Healthcare Asset Management Market 2030: Optimizing Inventory with Cutting-Edge Technology

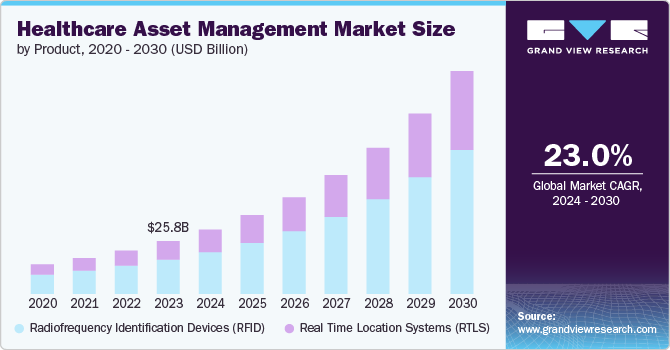

The global healthcare asset management market is buzzing with activity, valued at an estimated USD 25.8 billion in 2023 and poised for a remarkable surge at a compound annual growth rate (CAGR) of 23.0% from 2024 to 2030.

The global healthcare asset management market is buzzing with activity, valued at an estimated USD 25.8 billion in 2023 and poised for a remarkable surge at a compound annual growth rate (CAGR) of 23.0% from 2024 to 2030. This impressive expansion is being driven by a critical need to boost operational efficiency, the escalating challenge of drug counterfeiting, continuous technological advancements, and the ever-growing global expenditure on healthcare.

Leading market players are actively developing cutting-edge technologies and solutions specifically designed to empower healthcare organizations with superior asset management capabilities, further propelling market growth. For a prime example, in April 2024, TRIMEDX, a renowned clinical asset management company, unveiled GeoSense tailored for healthcare environments. This innovative real-time location system (RTLS) offers precise tracking for medical devices, a game-changer for medical facilities looking to optimize their asset management strategies. These sophisticated solutions serve multiple vital purposes within healthcare systems: they dramatically reduce the time spent searching for devices, significantly improve clinical efficiency, enhance critical clinical engineering services like maintenance and repairs, streamline service delivery, optimize inventory management, and ultimately, ensure greater device availability. These undeniable advantages are rapidly increasing the popularity of asset management solutions across the healthcare spectrum, driving their global demand.

Get a preview of the latest developments in the Healthcare Asset Management Market; Download your FREE sample PDF copy today and explore key data and trends

Moreover, the adoption of these solutions extends far beyond the traditional confines of hospitals and clinics. Pharmaceutical companies, in particular, are increasingly embracing these tools and even developing solutions specifically tailored for their industry. Take for instance, in January 2022, Aizon launched an asset monitoring application designed exclusively for pharmaceutical and biotech companies. Their Aizon Asset Health offers intelligent historical maintenance analysis, real-time critical asset condition monitoring, and proactive identification of potential problems, empowering pharma and biotech firms to eliminate unplanned downtime and significantly optimize maintenance costs.

Governments and private institutions worldwide are intensifying their focus on the healthcare sector, leading to a substantial increase in investments for global healthcare infrastructure development. Saudi Arabia, for example, earmarked USD 50.4 billion for its healthcare sector in 2023, with an ambitious goal to invest approximately USD 65 billion towards further developing its healthcare infrastructure. This burgeoning investment and the global expansion of healthcare infrastructure are creating a heightened need for technological solutions that can boost the operational efficiencies of healthcare facilities, thereby driving the demand for advanced healthcare asset management solutions.

Detailed Segmentation

Product Insights

Radiofrequency Identification Devices (RFID) segment led the market and accounted for a 65.0% share of the global revenue in 2023 owing to the improved tracking and visibility offered by these devices. Moreover, RFID is used for a wide range of applications beyond asset tracking in the healthcare setting, such as visitor tracking, medical staff tracking, patient tracking, and medication inventory management, which allows healthcare facilities to spot medication shortages and expiration, thereby improving patient care.

Application Insights

The hospital asset management segment held the largest market share in 2023. This can be attributed to the increasing emphasis on improving patient outcome and the availability of advanced solutions. The application of these solutions in hospitals has increased from just tracking medical equipment and devices to tracking staff, visitors, and patients, which can play a significant role in large-capacity hospitals. Moreover, the development of advanced systems and software is further increasing the adoption of these systems in hospitals. For instance, in September 2022, Medikabazaar launched MBARC, a medical equipment service platform that allows hospitals to monitor, manage, and measure their biomedical assets in an effective and efficient manner.

End Use Insights

The hospitals segment held the largest market share in 2023. Hospitals are increasing their efforts to enhance operational efficiency and manage their existing assets and workforce, as a lack of asset management practices can lead to asset loss and compromised patient care. Such factors increase the importance of these systems in hospitals. Moreover, hospitals are increasingly adopting Radio Frequency Identification (RFID) and Real-Time Location Systems (RTLS) to track and manage their assets. These technologies allow real-time tracking of equipment and supplies, improving visibility and reducing losses in the hospital setting, which increases their adoption and contributes to the high segment share.

Regional Insights

North America dominated the healthcare asset management market and accounted for a 42.0% share in 2023. This growth can be attributed to the region’s developed healthcare infrastructure, investments in advanced technologies, and stringent regulatory framework.

Key Healthcare Asset Management Company Insights

Some key players are using various strategies, such as product launches, partnerships, expansion, acquisitions, and collaborations, to increase their presence and gain a competitive edge over other market players.

Key Healthcare Asset Management Companies:

The following are the leading companies in the healthcare asset management market. These companies collectively hold the largest market share and dictate industry trends.

- AiRISTA Flow, Inc.

- CenTrak Inc.

- Novanta Inc.

- Sonitor Technologies

- VERSUS TECHNOLOGIES

- STANLEY Healthcare

- Zebra Technologies Corporation

- GE Healthcare

- IBM

- Siemens Healthcare GmbH

- Motorola Solutions, Inc.

- Infor, Inc.

- Accenture PLC

- Sonitor Technologies Inc.

- Tyco International Ltd

Healthcare Asset Management Market Segmentation

Grand View Research has segmented the global healthcare asset management market report based on product, application and region.

- Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Radiofrequency Identification Devices (RFID)

- Real Time Location Systems (RTLS)

- Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospital Asset Management

- Pharmaceutical Asset Management

- End Use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Laboratories

- Others

- Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- Thailand

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- North America

Curious about the Healthcare Asset Management Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments:

- In April 2023, GE Healthcare launched ReadySee, an asset management and network supervision solution. ReadySee is developed to transform device and infrastructure data into actionable insights, which can help healthcare professionals locate such devices, eliminate manual efforts, and manage cybersecurity protocols by identifying vulnerabilities.

- In November 2022, Vizient, Inc. and HANDLE Global entered into a strategic partnership to launch a capital asset management system for Vizient member healthcare organizations to assist them in tracking capital equipment and expenses, thereby enhancing equipment lifecycle planning and asset utilization.