India Construction Equipment Market Fueled by Tech Advancements in Machinery

The India construction equipment market is poised for steady growth, driven by robust infrastructure development, rising urbanization, and supportive government initiatives.

The India construction equipment market was valued at an estimated $7.89 billion in 2023 and is projected to reach $14.34 billion by 2030, with a Compound Annual Growth Rate (CAGR) of 8.9% during the forecast period. The demand for heavy construction equipment in India is being driven by a combination of factors, including increasing construction activity, major infrastructure development projects, government initiatives, and technological advancements.

Heavy construction equipment is crucial for the construction industry because it improves both the speed and quality of work. Modern equipment, with its high engine power and durability, is capable of operating efficiently in challenging conditions, such as rain, heavy loads, and vibrations.

The market is receiving significant support from government programs and projects aimed at boosting infrastructure development. Initiatives like the Smart City Mission, Pradhan Mantri Awas Yojana, PM Gati Shakti Master Plan, and the Bharatmala Pariyojana are creating a strong demand for construction machinery. For instance, the government's focus on infrastructure has led to a record number of new equipment sales in recent years. Furthermore, government policies provide incentives for small and medium-sized enterprises (SMEs), such as subsidies on taxes and power, which helps these companies invest in and utilize construction equipment.

Despite the positive growth drivers, the market faces a key constraint: the increasing popularity of equipment rental. Many small and medium-sized contractors find it difficult to afford the high initial cost of purchasing new heavy equipment. As a result, they prefer to rent machinery for specific projects, which allows them to save on capital, maintenance, and storage costs. This trend can fluctuate the demand for new equipment, particularly from smaller players in the market.

Key Market Insights:

- Engine Capacity: The "Up to 250 HP" segment held the largest market share, with over 60.0% of the market. This is due to its broad use in material handling, digging, grading, and excavating.

- Propulsion Type: Internal Combustion Engine (ICE) vehicles dominated the market, accounting for more than 90.0% of the share. This is because ICE technology is still the most widely used and trusted in the industry.

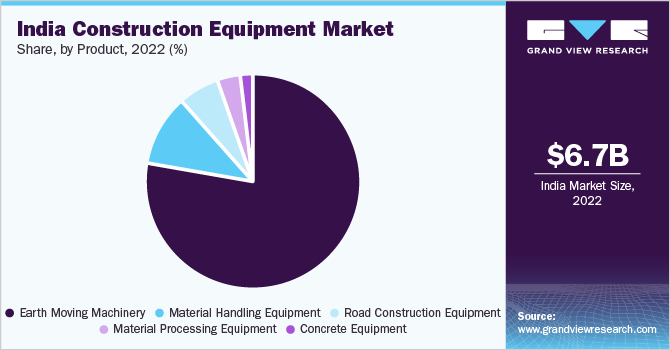

- Product Segment: Earthmoving machinery was the largest segment, holding over 70.0% of the revenue share. This segment is also expected to have the highest CAGR from 2023 to 2030, driven by its essential role in large-scale infrastructure projects like dams and highways.

Order a free sample PDF of the India Construction Equipment Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

- 2022 Market Size: USD 6.66 Billion

- 2030 Projected Market Size: USD 13.21 Billion

- CAGR (2023-2030): 9.0%

Key Companies & Market Share Insights

The India construction equipment market is highly competitive, with key players employing inorganic growth strategies like partnerships, mergers, and acquisitions to maintain their position. For example, in a move to advance electric construction equipment, Honda Motor Co., Ltd. and Komatsu Ltd. announced a joint development agreement in January 2021. The partnership focuses on a battery-sharing system using Honda's Mobile Power Pack (MPP) batteries for various construction and civil engineering equipment, including the electrification of Komatsu's PC01 mini excavators. This highlights the industry's shift towards sustainable and technologically advanced solutions.

Key Players

- AB Volvo

- Action Construction Equipment Ltd.

- Caterpillar

- Hyundai Construction Equipment Co., Ltd.

- J C Bamford Excavators Ltd.

- KOBELCO CONSTRUCTION EQUIPMENT INDIA PVT. LTD.

- Komatsu India Pvt. Ltd.

- LARSEN & TOUBRO LIMITED

- LIEBHERR

- LiuGong India Pvt. Ltd.

- SANY GROUP

- Tata Hitachi Construction Machinery

- XCMG Group

- Zoomlion India Pvt. Ltd.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The India construction equipment market is poised for steady growth, driven by robust infrastructure development, rising urbanization, and supportive government initiatives. The sector is benefiting from technological advancements and increasing demand for efficient, durable machinery. However, the growing trend of equipment rental, especially among smaller contractors, may temper the pace of new equipment sales. Earthmoving machinery and ICE vehicles continue to dominate the market due to their reliability and versatility. As the industry evolves, collaborations and innovations—particularly in electric equipment—are expected to shape the market’s future trajectory.