Industrial Cyber Security Market Drivers: The Push for Zero-Trust Architectures

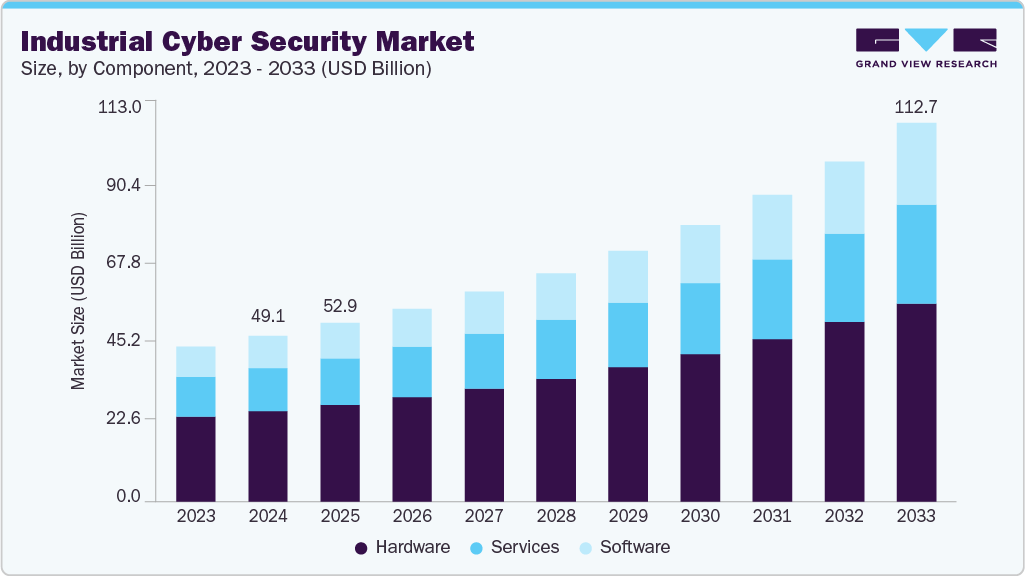

The global industrial cybersecurity market was valued at USD 49.13 billion in 2024 and is projected to reach USD 112.66 billion by 2033.

The global industrial cybersecurity market was valued at USD 49.13 billion in 2024 and is projected to reach USD 112.66 billion by 2033, growing at a CAGR of 9.9% from 2025 to 2033. This growth is primarily driven by the increasing convergence of operational technology (OT) and information technology (IT) systems in critical infrastructure and manufacturing environments.

Key drivers of this market expansion include the growing adoption of Industrial Internet of Things (IIoT) devices and cloud-based platforms. These technologies enable real-time monitoring and predictive maintenance, but they also introduce significant cybersecurity challenges due to the high volume of devices and the need for secure data transmission. Industrial organizations are responding by integrating cybersecurity solutions at both the network and device levels, increasing demand for solutions like device authentication, encrypted communication, and AI-driven anomaly detection.

As industrial organizations rely more on third-party vendors and remote access to manage OT infrastructure, the need for identity and access management (IAM) systems, secure remote connectivity, and zero-trust architectures has intensified, further propelling market growth.

Additionally, the emergence of digital twins, predictive maintenance, and advanced analytics in industrial settings has created a stronger demand for sophisticated cybersecurity frameworks. These technologies require the seamless exchange of real-time data across machines, sensors, cloud platforms, and analytics engines. Any breach, manipulation, or unauthorized access to this data could significantly impact operational efficiency, safety, and asset integrity. In response, companies are implementing end-to-end encryption, secure APIs, and network segmentation techniques to safeguard data authenticity and integrity, especially in high-stakes sectors such as aerospace, automotive, and energy.

Order a free sample PDF of the Industrial Cyber Security Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: North America led the industrial cybersecurity market with a revenue share of 36.5% in 2024. The rise in high-profile cyberattacks targeting industrial infrastructure, such as the Colonial Pipeline ransomware attack and intrusions on power grids and water treatment facilities, has heightened the urgency for stronger cybersecurity measures.

- Component Breakdown: The hardware segment dominated the market in 2024, accounting for 54.9% of revenue. This growth is driven by the increasing integration of edge computing and localized data processing in industrial environments, where edge devices require self-contained security capabilities.

- Solution Type: The SCADA segment emerged as the leader in 2024, due to the growing role of edge computing and distributed energy resources in industrial operations. As control and data processing become more decentralized, SCADA systems must adapt to new security demands, including endpoint security, network segmentation, and distributed threat response.

- Security Type: Infrastructure protection dominated the market with a share of over 28.0% in 2024. The convergence of cloud computing, edge processing, and big data analytics in industrial operations has increased vulnerabilities, making comprehensive infrastructure protection essential.

- Deployment Model: Cloud-based solutions were the dominant deployment method in 2024. The global expansion of remote work and industrial operations requires engineers, operators, and decision-makers to access systems and data from various locations, which necessitates strict cybersecurity controls.

- Enterprise Size: Large enterprises led the market in 2024, driven by the increasing digitization of operations through technologies like smart factories and autonomous systems. These organizations are adopting advanced technologies, including robotics, machine learning, and digital twins, to enhance operational efficiency.

- End-Use Sector: The manufacturing sector held the largest market share in 2024, driven by targeted cyberattacks on manufacturing infrastructure. Given the reliance on continuous operations and just-in-time supply chains, even short disruptions can result in significant financial losses.

Market Size & Forecast

- 2024 Market Size: USD 49.13 Billion

- 2033 Projected Market Size: USD 112.66 Billion

- CAGR (2025-2033): 9.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Key Companies & Market Share Insights

- Siemens: A global industrial conglomerate, Siemens offers a comprehensive industrial cybersecurity portfolio, including risk assessment, intrusion detection, and secure network architecture. Siemens integrates these services with its automation platforms, providing advanced firewalls, encrypted communication, and secure remote access solutions for industrial control systems.

- Palo Alto Networks: A global leader in cybersecurity, Palo Alto Networks offers an industrial OT security solution built on its Strata, Prisma, and Cortex platforms. Their solution includes firewall protection, Zero Trust principles, AI-powered threat detection, and integration with Security Operations Centers (SOCs).

- Tufin: Specializes in network security policy management, offering solutions like SecureTrack and SecureChange to help industrial organizations monitor network changes in real time, assess risk, and ensure compliance with regulatory standards such as NERC CIP and ISO 27001.

- Darktrace: A UK-based cybersecurity company, Darktrace uses AI and machine learning to protect OT environments. Its Darktrace/OT platform provides visibility into OT assets and network behavior, even in legacy or air-gapped environments.

Key Players

- Arctic Wolf Networks Inc.

- Cisco Systems, Inc.

- Claroty

- CrowdStrike

- DARKTRACE

- Dragos

- Fortinet, Inc.

- Fortra, LLC

- Huntress

- Industrial Defender

- Palo Alto Networks

- Rapid7

- Red Canary

- Siemens

- Tufin

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The industrial cybersecurity market is poised for robust growth as organizations increasingly integrate advanced technologies like IIoT, cloud platforms, and edge computing into their operations. The need to secure a growing number of connected devices, protect critical infrastructure, and safeguard data integrity will continue to drive demand for sophisticated cybersecurity solutions. With significant regional and sector-specific variations, companies across industries, especially in manufacturing, aerospace, and energy, are prioritizing cybersecurity to mitigate the risks of cyberattacks. The market is expected to continue evolving, with emerging solutions focusing on AI-driven threat detection, secure remote access, and zero-trust architectures as key elements in the protection of industrial environments.