Free Ad-supported Streaming TV Market: Charting the Future of Television

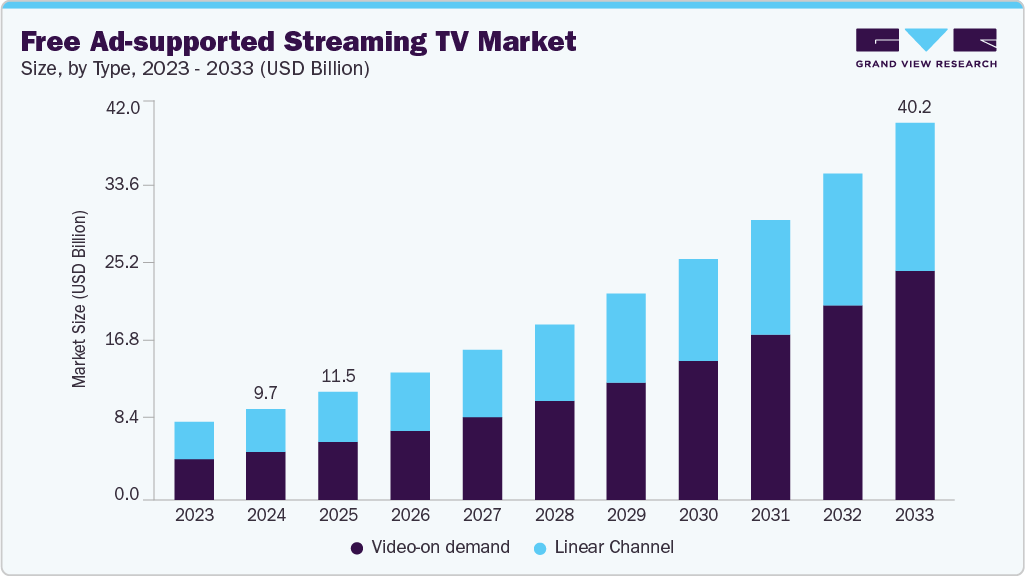

The global free ad-supported streaming TV (FAST) market was valued at USD 9.73 billion in 2024 and is projected to expand to USD 40.20 billion by 2033.

The global free ad-supported streaming TV (FAST) market was valued at USD 9.73 billion in 2024 and is projected to expand to USD 40.20 billion by 2033, registering a CAGR of 16.9% from 2025 to 2033. Market growth is being driven by rising demand for affordable entertainment options, increasing adoption of smart TVs and connected devices, growth in digital advertising spending, and the entry of major streaming platforms offering ad-supported viewing models.

Consumers are increasingly turning to cost-effective alternatives to traditional cable television and paid streaming subscriptions. Economic pressures, including rising living expenses and financial uncertainty, are accelerating the shift toward free, ad-supported platforms. FAST services provide access to a diverse range of content without recurring fees, making them highly attractive to budget-conscious viewers. At the same time, advertisers benefit from access to large and engaged audiences as viewership migrates toward free streaming channels, positioning FAST platforms as a sustainable and scalable segment within the digital entertainment ecosystem.

Content investment has become a central focus for FAST providers, with platforms expanding offerings across live television, movies, series, and niche programming. Curated channels and genre-focused content help attract specific audience segments and improve viewer retention. Collaborations with independent studios and international content creators further diversify libraries and appeal to multicultural audiences. Additionally, data-driven programming decisions allow platforms to optimize content schedules based on engagement insights, supporting higher viewership and improved advertising monetization.

Advertising demand is rapidly shifting toward digital video and streaming platforms due to their ability to deliver measurable returns and precise audience targeting. FAST services provide premium advertising inventory at lower costs than traditional television, attracting both large brands and small to mid-sized advertisers. The adoption of programmatic advertising enables real-time bidding and personalized ad delivery, enhancing monetization efficiency. Increasing advertising investment is also driving innovation in platform features and content development, reinforcing FAST platforms as influential players in the modern advertising landscape.

