Hot Rolled Coil Steel Market: The Impact of Oil & Gas on Growth

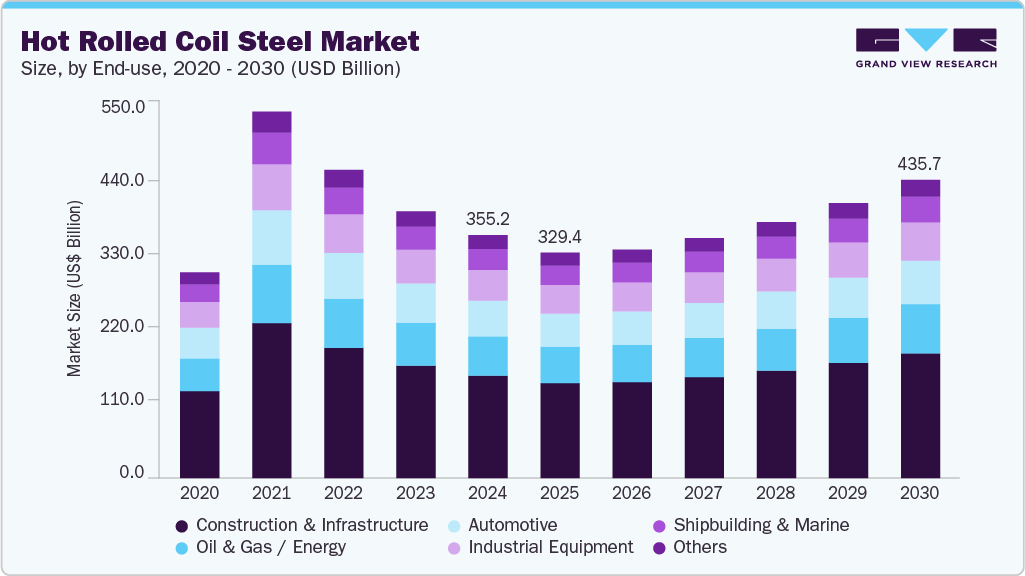

The global hot rolled coil (HRC) steel market was valued at USD 355.22 billion in 2024 and is expected to reach USD 435.65 billion by 2030.

The global hot rolled coil (HRC) steel market was valued at USD 355.22 billion in 2024 and is expected to reach USD 435.65 billion by 2030, expanding at a CAGR of 5.7% from 2025 to 2030. The industry is experiencing strong growth driven largely by increasing construction and infrastructure activities alongside rising demand in the oil and gas sector.

HRC steel is widely used due to its high strength and excellent weldability, making it essential for structural frameworks, bridges, rail tracks, and heavy machinery in construction and infrastructure projects. Likewise, the oil and gas industry relies on HRC steel for pipelines, drilling platforms, and storage tanks—especially in offshore and high-pressure environments where durability is crucial.

Innovations such as advanced thermomechanical controlled rolling (TMCR) and low-carbon steel production methods have enhanced the mechanical properties of HRC steel while lowering its environmental impact. These advancements help improve product quality and ensure competitiveness in a market increasingly influenced by environmental regulations and decarbonization goals.

Order a free sample PDF of the Hot Rolled Coil Steel Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Dominance: The Asia Pacific region accounted for over 62.0% of the global demand in 2024, making it the largest and fastest-growing market. This dominance stems from rapid industrialization, urbanization, and significant investments in infrastructure and manufacturing across countries including China, India, Japan, and South Korea.

- By Thickness: Steel with a thickness of less than or equal to 3 mm held more than 31% of the market share in 2024. This thinner HRC steel is favored for its excellent formability, weldability, and cost efficiency. It is widely used in the automotive industry for manufacturing body panels, inner structural parts, and underbody components where lightweight materials contribute to improved fuel efficiency.

- By End-Use: The construction and infrastructure sectors were the largest consumers of HRC steel in 2024, accounting for over 42% of the market share. Driven by rapid urban growth, increasing demand for residential and commercial buildings, and major infrastructure projects like bridges, highways, and railways, the construction industry relies heavily on HRC steel for structural components, beams, and reinforcements.

Market Size & Forecast

- 2024 Market Size: USD 355.22 Billion

- 2030 Projected Market Size: USD 435.65 Billion

- CAGR (2025-2030): 5.7%

- Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Prominent players in the HRC steel market include China Baowu Steel Group, ArcelorMittal, and Nippon Steel Corporation.

- China Baowu Steel Group is the world’s largest steel producer and leads global HRC production. The company reported a crude steel output of 130.77 million metric tons in 2023.

- ArcelorMittal, headquartered in Luxembourg, is the second-largest steel producer globally with an annual crude steel production of 58 million metric tons in 2024. The company operates in 15 countries and produces a significant portion of its iron ore and coke requirements.

- Nippon Steel Corporation, based in Japan, is known for its high-quality steel products and advanced technological capabilities, serving key industries such as automotive, construction, and machinery.

Key Players

- ArcelorMittal

- Baowu Steel Group

- Benxi Steel Group

- Hesteel Group

- JFE Steel Corporation

- Nippon Steel Corporation

- Nucor Corporation

- POSCO

- Shougang Group

- Tata Steel

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global hot rolled coil steel market is set for steady growth driven by robust demand from construction, infrastructure, and the oil and gas sectors. Asia Pacific’s leadership in market share reflects the region’s rapid industrialization and infrastructure expansion. Technological advancements in steel production, focusing on improving mechanical properties while reducing environmental impact, will enhance the market’s sustainability and competitiveness. With major players like China Baowu, ArcelorMittal, and Nippon Steel spearheading innovation and production capacity, the HRC steel market is well-positioned to meet the rising global demand through 2030.