Construction Equipment Rental Market Outlook: Rising Preference Over Equipment Ownership

The global construction equipment rental market is poised for steady growth through 2030, driven by infrastructure investments, digitalization, and technological integration in equipment management.

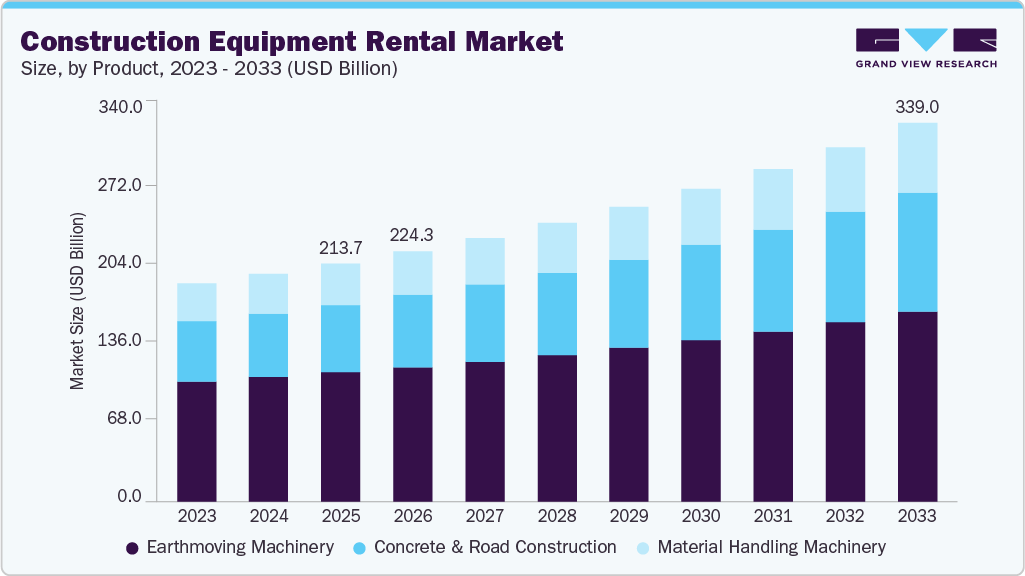

The global construction equipment rental market size was estimated at USD 204.06 billion in 2024 and is anticipated to reach USD 280.13 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030. The market’s growth is primarily driven by increasing government investments in public infrastructure projects, which have accelerated mining and construction activities across developing nations, fueling demand for construction equipment.

Rising costs of new machinery are making equipment rental an increasingly attractive option for contractors and construction firms. The integration of cutting-edge technologies and automation is further propelling market expansion. One key trend shaping the industry is the growing adoption of telematics systems, which enable rental companies to remotely monitor equipment usage, performance, and location. These advanced systems significantly enhance fleet management and preventive maintenance practices, improving operational efficiency.

The adoption of IoT-enabled devices and sensors in rental equipment has also surged, providing real-time insights into fuel consumption, equipment health, and operator safety. These innovations allow companies to optimize performance, minimize downtime, and improve asset utilization.

Additionally, online platforms and mobile applications are transforming the equipment rental landscape by streamlining rental operations and expanding access for both owners and renters. Such platforms enable equipment owners—particularly small and mid-sized businesses—to showcase their inventory to a wider audience, secure more rental agreements, and generate additional revenue. This digital transformation is fostering a more transparent, competitive, and customer-focused rental ecosystem, offering enhanced convenience and service quality.

Key Market Trends & Insights

- The Asia Pacific market accounted for 49.7% of the overall market share in 2024.

- The U.S. construction equipment rental industry maintained a dominant position in 2024.

- By product, earthmoving machinery led the market with a 54.7% share in 2024.

- By drive type, the ICE segment accounted for the largest market revenue share in 2024.

Download a free sample PDF of the Construction Equipment Rental Market Intelligence Study by Grand View Research.

Market Size & Forecast

- 2024 Market Size: USD 204.06 Billion

- 2030 Projected Market Size: USD 280.13 Billion

- CAGR (2025–2030): 5.6%

- Asia Pacific: Largest market in 2024

Competitive Landscape

The construction equipment rental market features several leading global players focused on expanding their rental fleets, strengthening regional presence, and integrating advanced telematics technologies.

Key players include Caterpillar Inc., Deere & Company, Komatsu Ltd., Liebherr-International AG, and United Rentals, Inc.

- Liebherr-International AG, along with its subsidiaries, manufactures and supplies a broad range of construction machinery and equipment. Its product portfolio includes mobile and crawler cranes, concrete technology, deep foundation machines, maritime cranes, and port equipment, as well as aerospace systems, refrigeration solutions, and automation components.

- United Rentals, Inc., based in the U.S., is one of the largest equipment rental providers globally, operating over 1,400 branches across North America and Europe. The company’s extensive network includes 1,345 rental locations in North America and 11 in Europe, with a strong presence across the U.S., Canada, Europe, and Asia Pacific.

Key Companies Profiled

- Ahern Rentals Inc.

- AKTIO Corporation

- Caterpillar Inc.

- Byrne Equipment Rental

- Cramo Plc

- Finning International Inc.

- Liebherr-International AG

- Kanamoto Co., Ltd.

- Maxim Crane Works, L.P.

- United Rentals, Inc.

Explore Horizon Databook – the world’s most comprehensive market intelligence platform by Grand View Research.

Conclusion

The global construction equipment rental market is poised for steady growth through 2030, driven by infrastructure investments, digitalization, and technological integration in equipment management. Rising equipment costs and the growing adoption of telematics and IoT-based solutions are making rental services more efficient and cost-effective. Supported by strong demand from construction, mining, and industrial sectors, the market is expected to experience sustained momentum, led by key players such as Caterpillar, Liebherr, and United Rentals.