through 2030, driven by rapid technological advancements, rising adoption of usage-based insurance models, and increasing focus on road safety and environmental sustainability. North America remains the leading market, while Asia Pacific is emerging as the fastest-growing region. As insurers increasingly rely on real-time vehicle data to deliver personalized, efficient, and eco-friendly solutions, insurance telematics is becoming a critical component of modern insurance ecosystems worldwide.