India Herbal Shampoo Market Driven by Rising Awareness of Scalp Health

The India herbal shampoo market is positioned for strong expansion, supported by consumer trust in ayurvedic traditions, affordable sachet packaging, and government initiatives promoting herbal cultivation.

The India herbal shampoo market**** size was estimated at USD 263.00 million in 2024 and is projected to reach USD 422.0 million by 2030, growing at a CAGR of 8.4% from 2025 to 2030. The industry is witnessing robust growth fueled by shifting consumer preferences, cultural affinity toward Ayurveda, continuous product innovation, and government-backed initiatives. Increasing trust in ayurvedic and herbal formulations—perceived as safe, chemical-free, and effective—is driving demand across urban and rural segments.

Major players such as Patanjali, Dabur, and Hindustan Unilever (HUL) have heavily invested in this category. Patanjali, in particular, has accelerated the acceptance of ayurvedic products, leveraging cultural pride and the “swadeshi” movement to build scale.

Government support is also reinforcing this growth trajectory. Under the Atma Nirbhar Bharat initiative, the Ministry of Finance introduced a ₹4,000 crore package in 2021 to promote herbal cultivation, improving the supply of quality raw materials. Additionally, the AYUSH Entrepreneurship Development Scheme provides subsidies, loans, and financial aid to startups and MSMEs in the sector, boosting innovation in herbal hair care.

Sachets remain a dominant format in India due to their affordability and accessibility, priced as low as ₹1–₹2. This packaging innovation aligns with the daily or weekly purchasing habits of millions of price-sensitive consumers. For example, Himalaya Wellness launched ₹2 sachets of Aloe Vera Dandruff Control and Bhringaraja Hair Fall Control shampoos, catering to mass-market demand while maintaining brand accessibility.

Key Market Insights

- By Form: The liquid herbal shampoo segment held the largest share at 59.30% in 2024, supported by convenience and consumer preference.

- By Gender: Women accounted for 70.56% of the market in 2024, reflecting strong cultural, biological, and behavioral drivers of hair care habits.

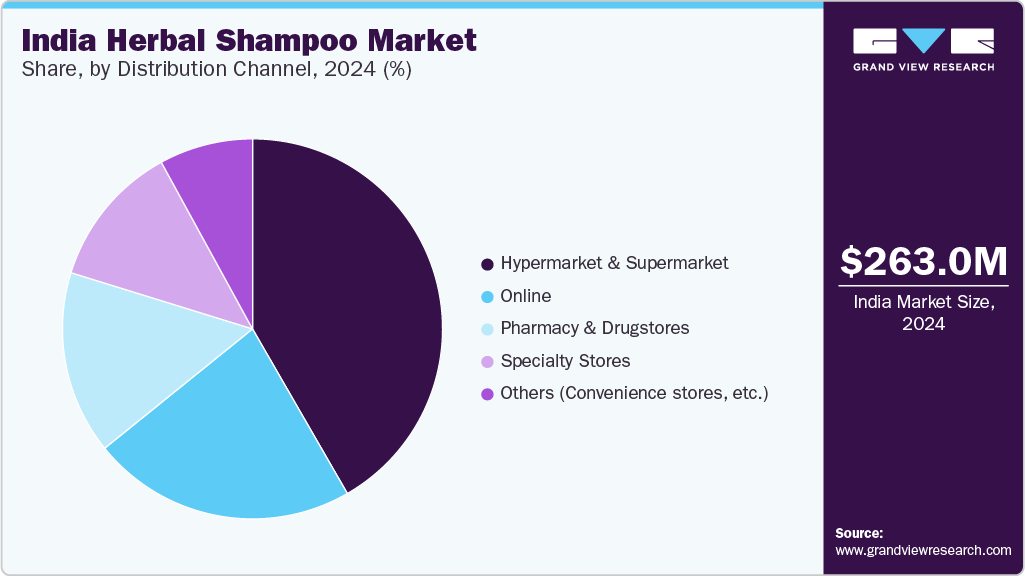

- By Distribution Channel: Hypermarkets and supermarkets represented 41.68% of sales in 2024, offering variety, competitive pricing, and ease of access.

Order a free sample PDF of the India Herbal Shampoo Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 263.00 Million

- 2030 Projected Market Size: USD 422.0 Million

- CAGR (2025–2030): 8.4%

Key Companies & Market Share Insights

The competitive landscape is defined by established leaders such as Procter & Gamble (P&G), Dabur, and Himalaya Wellness, supported by mid-sized and boutique herbal care brands.

- CavinKare Private Limited – Founded in 1983 and headquartered in Chennai, CavinKare pioneered the sachet format in India with its flagship Chik shampoo. Today, it manages a portfolio of 30+ brands across personal care, food, beverages, and salon products. With a strong rural distribution network and R&D focus, the company has expanded into 44+ countries, offering affordable innovations tailored to diverse markets.

- Himalaya Wellness Company – Established in 1930 in Bengaluru, Himalaya is a pioneer of ayurvedic-inspired personal care. Its Himalaya Herbals line combines traditional plant-based remedies with modern scientific research. With a footprint in 90+ countries, Himalaya emphasizes sustainable sourcing, eco-friendly packaging, and stringent quality standards across shampoos, skincare, baby care, and wellness products.

Key Players

- The Procter & Gamble Company (Herbal Essences)

- Unilever PLC

- Dabur India Limited

- CavinKare Private Limited

- Patanjali Ayurved Limited

- Himalaya Wellness Company

- Khadi Natural Healthcare (India)

- Biotique Ayurvedics Pvt. Ltd.

- Forest Essentials (A Luxasia Company)

- Amway India Private Limited

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The India herbal shampoo market is positioned for strong expansion, supported by consumer trust in ayurvedic traditions, affordable sachet packaging, and government initiatives promoting herbal cultivation. With rising demand for safe, natural, and chemical-free products, both established giants and innovative startups are intensifying competition. As sustainability, wellness, and accessibility remain key themes, herbal shampoos are set to become an increasingly dominant choice in India’s evolving hair care landscape.