Harvester Market 2030: Cultivating Efficiency and Productivity

The global harvester market was valued at USD 36.00 billion in 2023 and is projected to reach USD 58.41 billion by 2030.

The global harvester market was valued at USD 36.00 billion in 2023 and is projected to reach USD 58.41 billion by 2030, growing at a CAGR of 7.5% from 2024 to 2030. Growth is driven by increasing mechanization in agriculture, rising global food demand, and technological advancements in harvesting equipment.

Governments worldwide are supporting the modernization of agriculture through financial incentives, subsidies, and low-interest loans, encouraging farmers, particularly in emerging economies, to adopt advanced harvesters. Technological innovations are making harvesters more efficient, reliable, and cost-effective. Integration of AI, machine learning, robotics, and IoT into harvesting equipment is enhancing capabilities and driving market growth. Precision agriculture, equipped with GPS, sensors, and IoT technology, enables field mapping, crop health monitoring, and optimized harvesting, improving efficiency while reducing waste and environmental impact.

Environmental sustainability is also shaping the market, with rising demand for eco-friendly harvesting solutions. Manufacturers are developing energy-efficient machines and exploring alternative power sources such as electric and hybrid engines. For example, in January 2024, Caterpillar Inc. announced a prototype demonstration project for a 600V battery-powered electric field elevator for nut-harvesting equipment. This initiative is in collaboration with Flory Industries and Holt of California.

Order a free sample PDF of the Harvester Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Insights: Asia Pacific dominated the global harvester market in 2023, accounting for over 39.0% of revenue. Growth is driven by agricultural mechanization in countries like India and China. The demand for multi-crop harvesters is rising due to diverse cropping patterns and a shift from manual labor to mechanized farming practices.

- By Type: The forage harvester segment led the market in 2023 with more than 26.0% of global revenue. Self-propelled forage harvesters are increasingly adopted due to their high efficiency and adaptability to various field conditions. The trend toward sustainable farming practices is influencing manufacturers to design equipment that reduces environmental impact.

- By Automation Level: Semi-automatic harvesters dominated the market with over 54.0% share in 2023. Rising labor costs and shortages of skilled farm labor drive adoption of semi-automatic systems, which offer a balance between cost and efficiency. In countries like China, India, and Brazil, semi-automatic harvesters are being increasingly adopted as part of agricultural modernization programs, incorporating features such as GPS tracking, yield mapping, and real-time data analytics.

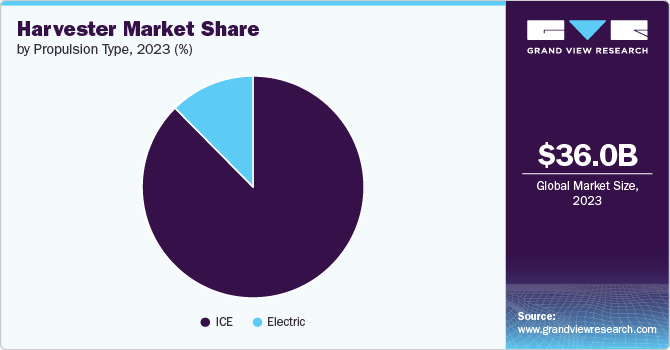

- By Propulsion Type: Internal combustion engine (ICE) harvesters accounted for more than 87.0% of global revenue in 2023. Established diesel infrastructure in rural areas makes ICE harvesters convenient. Manufacturers are also enhancing engine technologies, such as Tier 4 engines compliant with U.S. EPA standards, using selective catalytic reduction (SCR) and exhaust gas recirculation (EGR) to reduce nitrogen oxide (NOx) emissions.

Market Size & Forecast

- 2023 Market Size: USD 36.00 Billion

- 2030 Projected Market Size: USD 58.41 Billion

- CAGR (2024-2030): 7.5%

- Asia Pacific: Largest market in 2023

Key Companies & Market Share Insights

Leading players include AGCO Corporation, CLAAS KGaA mbH, CNH Industrial N.V., Dasmesh Group, Deere & Company, KUBOTA Corporation, Linttas Electric Company, Mahindra & Mahindra Ltd., SDF, and Caterpillar Inc.:

- AGCO Corporation designs, manufactures, and distributes agricultural tractors and replacement parts worldwide. Its brands include Challenger, Fendt, Massey Ferguson, Valtra, Gleaner, and AGCO Allis. AGCO focuses on innovation and R&D for High Horsepower tractors and advanced harvesting technology platforms, distributing products through approximately 3,275 independent distributors and dealers in 140 countries.

- Emerging Players: Linttas Electric Company (South Australia) develops electric-powered combine harvesters, aligning with the global trend toward sustainable farming solutions, which is gaining traction among environmentally conscious farmers and large agricultural enterprises.

Key Players

- AGCO Corporation

- CLAAS KGaA mbH

- CNH Industrial N.V.

- Dasmesh Group

- Deere & Company

- KUBOTA Corporation

- Linttas Electric Company.

- Mahindra&Mahindra Ltd.

- SDF

- Caterpillar Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global harvester market is poised for robust growth, driven by rising mechanization, increasing food demand, and technological advancements in harvesting equipment. Asia Pacific leads the market due to high adoption rates in emerging economies. Technological innovations, including AI, IoT, and robotics, are enhancing efficiency and precision, while the shift toward sustainable and electric-powered machinery reflects growing environmental concerns. Key industry players, including AGCO and Linttas Electric Company, are leveraging innovation and strategic expansion to meet evolving agricultural needs and sustain market growth.