Hydraulic Workover Unit Market 2030: Exploring the Asia Pacific Growth Potential

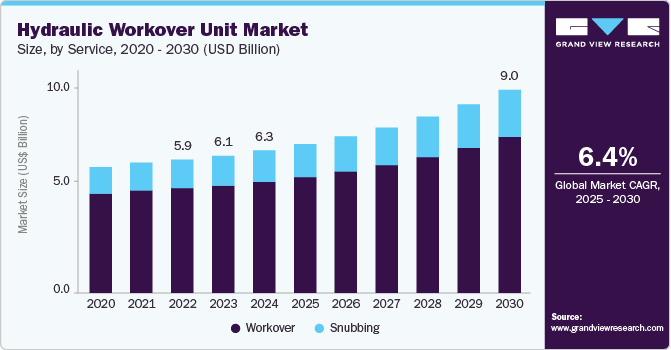

The global hydraulic workover unit market size was estimated at USD 6,357.1 million in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2030

The global hydraulic workover unit market size was estimated at USD 6,357.1 million in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2030. The hydraulic workover unit industry is driven primarily by the growing demand for efficient and cost-effective solutions in drilling, completing, and repairing wells, especially in the oil & gas industry.

In addition, the integration of digital technologies, such as remote monitoring and automation, is improving operational efficiency and safety. The market is also witnessing a shift towards higher-capacity units, particularly in offshore applications, to meet the demands of deepwater drilling and complex well interventions. North America continues to be a leading market, with a significant share attributed to the proliferation of shale gas production and unconventional oil reserves.

Key Market Highlights:

- In terms of segment, workover accounted for a revenue of USD 6,125.0 million in 2023.

- Workover is the most lucrative service segment registering the fastest growth during the forecast period.

- In terms of region, North America was the largest revenue generating market in 2023.

- The workover service segment led the market with the largest revenue share of 78.1% in 2024.

- The skid mounted installation segment led the market with the largest revenue share of 60.1% in 2024

- The onshore segment led the market with the largest revenue share of 66.3% in 2024.

- The above 200 tons capacity segment led the market with the largest revenue share of 58.3% in 2024.

Get a preview of the latest developments in the Hydraulic Workover Unit Market; Download your FREE sample PDF copy today and explore key data and trends

Detailed Segmentation

Service Insights

The workover service segment led the market with the largest revenue share of 78.1% in 2024. The hydraulic workover unit industry for workover services has been witnessing notable growth, driven by the critical need for repair, maintenance, and enhancement of existing wells in the oil and gas sector. Workover services represent a significant segment of the market, given their essential role in extending the life of wells, increasing production, and ensuring operational safety and environmental compliance.

Installation Insights

The skid mounted installation segment led the market with the largest revenue share of 60.1% in 2024. Skid-mounted hydraulic workover units are particularly valued for their ease of transportation and quick setup times, making them ideal for operations in remote or difficult-to-access locations. Their compact footprint allows for operations in limited space environments, which is a significant advantage in densely packed oil fields or when dealing with environmental and logistical constraints.

Application Insights

The onshore segment led the market with the largest revenue share of 66.3% in 2024. The market is driven by the escalating demand for efficient and economical solutions for well maintenance, repair, and drilling operations in onshore oil & gas fields. This demand is further amplified by the continuous development of onshore resources and the need for sustainable production levels, especially in mature fields where enhancing the recovery of existing wells becomes crucial.

Capacity Insights

The above 200 tons capacity segment led the market with the largest revenue share of 58.3% in 2024, primarily due to their optimal balance of power, versatility, and operational scope suited for a wide array of well intervention and workover applications. This capacity range is especially beneficial for medium to deep well operations, where more substantial lifting and pulling capabilities are required, but without the extensive footprint and logistics of larger units.

Regional Insights

North America dominated the hydraulic workover unit market with the largest revenue share of 32.2% in 2024. The North America market is experiencing robust growth, driven by the region's large oil & gas production, mainly in the U.S. and Canada. North America, home to some of the world's largest and most productive oil and gas fields, including the Permian Basin, Eagle Ford Shale, and the Western Canadian Sedimentary Basin, significantly contributes to the demand for hydraulic workover units. These units are crucial for well maintenance, completion, and intervention operations, catering to both conventional and unconventional resources.

Key Hydraulic Workover Unit Companies:

The following are the leading companies in the hydraulic workover unit market. These companies collectively hold the largest market share and dictate industry trends.

- Halliburton

- National Oilwell Varco

- Archer

- Cudd Energy Services

- Precision Drilling Corporation

- High Arctic Energy Services Inc.

- Basic Energy Services

- Superior Energy Services

- Velesto Energy

- Canadian Energy Equipment Manufacturing FZE

- PT Elnusa Tbk

- Uzma Berhad

- ZYT Petroleum Equipment Co., Ltd

Hydraulic Workover Unit Market Segmentation

Grand View Research has segmented the global hydraulic workover unit market report based on the service, Installation, application, capacity, and region.

- Service (Revenue, USD Million, 2018 - 2030)

- Workover

- Snubbing

- Installation (Revenue, USD Million, 2018 - 2030)

- Skid Mounted

- Trailer Mounted

- Application Outlook (Revenue, USD Million, 2018 - 2030)

- Offshore

- Onshore

- Capacity (Revenue, USD Million, 2018 - 2030)

- Below 150 Tons

- 151 - 200 Tons

- Above 200 Tons

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Russia

- Norway

- UK

- Netherlands

- Germany

- Asia Pacific

- Japan

- China

- India

- Indonesia

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Kuwait

- Saudi Arabia

- UAE

- Nigeria

- Iraq

- Qatar

- North America

Curious about the Hydraulic Workover Unit Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In April 2025, Boots & Coots International Well Control signed a three-year contract, with a two-year extension option, with Algeria's Sonatrach to provide hydraulic workover/snubbing services. Worth USD 28 million, this contract adds to the company’s existing agreements in Algeria and includes deploying two additional 150K hydraulic workover units. Operations are expected to begin in Q4 2025.

- In April 2024, PV Drilling signed a contract to purchase a new hydraulic workover unit (HWU), marking a key move for its business. This acquisition will enable PV Drilling to expand into workover and P&A programs while integrating additional services from its subsidiaries, including wireline, casing/tubing running, and coil tubing. The goal is to enhance the value chain, offering clients high-quality services at competitive prices.

- In March 2023, EEST Energy Services (Thailand), a leading offshore contractor and service provider operating globally, has been awarded a contract valued at USD 9 million by Hibiscus Petroleum Berhad, Malaysia. The contract encompasses the delivery of services for well workover/replacement and well plugging and abandonment. These services will be carried out employing the EEST-502 hybrid hydraulic conversion unit, showcasing the innovative solutions EEST Energy Services brings to the industry.