eSIM Market 2033: Navigating the Security Landscape

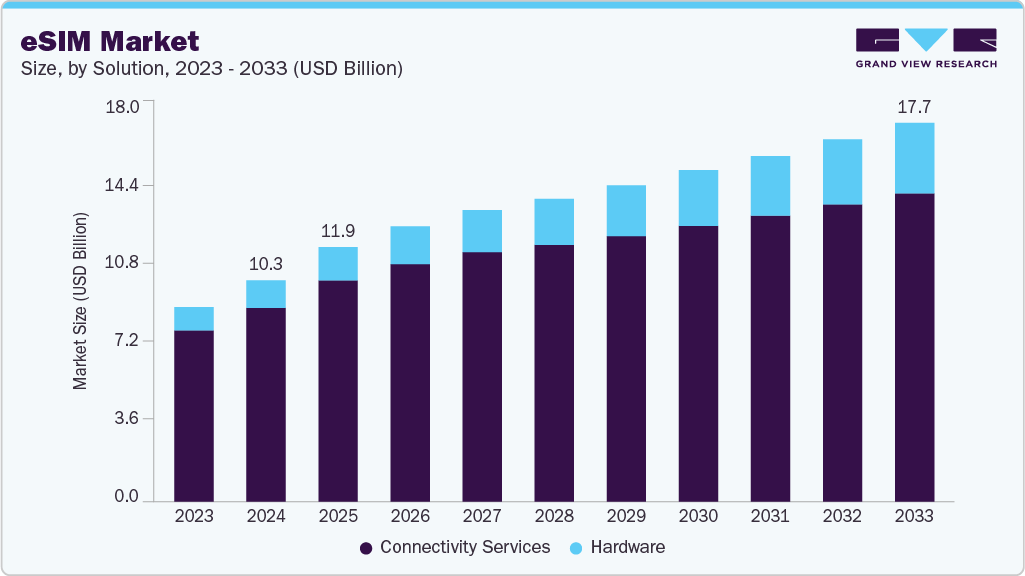

The global eSIM market was valued at USD 10.32 billion in 2024 and is projected to reach USD 17.67 billion by 2033.

The global eSIM market was valued at USD 10.32 billion in 2024 and is projected to reach USD 17.67 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. This growth is driven by the increasing adoption of Internet of Things (IoT)-connected devices in Machine-to-Machine (M2M) applications and consumer electronics.

One of the main factors propelling market growth is the surge in the number of eSIM profiles being downloaded across consumer devices. Additionally, the introduction of eSIM technology into the automobile industry has expanded the potential of cellular connectivity in cars and trucks, offering flexibility and unlocking new features. It is expected that, within a few years, all vehicles will be equipped with cellular connectivity, enhancing the driving experience through new linked services. The automotive industry has also moved forward by implementing the GSMA-embedded SIM specification to improve vehicle connectivity and security for various connected services.

eSIM solutions allow automatic interoperability across multiple SIM operators, connection platforms, and remote SIM profile provisioning. However, as more network service providers are involved in the operational chain, maintaining system security has become increasingly complex. Mobile Network Operators (MNOs) store their credentials within the eSIM's software, making them vulnerable to security breaches. Additionally, operating eSIM across diverse physical platforms and MNOs introduces various concerns related to virtual environments. These security risks could undermine the operational flexibility of eSIMs, potentially impeding market expansion.

The rise of Industry 4.0, characterized by smart machines and automated communication systems, has also contributed to the market's growth. In Industry 4.0, data and information are transferred between M2M and Machine-to-Other (M2O) devices via IoT. M2M systems, which rely on public and cellular networks for internet access, are increasingly integrating eSIM technology. This integration facilitates better connectivity and communication, contributing to the broader adoption of eSIM-enabled devices across various industries.

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America led the eSIM market in 2024, holding a revenue share of 42.8%. The region’s dominance is due to the strong presence of network providers and rapid technological advancements.

- Connectivity Services dominated the market in 2024, accounting for 87.5% of the market share. This growth is fueled by the increasing use of eSIM for M2M communications, generating revenue through subscription services provided by Mobile Network Operators (MNOs). The automotive sector’s adoption of the GSMA Embedded SIM Specification is expected to further bolster security and connectivity, driving market expansion.

- M2M Applications were the largest application segment in 2024. eSIM technology has become a key enabler for the automotive industry, especially for connected vehicles. The widespread adoption of connected cars is expected to drive growth in the M2M segment, with other industries likely to follow suit in adopting IoT and M2M technologies.

Market Size & Forecast

- 2024 Market Size: USD 10.32 Billion

- 2033 Projected Market Size: USD 17.67 Billion

- CAGR (2025-2033): 5.1%

- North America: Largest market in 2024

Key Companies & Market Share Insights

Leading companies in the eSIM industry include Giesecke+Devrient GmbH, Infineon Technologies AG, and Thales, among others. These companies are using strategies such as product launches, acquisitions, and collaborations to expand their global presence. Competition in the eSIM market is expected to intensify as companies focus on developing advanced, cost-effective solutions and technologies. The ability of eSIM to simplify mobile operator switching is expected to drive greater competition among network providers.

- Thales Group is a key player in digital identity and security, offering end-to-end eSIM management solutions for mobile network operators, device manufacturers, and enterprises. With a strong presence in over 50 countries, Thales supports eSIM applications across sectors like consumer electronics, automotive, and industrial IoT, leveraging its expertise in cybersecurity and embedded systems.

- Giesecke+Devrient GmbH is a German technology leader in security and digital communications. Their embedded SIM (eSIM) management solution reduces the need for additional materials, thereby minimizing waste and logistical burdens. By replacing traditional removable SIM cards with built-in eSIM chips, the company eliminates the need for extra plastic components and packaging.

Key Players

- Arm Limited

- Deutsche Telekom AG

- Giesecke+Devrient GmbH

- Thales

- Infineon Technologies AG

- KORE Wireless

- NXP Semiconductors

- Sierra Wireless

- STMicroelectronics

- Workz

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global eSIM market is poised for significant growth, driven by the increasing adoption of connected devices in M2M applications, particularly within the automotive sector. With its ability to streamline connectivity across multiple networks and devices, eSIM technology is reshaping industries by offering greater flexibility and security. North America remains the leading region, with North American players leading the charge in technological advancements and market expansion. As the market continues to grow, the rise of Industry 4.0 and increased adoption of IoT will further accelerate the demand for eSIM solutions. However, security concerns remain a key challenge, and addressing these issues will be crucial for the continued growth of the market.