Hydronic HVAC Systems Market 2030: Why Water-Based Systems are the Future of HVAC

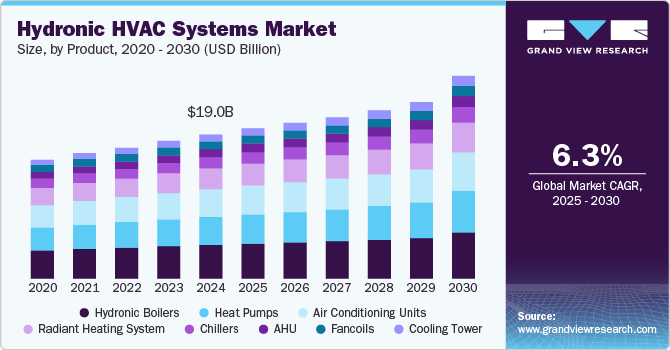

The global hydronic HVAC systems market size was estimated at USD 19.02 billion in 2024 and is expected to grow at a CAGR of 6.3% from 2025 to 2030.

The global hydronic HVAC systems market size was estimated at USD 19.02 billion in 2024 and is expected to grow at a CAGR of 6.3% from 2025 to 2030. The hydronic HVAC systems industry is increasingly driven by a growing demand for energy-efficient and environmentally friendly solutions in both residential and commercial applications. With the rising focus on sustainability and reducing carbon footprints, these systems are gaining popularity due to their ability to deliver consistent heating and cooling while using less energy compared to traditional HVAC systems.

In addition to energy efficiency, the hydronic HVAC market is benefiting from the rise in green building initiatives and regulatory standards that encourage the use of sustainable building practices. The systems are highly adaptable and are increasingly being incorporated into new constructions, as well as in retrofitting older buildings to meet modern standards. Hydronic systems’ ability to provide zoned heating and cooling, combined with their lower operational costs, is making them a preferred choice for both commercial and residential projects.

Get a preview of the latest developments in the Hydronic HVAC Systems Market; Download your FREE sample PDF copy today and explore key data and trends

Detailed Segmentation

Product Insights

The hydronic boilers product segment accounted for a revenue share of 23.4% in 2024. The demand for hydronic boilers is increasing due to their energy efficiency and ability to provide consistent heating in residential and commercial spaces. Additionally, the growing emphasis on sustainable energy solutions and energy-saving technologies has boosted the adoption of these systems.

Application Insights

The commercial application segment accounted for a revenue share of 42.9% in 2024. In commercial spaces such as offices, hotels, and retail establishments, hydronic HVAC systems are used for their energy efficiency and ability to maintain consistent indoor climates, enhancing comfort for occupants while reducing operational costs.

Fuel Type Insights

The natural gas fuel type segment accounted for a revenue share of 41.2% in 2024. Natural gas is a popular fuel type for hydronic HVAC systems due to its efficiency and cost-effectiveness in heating. It is commonly used in residential and commercial settings for its ability to provide consistent and reliable heat with lower emissions compared to other fossil fuels. Systems powered by natural gas are known for their quick response time and high heat output, making them ideal for colder climates.

Regional Insights

The demand for hydronic HVAC systems in North America is rising due to growing awareness of energy efficiency and sustainability. With increasing environmental regulations and a focus on reducing carbon footprints, both residential and commercial buildings are transitioning toward hydronic systems, which provide energy-efficient solutions for heating and cooling.

Key Hydronic HVAC Systems Companies:

The following are the leading companies in the hydronic HVAC systems market. These companies collectively hold the largest market share and dictate industry trends.

- Daikin Industries, Ltd.

- Trane Technologies

- Carrier

- Johnson Controls International PLC

- Bosch Thermotechnology

- Viessmann Group

- Fujitsu General Limited

- Mitsubishi Electric Corporation

- Grundfos

- Lennox International Inc.

- Ariston Thermo Group

- Danfoss

- KSB SE & Co. KGaA

- Wilo SE

- A. O. Smith Corporation

Hydronic HVAC Systems Market Segmentation

Grand View Research has segmented the global hydronic HVAC systems market based on product, application, fuel type, and region:

Hydronic HVAC Systems Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Hydronic Boilers

- Heat Pumps

- Radiant Heating System

- Chillers

- Air Conditioning Units

- Fancoils

- AHU

- Cooling Tower

Hydronic HVAC Systems Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Commercial

- Residential

- Industrial

Hydronic HVAC Systems Fuel Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Natural Gas

- Oil

- Electricity

- Biomass

Hydronic HVAC Systems Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE

Curious about the Hydronic HVAC Systems Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In March 2024, U.S. Boiler introduced a hydronic heat pump designed for residential use. The company highlighted that the new system is ideal for both new constructions and retrofitting projects, and it can function as a standalone heat source or in dual-fuel setups. It has a 5-ton capacity, with a rating of 60,000 British thermal units (BTUs) per hour (MBH).

- In March 2023, Panasonic Corporation has revealed its plans to fast-track its growth strategy for the HVAC company in the European market, focusing on the hydronic systems, and air-to-water heat pump industries. Further, the company invested an additional 15 billion yen in its Czech Plant to boost manufacture of A2W heat pumps.