Growing Online Distribution Presents Opportunities in Car Insurance

The car insurance market is expanding rapidly, fueled by rising accident rates, digital disruption, and the evolving landscape of autonomous vehicles.

The global car insurance market size was valued at USD 730.1 million in 2023 and is projected to reach USD 1,764.2 million by 2030, expanding at a CAGR of 13.7% from 2024 to 2030. A key factor driving market growth is the rising number of road accidents worldwide.

As urban areas grow more congested and vehicle ownership increases, the probability of accidents rises. This trend has heightened consumer awareness about the importance of comprehensive car insurance. More drivers are opting for policies to protect against financial risks such as vehicle repairs, medical expenses, and legal liabilities. In response, insurers are expanding their product portfolios and streamlining claims processes to deliver faster and more reliable coverage.

The industry is also undergoing significant transformation with the rise of autonomous vehicles (AVs). Traditional risk models based on human driving behavior are becoming less applicable, as AV adoption shifts focus toward the reliability of vehicle technology and manufacturer liability in the event of malfunctions. This transition is expected to give rise to new insurance models and coverage types, marking a shift from driver-centric to vehicle-centric policies. While this poses challenges for insurers, it also opens opportunities for innovation in risk management.

Digitalization is another major trend reshaping the car insurance sector. Customers are increasingly turning to online platforms to purchase policies and manage claims, fueled by the convenience, transparency, and speed they offer. Insurtech companies are at the forefront of this shift, delivering innovative, customer-focused solutions that challenge traditional insurers. Technologies such as artificial intelligence and machine learning are being leveraged to automate underwriting, enhance fraud detection, and improve customer engagement. This digital disruption is enhancing efficiency, boosting satisfaction, and driving higher retention rates.

Key Market Insights:

- North America led the global market with a 33.2% revenue share in 2023.

- By coverage, the third-party segment accounted for the largest share at 40.5% in 2023.

- By distribution channel, the insurance agents/brokers segment dominated in 2023.

- By vehicle age, new vehicles represented the largest market share in 2023.

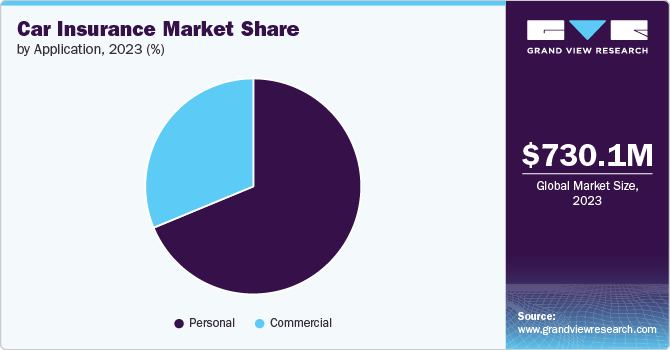

- By application, the personal segment was the leading segment in 2023.

Order a free sample PDF of the Car Insurance Market Intelligence Study, published by Grand View Research.

Market Size & Forecast:

- 2023 Market Size: USD 730.1 Million

- 2030 Projected Market Size: USD 1,764.2 Million

- CAGR (2024–2030): 13.7%

- North America: Largest market in 2023

Key Companies & Market Share Insights:

The car insurance market is highly competitive, with established players leveraging extensive distribution networks, strong brand presence, and diverse product offerings. At the same time, insurtech firms and digital-first platforms are disrupting the landscape with innovative, flexible, and cost-effective solutions, further accelerating market growth.

Recent Development:

- In January 2023, New India Assurance (NIA) launched its Pay as You Drive (PAYD) policy. The offering includes features such as coverage beyond distance limits, renewal discounts, and enhanced protections like roadside assistance, nil depreciation, and return-to-invoice benefits. Such flexible and personalized policies are gaining traction and supporting overall market growth.

Key Players:

- Allianz Group

- AXA

- Zurich Insurance Group

- Bajaj Finserv

- Liberty Mutual Insurance

- Progressive Casualty Insurance Company

- The Travelers Indemnity Company

- Chubb

- State Farm Mutual Automobile Insurance Company

- American International Group (AIG)

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion:

The car insurance market is expanding rapidly, fueled by rising accident rates, digital disruption, and the evolving landscape of autonomous vehicles. With insurers adapting to shifting risk models and consumer preferences, the industry is set to witness strong and sustained growth.