Order a free sample PDF of the Free Ad-supported Streaming TV Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America: North America held the largest revenue share of over 31.0% of the global FAST market in 2024. This dominance is supported by high digital adoption, widespread smart TV usage, and the presence of major platforms such as Pluto TV, Tubi, and The Roku Channel. A mature advertising ecosystem and growing consumer preference for free, ad-supported services over paid subscriptions continue to expand viewership and advertising revenue. As a result, North America remains the most established and influential FAST market globally.

- By Type – Linear Channels: The linear channel segment played a major role in market growth in 2024, accounting for over 46% of global revenue. Consumers increasingly favor the traditional, lean-back viewing experience offered by scheduled programming within streaming environments. Curated content reduces choice overload and encourages longer viewing sessions, driving higher engagement. For advertisers, linear channels offer predictable ad placements and consistent inventory. Leading providers such as Pluto TV, Samsung TV Plus, and Xumo have expanded their genre-based channel offerings, strengthening audience retention and advertising performance.

- By Device Type – Smart TVs: The smart TV segment is expected to register the fastest CAGR during the forecast period. Built-in streaming functionality has simplified access to FAST platforms by eliminating the need for external devices. Manufacturers including Samsung, LG, and Vizio are enhancing interfaces and collaborating with FAST providers to offer pre-installed apps and personalized recommendations. This seamless integration has expanded viewership, improved accessibility, and increased advertising reach, making smart TVs a key growth driver for the FAST ecosystem.

- By Content Type – Movies: The movies segment accounted for the largest revenue share in 2024, driven by partnerships between FAST platforms and major film studios to secure exclusive and diverse movie libraries. Platforms use data analytics to tailor movie recommendations, boosting viewer engagement and retention. The availability of high-quality, genre-diverse films attracts broad audiences and supports strong advertising demand, reinforcing the segment’s importance in overall FAST market growth.

Market Size & Forecast

- 2024 Market Size: USD 9.73 Billion

- 2033 Projected Market Size: USD 40.20 Billion

- CAGR (2025-2033): 16.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Prominent players in the free ad-supported streaming TV market include Pluto TV, Tubi TV, The Roku Channel, Peacock TV, and Sling TV. These companies are focusing on content expansion, advertising innovation, and strategic partnerships to strengthen their market positions.

- Pluto TV: Owned by Paramount Global, Pluto TV is a leading FAST platform offering a wide range of live and on-demand channels across genres such as news, sports, entertainment, and lifestyle. The service operates on an ad-supported model, using advanced targeting capabilities to maximize advertiser returns. Its global expansion efforts and partnerships with major content providers have positioned Pluto TV as a pioneer in the FAST market.

- The Roku Channel: Operated by Roku, Inc., The Roku Channel is deeply integrated into Roku’s streaming device and smart TV ecosystem. It provides live linear channels, on-demand movies, and exclusive Roku Originals supported entirely by advertising revenue. Roku’s strong distribution network, user data insights, and advertiser relationships make The Roku Channel a key driver of engagement and monetization within the FAST landscape.

Key Players

- Amazon.com, Inc.

- Crackle

- Peacock TV LLC

- Plex

- Pluto TV

- Roku, Inc.

- Sling TV

- Tubi TV

- Vudu

- Xumo, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global free ad-supported streaming TV market is experiencing rapid growth as consumers seek affordable entertainment options and advertisers shift budgets toward digital video platforms. With market value projected to rise from USD 9.73 billion in 2024 to USD 40.20 billion by 2033, FAST services are becoming a core component of the digital media ecosystem. North America remains the leading market, while Asia Pacific is emerging as the fastest-growing region. Continued investment in content, smart TV integration, and advanced advertising technologies will further strengthen FAST platforms, positioning them as a long-term, sustainable model for both viewers and advertisers.